$25M Uniswap Proposal Sparks Another Governance Controversy

Key Takeaways

Flipside Crypto has requested a $25 million grant from Uniswap to build a community driven analytics firm.

Critics of the proposal have questioned why the Uniswap grant should favor only one actor in the space.

Uniswap’s governance process was also criticized last month as a small number of parties can influence votes due to the number of tokens they have been delegated.

Share this article

A controversial new governance proposal is up for a vote on Uniswap. The proposal would allocate $25 million worth of UNI tokens to the crypto data analytics firm Flipside Crypto.

More Criticism Over Uniswap Governance

A new Uniswap governance proposal has sparked debate over decentralization and favoritism in the crypto community.

Flipside Crypto, a community-driven data analytics firm focused on crypto, has requested a $25 million grant to finance its activity over the next two years. Competing data analytics firm Dune Analytics took to Twitter to express its discontent at the proposal. “Grants should go to community members, not service providers,” the announcement read.

Grants should go to community members, not service providers.

There is no reason for @uniswap to fund @flipside’s daily operations with 8 full time employees.

— Dune Analytics (@DuneAnalytics) August 19, 2021

Until Dune Analytics’ post, votes were in overwhelming favor of the proposal. Dune Analytics argued that Uniswap was effectively picking a single winner out of the many firms interested in crypto analytics. Other leading data analytics firms in the space include Nansen, The Graph, and Token Terminal.

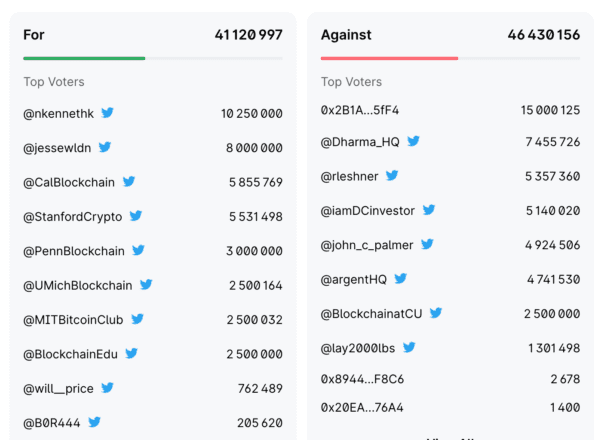

The proposal has since received many competing votes mostly against the proposal. The majority has now shifted to a NO vote, with around 41 million for and 46 million against at the time of writing. Voting ends on Aug. 20.

Of the yes voters, the various university blockchain clubs to whom Andreessen Horowitz distributed most of its UNI tokens represent most of the support for the proposal. Some of the biggest opponents include Dharma, Compound founder Rob Leshner, and vocal crypto advocate DCinvestor.

In a tweet addressing the proposal, DCinvestor said that the precedent of projects “using the UNI treasury for large cash grabs to support pet causes often benefitting narrow groups of actors is very bad.”

The Flipside Crypto proposal is the second incident in which Uniswap’s governance process has come under fire in recent weeks. Last month, the DeFi Education Fund was criticized for dumping $10 million worth of UNI for USDC after it received a $20 million grant from the Uniswap treasury. The vote for the proposal passed after some university clubs that Andreessen Horowitz had delegated UNI tokens to voted in favor of the proposal, sparking debate over Uniswap’s degree of decentralization.

At this point, the latest proposal seems very unlikely to pass due to the vocal opposition on Twitter.

Disclaimer: The author held ETH, and several other cryptocurrencies at the time of writing. The author also holds UNI through an index token.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Uniswap Grantees Slammed for Dumping $10M in UNI

The controversial DeFi Education Fund, recently voted into existence following a Uniswap governance proposal, has come under fire for selling half of its UNI token grant. The sale was worth…

Nansen Discusses the Growth of DeFi on Ethereum

Crypto Briefing sits down with Ethereum analytics firm Nansen’s researchers to discuss the state of DeFi since the market-wide crash in May. DeFi Yields Are Falling Crypto is currently experiencing…

How to Trade Using the Inverse Head and Shoulders Pattern

In stock or cryptocurrency trading, you may have heard of the term “inverse head and shoulders.” Also known as the “head and shoulders bottom” formation, the inverse head and shoulders chart pattern can…

Uniswap Passes First Successful Proposal, Hires Grants Lead

Presented by Jesse Walden of Variant Fund and co-authored by Kenneth Ng, the Uniswap Grant Proposal (UGP) has passed successfully. The proposal aims to bolster the development of the Uniswap…