The Number of Euro-Pegged Stablecoins Has Swelled 1,683% Since 2020 – Altcoins Bitcoin News

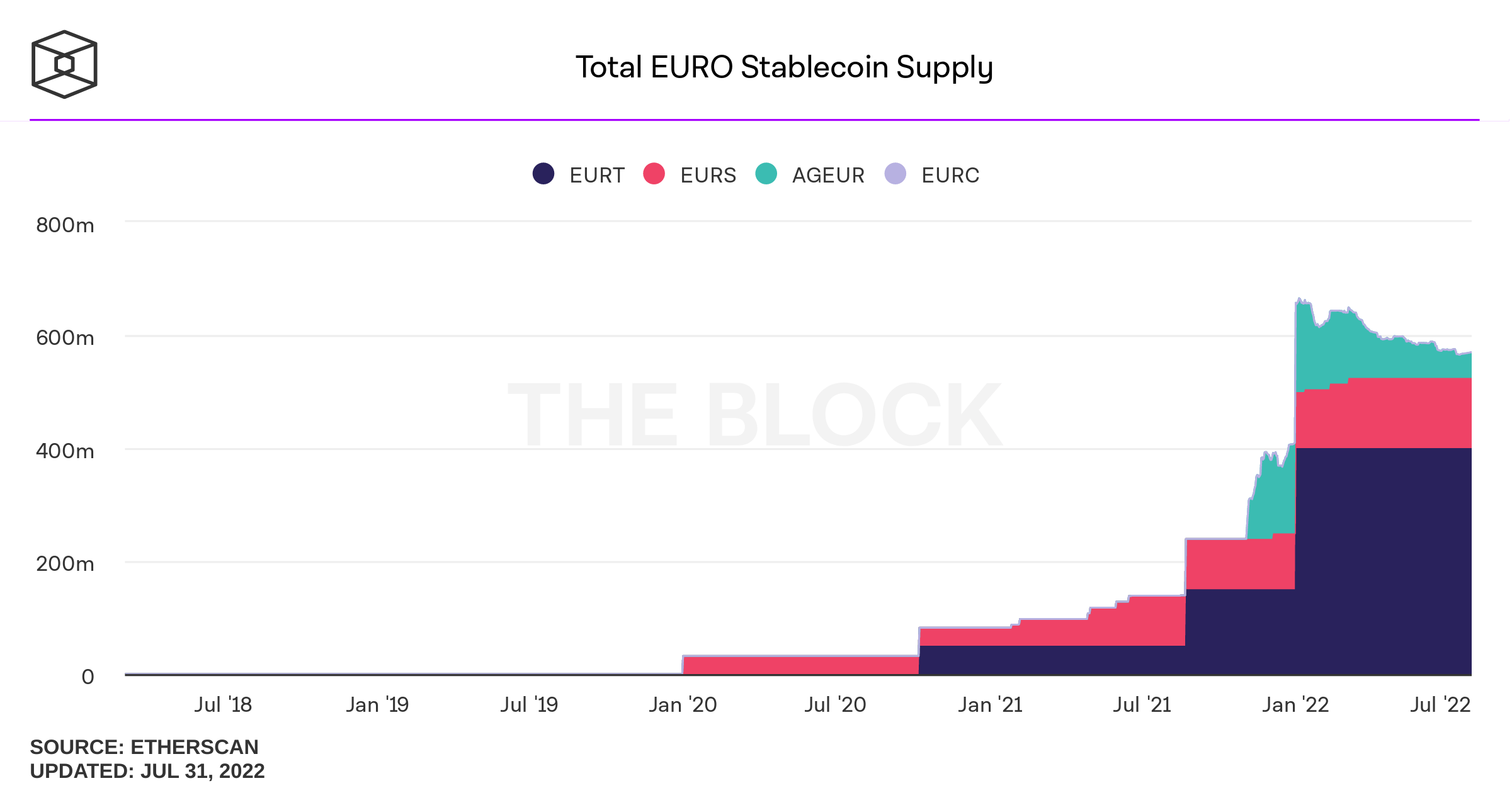

While the stablecoin economy is worth roughly $153 billion today, euro-backed stablecoin issuance has increased 1,683% from $31.9 million worth of euro-based tokens on January 3, 2020, to today’s $569 million. Since November 2021, the number of euro stablecoins swelled by 85.34%, but from January 2022 to today, euro stablecoin numbers dropped 14.17% during the last seven months.

Euro-Pegged Stablecoins Cross Half a Billion in Value Since the Start of the Year

Today, most of the stablecoin economy’s value is based on tokens backed by the U.S. dollar, but a small number of other crypto-fiat tokens exist as well. For instance, while the stablecoin issuer Tether manages the largest USD-pegged token USDT, Tether also manages fiat-pegged crypto assets based on the euro, peso, pound sterling, and yuan.

Tether recently launched British pound sterling and Mexican peso stablecoins, and the stablecoin issuer Circle just launched the company’s second major stablecoin backed 1:1 with the euro. According to data, there’s more than a half-billion worth of euro-based stablecoins in existence today, or approximately $569 million on July 31, 2022.

The value of the euro-based stablecoin economy has swelled by 1,683% since the first month of 2020. Tether’s euro-pegged stablecoin is the largest of them all, with $400 million worth of EURT in circulation today. Stasis euro (EURS) issued by Stasis is the second-largest euro stablecoin with a $124 million market cap, and Angle Protocol’s ageur (AGEUR) has $44.34 million worth of AGEUR in circulation.

While Circle has introduced the euro-pegged stablecoin euro coin (EUROC), the market valuation is much lower than the top euro stablecoin contenders. There’s approximately 1,020,192 EUROC in circulation today after the company first issued 2,330 EUROC on June 30. Even though Circle’s euro-pegged crypto has a low market cap compared to EURT, EURS, and AGEUR, since June 30 EUROC’s overall valuation grew by 43,685%.

The Aggregate Euro Stablecoin Valuation Is a Drop in the Ocean Compared to USD-Pegged Stablecoins

Stasis euro (EURS) increased 799.42% since June 5, 2020, but AGEUR’s market valuation did the opposite, dropping 74.94% from 177 million AGEUR to today’s $44.34 million worth of AGEUR. Tether’s EURT and Angle Protocol’s AGEUR have roughly the same amount of 24-hour trade volume, as EURT has seen $1,451,459 in 24-hour trades and AGEUR recorded $1,492,259 in global swaps.

Stasis euro has seen the most trade volume on August 1, 2022, with $13,273,109 in global trades, and Circle’s EUROC has recorded just over $127K in 24-hour trade volume. The number of euro-based stablecoins has increased a great deal since 2020 but since the first month of 2022, the quantity of euro-based stablecoins has declined by 14.17%. There are also a few smaller euro-based stablecoin crypto projects like EURST and EUROS.

Moreover, despite the 1,683% increase over the last two years, euro-pegged stablecoins are just a drop in the ocean compared to the entire stablecoin economy. Euro crypto assets today only represent 0.37% of the $153 billion stablecoin economy. Furthermore, while the number of euro-pegged stablecoins has increased since 2020, the euro’s value against the U.S. dollar has been shaky. In mid-July, the euro met parity with the U.S. dollar but since then it has jumped above it again at $1.02 per euro on August 1.

What do you think about the growth of euro crypto tokens in the stablecoin economy? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, theblock.co/data/decentralized-finance/stablecoins/total-euro-stablecoin-supply

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.