VeChain price prediction as bullish momentum remains on course

VeChain blockchain endears to solve complex supply chain problems

VeChain token is recovering alongside other cryptocurrencies

The token has more upside potential but could face resistance

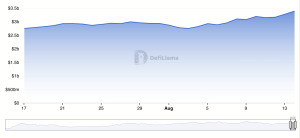

A snapshot of the crypto market shows that most cryptocurrencies are gaining again. Bitcoin is up by 2.08%, while Ethereum has gained by 5.05% in the last 24 hours. As expected, most altcoins surge whenever the top cryptocurrencies post gains. VeChain VET/USD is one of the cryptos going higher.

VeChain is a blockchain that aims to tackle complex supply chain issues via distributed ledger technology. While the technology remains at an infant stage, the VeChain token saw a lot of interest last year. That pushed the token to a high of $0.28 in April 2021. Since then, the token has lost its mojo and trades at merely $0.029, 10 times less. Investor interest could grow at such attractive valuations, but where are the buyers?

VET has witnessed buyer interest in the past week. With gains of 27%, the token rivals some few cryptocurrencies with similar double-digit gains. That happened after the cryptocurrency remained stable since mid-June. Technical indicators suggest more upside, although long-term recovery will take time.

VeChain token gains as bullish momentum accelerate

Source – TradingView

On the technical outlook, VeChain is bullish but trades below key resistance at $0.033. That represents an upside potential of around 14%. However, VeChain is already overbought, with the RSI reading pointing to 70. That means we might see short-term retracements before the token hits $0.033. We recommend buying in the short term on a potential retracement at the current level.

While long-term gains are possible, buyers should be aware of the key resistance. A breakout of the level would usher in a more lasting bullish momentum.

Summary

VeChain is likely to maintain the current momentum. Some short retracements are possible, although the token’s resistance is at $0.033. Investors should consider buying on short dips and ride the trend to the resistance level.