BNB recovery looks sustainable as the price aims for $326 resistance again

Binance coin has started a bullish reversal at the $277 support.

Cryptocurrencies are mixed in an uncertain macroenvironment.

BNB could break above the $326 resistance if the current momentum is sustained.

Binance coin BNB/USD is very strong despite looking to have lost an important resistance of $326. The cryptocurrency dipped to minor support at $277 but now shows enthusiasm to $326 again. The token was trading at $297 at press time.

Cryptocurrencies have been mixed of late as markets digest potential rate hikes by the Federal Reserve. In the last 24 hours, most tokens were in the green. The gains were, however, not sufficient to erase the losses in the past one week. BNB had returned almost 2% in the same period, but losses remained at 6.47% in the past 7 days.

Nonetheless, BNB is the cryptocurrency to watch this week as price action shows strong momentum. The cryptocurrency has been getting boosts from crypto recoveries as exchange trading volumes improve.

BNB surges above $277 support after the latest correction

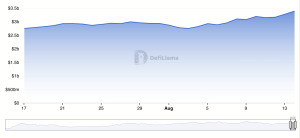

Source – TradingView

From the technical outlook, BNB is towering above the $277 support. The price has broken from an inside bar pattern formed at the support zone.

The momentum indicator is bearish for BNB. However, the momentum reflects the latest correction. As BNB pumps above $277, we could see the MACD line cross above the moving average. The token eyes $326 next, the previous resistance zone. A longer-lasting momentum could see BNB break past the resistance.

Concluding thoughts

As the BNB price recovers above $277, the next target zone for the token is $326. However, investors should be keen on a potential breakout at $326. A break above the resistance could set BNB for a sustained recovery to above $400.