Is Binance BNB/USD attractive as it battles $274?

Binance announced the Binance Account Bound token on September 8

BAB will be an identity verification proof on Binance Chain

Binance coin lost important support after inflation data

A week ago, Binance BNB/USD announced the launch of the Binance Account Bound token or BAB. The crypto exchange described it as a soul-bound token that will only be used as proof of KYC verification. Users can mint the new token on BNB Chain, participate in projects, and generate rewards.

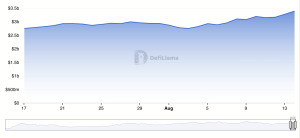

The launch of BAB coincided with a surge in BNB price and trading volumes on the exchange. BNB trading volumes rose past the 1 billion mark highlighting the significance of the latest development. The prior gains seem to have now waned.

From the technical front, the BNB price initiated a bullish breakout from an inside bar. Our latest call indicated that the breakout makes BNB likely to head to $326. However, Tuesday’s inflation data triggered a bearish market for BNB. That has pushed BNB back to $274, below the key support of $278. Does the price indicate that BNB is bearish?

BNB price movement and prediction as price slides below support

eToro

eToro is one of the world’s leading multi-asset trading platforms offering some of the lowest commission and fee rates in the industry. It’s social copy trading features make it a great choice for those getting started.

Buy BNB with eToro today

Disclaimer

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600.

Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

Buy BNB with Binance today

Source – TradingView

On the technical front, BNB has lost the battle at the $278 support, the 20-day and 50-day moving averages. The MACD line has also closed below the moving averages as bearish pressure mounts. However, we cannot confirm a bearish momentum at the moment.

At the current price, BNB is yet to break below the primary bar, which initiated an inside bar breakout. To confirm a bearish movement, the price needs to clear below $261. At the same time, BNB is not attractive at $274. All the technical indicators are bearish.

Concluding thoughts

We need more price action to confirm a bullish or bearish bias for BNB. For now, the token has not yet invalidated a bullish bias from the inside bar breakout.