Stellar Lumens XLM/USD makes a bullish statement

Stellar Lumens XLM/USD trades at key resistance of $0.126. However, momentum is building, with key technical indicators pointing to a potential breakout. According to the CoinMarketCap data, Stellar Lumens has added nearly 10% in the past one week. The gains are the highest in the week after Ripple’s XRP.

LunarCrush AltRank™ places XLM and XRP as potential bullish movers. According to a tweet on October 8, XLM, alongside XRP, has a low AltRank. The ranking is interpreted as a sign of a bullish move. Crypto analytics firm DYOR.net also recognises XLM among the top digital assets with potential bullish trends.

XLM trades at resistance as bullish momentum build

eToro

eToro offers a wide range of cryptos, such as Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro users can connect with, learn from, and copy or get copied by other users.

Buy XLM with eToro today

Disclaimer

Bitstamp

Bitstamp is a leading cryptocurrency exchange which offers trading in fiat currencies or popular cryptocurrencies.

Bitstamp is a fully regulated company which offers users an intuitive interface, a high degree of security for your digital assets, excellent customer support and multiple withdrawal methods.

Buy XLM with Bitstamp today

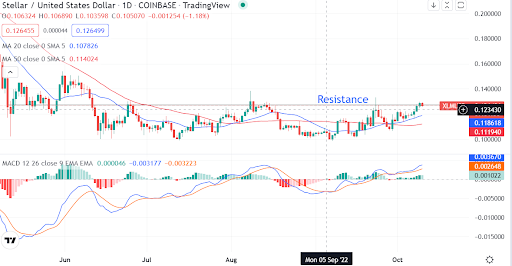

Source – TradingView

Source – TradingView

On the daily chart, XLM is attempting to break above the resistance. In fact, XLM is retesting the resistance after unsuccessfully dislodging it last month. The token remains supported by the 20-day moving average and 50-day moving average. A 20-day MA crossover above the 50-day MA confirms a bullish momentum.

If we turn to the MACD, the indicator is in the bullish zone. A growing divergence of the oscillator and the signal line indicates that momentum is building up for XLM. With momentum building at the resistance, the odds are for a breakout rather than a correction.

Should you buy XLM now?

XLM remains on a potential breakout. The fundamentals and the technical align, reinforcing a bullish view. Should the cryptocurrency break to the upside, XLM would move higher to find the next resistance at $0.148.

Currently, investing in XLM at the key level is not a good idea. Wait for a breakout and assess the trade. Potentially, the inflation data on Thursday could drag markets and force a correction. Aside from the market dynamics, XLM should be on the investors’ watch list.