BTC Price Is Unable to Sustain above $20.5K

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin Rebounds above $19.2K but Is Unable to Sustain above $20.5K – October 25, 2022

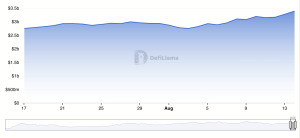

On October 25, BTC/USD rebounded as it broke above the moving average lines but was unable to sustain above $20.5K. The cryptocurrency has risen and may further reach the high of $20,700 price level. In the October 4 price action, the BTC price broke above the moving average lines but the uptrend was stalled at the high of $20,543. Later, the largest crypto declined below the moving average lines. Today, Bitcoin has regained bullish momentum as it reached a high of $20,252.

Bitcoin Price Statistics Data:•Bitcoin price now – $20,252.28•Bitcoin market cap – $388,667,819,399•Bitcoin circulating supply – 19,189,468.00 BTC•Bitcoin total supply – $424,769,975,087•Bitcoin Coinmarketcap ranking – # 1

Resistance Levels: $50,000, $55, 000, $60,000 Support Levels: $25,000, $20,000, $15,000

Bitcoin (BTC) increased on October 25 after breaking above the moving average lines. However, as the largest cryptocurrency approaches the overbought region at $20,500, Bitcoin may face rejection at the recent high. On October 4, buyers failed to overcome the resistance at $20,500. Today, the BTC price is retesting the resistance zone to break above it. The market will rally to $22,480 if buyers are successful above the recent high.

Nonetheless, if the bullish momentum is sustained, BTC price will break the $22,480 and rally to the overhead resistance at $25,205.In contrast, if Bitcoin turns down from the $20,500 resistance zone, the coin will decline and find Support above the breakout level of $19,689. This will cause the cryptocurrency to resume its range-bound move between the $18,800 and $19,900 price levels.

Ukraine Invasion Increases Stablecoin Usage in Russia

As a result of the Russian invasion of Ukraine, a new analysis from blockchain analytics company Chainalysis reveals a rise in stablecoin adoption in Russia. This has been followed by sanctions and inflation. The data, which was published on October 12, showed that since the invasion, the share of stablecoin’s transaction volume on mostly Russian services has climbed from 42% in January to 67% in March. Stablecoins are likely to be the favored form of trade due to their price stability.

According to an anonymous expert on regional money laundering who spoke to Chainalysis. This is because of Russia’s exclusion from the SWIFT cross-border system. According to the research, some of the rises in stablecoin usage is probably the result of regular Russian citizens exchanging their Rubles for stablecoins to preserve the value of their possessions in the face of the country’s high inflation rate since the conflict started.

Meanwhile, the Bitcoin uptrend has been interrupted as it is unable to sustain above $20.5K. The coin is fluctuating below the resistance zone. Bitcoin is above the 80% range of the daily Stochastic. The uptrend is doubtful as Bitcoin run to the overbought region of the market. However, in a strong trending market, an overbought condition may not hold.

The Dash 2 Trade presale is off to an excellent start, having already raised more than $2 million in just a few days. The cost was only $0.0476 at the beginning, and it is currently $0.05. The price will again increase to $0.0513 at the third presale phase.

Related

• D2T Price Prediction• How to buy D2T token

Dash 2 Trade – High Potential Presale

Active Presale Live Now – dash2trade.com

Native Token of Crypto Signals Ecosystem

KYC Verified & Audited

Join Our Telegram channel to stay up to date on breaking news coverage