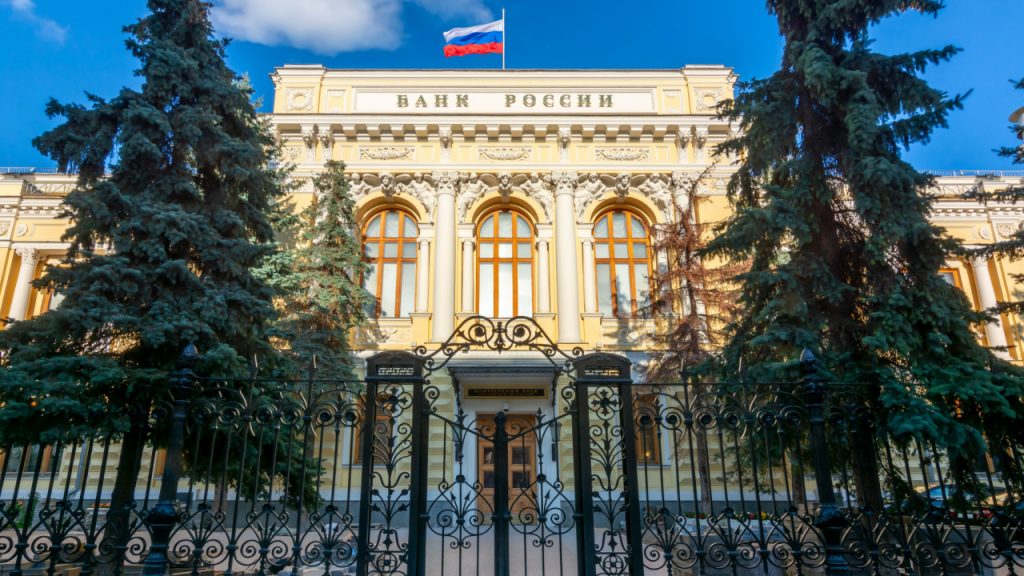

Bank of Russia Sets Out to Regulate Digital Asset Taxation, Exchange, Still Opposed to Crypto – Regulation Bitcoin News

The Central Bank of Russia supports the development of digital financial assets but remains opposed to legalizing crypto payments, its top management has reiterated. The monetary authority is now working on a set of regulatory proposals that will be submitted to parliament by the end of the year.

Russia’s Central Bank Takes Legislative Initiative in Digital Assets Regulation

The Central Bank of the Russian Federation (CBR) intends to file a legislative package concerning the regulation of digital financial assets (DFAs) with the State Duma, the lower house of parliament. Under current Russian law, the term DFA refers to coins and tokens with an issuing entity as opposed to cryptocurrencies like bitcoin.

Speaking during Finopolis, a forum devoted to financial innovations, the bank’s Deputy Chairman Olga Skorobogatova explained that the proposals pursue three main objectives — improving taxation and eliminating tax arbitrage, developing exchange platforms and regulating smart contracts.

The CBR executive highlighted the strong interest in the development of DFAs in Russia. “We believe that this is a very good new tool for financial market participants,” she said, quoted by the crypto news outlet Forklog.

Skorobogatova revealed that the monetary authority is currently reviewing nine applications by companies seeking to obtain a license to issue and circulate digital financial assets. Three “information system operators” – Sberbank, Atomyze and Lighthouse – have been already authorized to do that, she noted.

Bank of Russia Maintains Opposition to Legalization of Settlements in Cryptocurrency

Meanwhile, speaking in the Duma, CBR Governor Elvira Nabiullina stated that while the Bank of Russia supports the development of digital financial assets, it is against the use of private cryptocurrencies in settlements. Quoted by Tass news agency, she also insisted that digital financial assets are not limited to crypto alone and emphasized:

We have not changed our position that private cryptocurrencies, for which it is not clear who and how is responsible, which are opaque and carry high risks of volatility, should not be used in settlements.

Discussions on the status of cryptocurrencies and the regulation of the crypto market in Russia have been going on for over a year. The CBR has traditionally maintained a hardline stance, proposing a blanket ban on related activities such as mining and trading in January.

However, sanctions over the war in Ukraine, including restrictions affecting international payments, have softened its position. In September, the monetary authority agreed with the finance ministry that in the current conditions it would be impossible for Russia to do without cross-border settlements in cryptocurrency.

Do you think the Bank of Russia can change its attitude towards domestic crypto payments? Share your thoughts on the subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Mistervlad / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.