Bitcoin to Enter “Secular Bull Market” If the Fed Pivots, Says Hayes

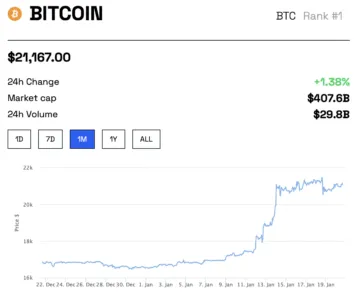

Bitcoin, the digital currency known for its volatility and decentralized nature, is once again making headlines.

Given BTC’s recent price action, financial experts, like former CEO of BitMEX Arthur Hayes, are now speculating on the potential impact of monetary policy changes by the Federal Reserve on the crypto market.

Will Bitcoin Start a New Bull Run?

Recent data from the US Bureau of Labor Statistics has shown that inflation, as measured by the Consumer Price Index (CPI), has peaked at 9% in mid-2022 and is now decreasing towards the target 2% level. Some experts believe that this trend may signal a shift in policy by Federal Reserve Chairman Jerome Powell, potentially moving away from Quantitative Tightening (QT) in response to the threat of a recession.

But what does this mean for Bitcoin? Many argue that the crypto market, specifically Bitcoin, operates independently of manipulation by central banks and large financial institutions. Furthermore, the price of Bitcoin is heavily dependent on the future path of USD global liquidity due to the dollar’s role as the global reserve currency.

Recent performance in the market suggests that investors are anticipating a pivot in Federal Reserve policy. Some experts predict that if the Fed does follow through with a policy shift, it could continue to drive the current rally in Bitcoin and potentially start a “secular bull market.”

Still, if the Fed does not follow through or talks down any expectation of a pivot, Bitcoin’s price could potentially crash back down towards previous lows.

It’s important to note that, like any market, the crypto market is subject to fluctuations and corrections. Some have pointed to the failure of companies like Three Arrows Capital, FTX, Genesis, and Celsius as evidence of this. However, others argue that these failures were a natural part of the market correcting itself and purging itself of poorly run businesses with flawed business models, ultimately leading to a swift and healthy rebound.

As the world continues to watch the future of monetary policy and its potential impact on the crypto market, one thing is clear: the world of Bitcoin and digital currencies is rapidly evolving, and the potential for both volatility and growth remains high.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.