USDC Supply Shrinks by $1 Billion Amid Market Correction

USDC, the second-largest stablecoin by market cap, has seen a sharp drop in its circulating supply over the past week as the market experienced a correction, which pushed the price of Bitcoin below $22,000.

On-chain data showed that USDC’s market cap decreased by around 5% in the last 30 days to $41.3 billion, with the stablecoin issuer’s supply shrinking by over $10 billion over the past year.

Panic Over Regulatory Crackdown Sweeps Crypto Market

The drop in USDC’s supply can be attributed to the recent enforcement action taken by US regulators against the crypto industry, which caused panic among crypto traders.

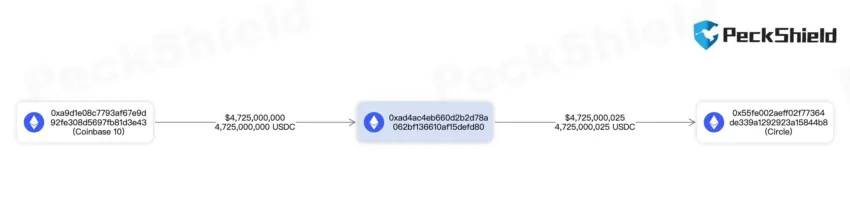

On-chain data from Etherscan showed that Coinbase burned $4.8 billion worth of USDC on February 10, though the exchange reportedly saw a similar inflow during the same period. USDC tokens are burned when users convert their holdings into fiat.

Crypto reporter Wu Blockchain commented that the drop in USDC’s supply might be related to the panic caused by US regulatory actions.

The US Securities and Exchange Commission recently filed an enforcement action against the crypto exchange Kraken, while reports emerged that another stablecoin issuer, Paxos, was under investigation by New York authorities.

Stablecoin Rivalries Heat Up

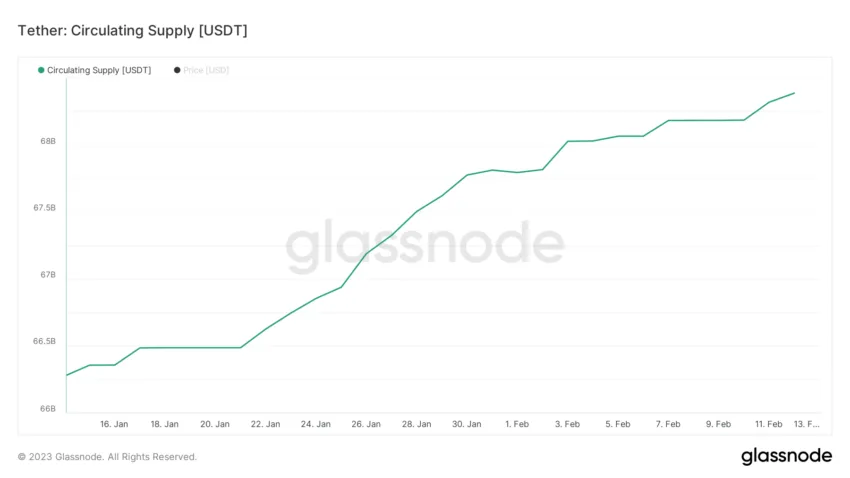

Despite the current market conditions, rival stablecoin issuers like Tether and Binance-backed BUSD seem to have performed better than USDC.

On-chain data showed that Tether’s supply rose by 3% to $68.4 billion over the last 30 days, with the company reporting a profit of $700 million during the fourth quarter of last year. Meanwhile, BUSD’s market cap lost only 0.5% in the last 30 days to hit $16.15 billion as of press time.

Despite recent controversies surrounding Binance, the exchange remains dominant in the crypto space.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.