Bitcoin Could Spiral to $200T in 9 Years Claims Cryptographer

Blockstream CEO Adam Back took to Twitter to claim that Bitcoin could hit a $200 trillion market cap in around nine years.

The British cryptographer based his findings on the BTC movement over the last decade. He explained that Bitcoin went up 2.036x per year or 1,200x in a decade. This brings his market cap estimate of $200 trillion for Bitcoin by the end of two halvings.

Unsure About Adoption, but Capitalization Could Spiral

Back stated, “I’m not sure about the adoption slowing, nor the volatility reducing; there are other factors. The new cycle people who learn to hodl/stack, who over time make it their mission to buy and cold store a much #bitcoin as possible, even resorting to leverage (volatility creator).”

The cryptographer is of the view that adoption may create bursts of hyperbitcoinization. He explained that rapid viral adoption could destroy a weak currency in a hyperinflationary frenzy. He maintains that if the public witnesses that a fiat currency is dissolving, they could become pragmatists and quickly react to defend their savings.

Next Bitcoin Halving in One Year

Back noted, “So I think things will get ‘interesting’ over the next two halvings. And fast. We don’t have much time to scale tech. We need somewhere for the next billion users to own their own UTXO, their own keys, with censorship-resistant cold storage, without weakening main-chain security.”

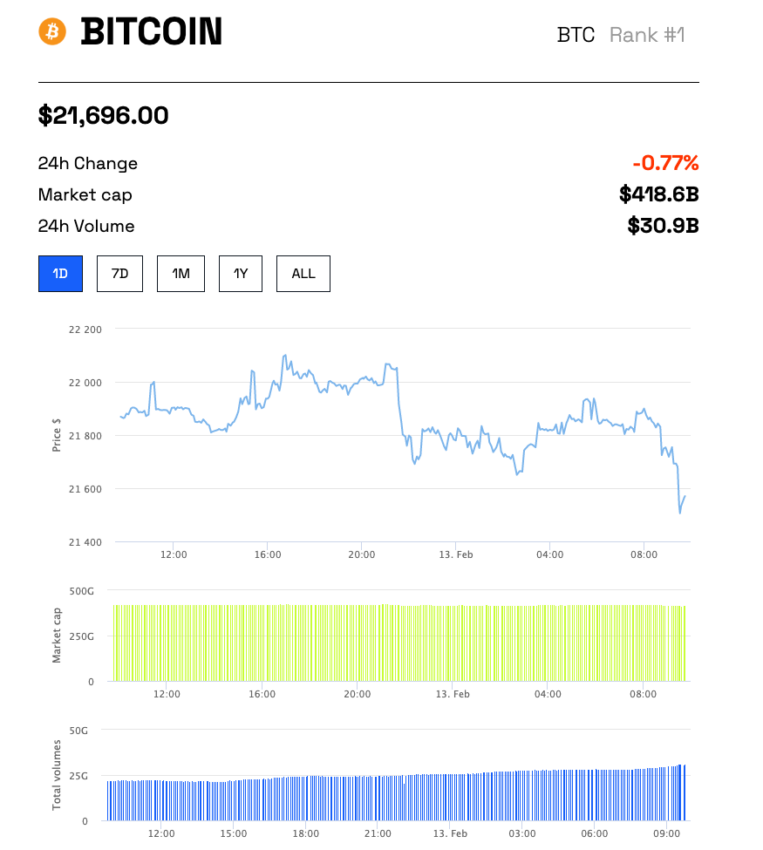

The next BTC halving is expected to occur on Apr 14, 2024. At the time of writing, Bitcoin is hovering in the 24-hour range of $21,650 – $22,100. However, in the last year, BTC’s price has slashed by around 50% amid the ongoing crypto winter. While its gains remain muted in the previous day, the past week has lost over 5%.

In this price range, 63% of BTC holders are in the money, per analysis by InToTheBlock. Only 3% of holders are breaking even in this price range, while 34% have lost money. Notably, the analysis confirms that 11% of all BTC is accumulated with whales.

That said, Back puts out the idea that Bitcoin-structured products, mortgages with real estate backing but interest guaranteed by BTC, along with other products, foster growth.

Meanwhile, recent developments in technical indicators may herald the beginning of a long-term bull market for Bitcoin, according to BeInCrypto research.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.