Fidelity’s Bitcoin Halving Meaning: Lower Supply, Higher Demand

National monetary policies are constantly shaped by political will and external economic factors. However, Bitcoin represents a counterpoint, embodying a monetary system where policy is largely untouched by these influences thanks to the halving.

Encapsulating this idea, Fidelity argues that Bitcoin’s monetary policy remains steadfastly unaltered by politics or external factors.

Halving Meaning: Lower Supply for Higher Demand

Central to Bitcoin’s economic model, the halving occurs approximately every four years, or every 210,000 blocks mined. The Bitcoin “halving” denotes the reduction by half of the reward miners receive for adding new blocks to the blockchain.

This process impacts Bitcoin’s supply and demand dynamics by decreasing the rate of new BTC issuance yet leaving the miners’ production costs unaltered. Each interval halves Bitcoin’s block subsidy, which is the compensation miners receive.

“This monetary policy is set in code and unlikely to ever change. Simply put, Bitcoin’s monetary policy is not dependent on or impacted by politics or external economic factors,” said Daniel Gray, Research Analyst at Fidelity.

The predictable and unalterable reduction in the issuance rate gives Bitcoin a unique monetary policy.

For instance, in Bitcoin’s initial four years, the mining reward stood at 50 BTC per block, declining to 25, then 12.5, and currently sits at 6.25 BTC per block. The next halving projects the reward to shrink to 3.125 BTC, which implies an average inflation rate of roughly 0.8%.

Interestingly, even as the halving diminishes the miners’ native BTC rewards, it does not necessarily erode their USD-denominated returns. The underlying reason is that supply and demand predominantly influence Bitcoin’s price.

With the halving causing a decrease in new supply, given that demand remains constant, the price may face upward pressure. As Bitcoin’s issuance appears to be tapering off, its USD-denominated revenue grows. Therefore, making the halving events beneficial for the miners and investors.

“Without any change to price or demand, the halving reduces the issuance from 900 to 450, ultimately halving the sell-side pressure. To maintain a stable price of $28,000 with half of the new issuance, there only needs to be $12.6 million of demand. If [the current demand of $25 million] remains unchanged, the price must soon correct to match the demand,” added Gray.

Is the Bitcoin Halving Priced In Yet?

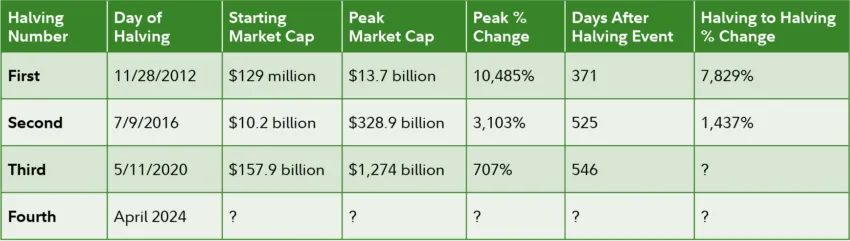

The halving also affects Bitcoin’s market behavior. Historical trends suggest that Bitcoin experiences a surge in value following a halving. Past events have seen returns spike as the reduced supply meets a growing demand.

As adoption continues to rise, the simultaneous contraction of the issuance rate could potentially trigger an upward correction in price. Bitcoin’s halvings have served as catalysts for substantial appreciation in market cap.

“Before Bitcoin had reached a market cap of over $150 million, the first halving took place. Roughly a year later, Bitcoin’s price had rallied approximately 9,100%…. The second halving led to a price peak of 2,913% roughly a year and a half later…. The third halving’s price peak growth was 686%, also around a year and a half later,” concluded Gray.

Through mechanisms like the halving, Bitcoin proves its resilience and self-sustaining nature. Subsequently forging a path as a truly decentralized and self-regulated monetary system.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.