Tesla Didn’t Sell Any Bitcoin (BTC)

Tesla’s Q2 FY23 quarterly earnings report was released last night, and it is surprisingly good considering the current state of the economy.

Healthy Margins, Record Revenues

According to the report, the second quarter of 2023 saw new records as far as production and deliveries are concerned. Tesla also generated the highest revenue of any quarter so far. This quarter, Tesla managed to rake in $24.9 billion. Although this is only about $1.6 billion more in revenue than the company generated in the previous quarter, it represents a 47% increase in profit year-over-year.

In the second quarter of 2022, Tesla’s revenues hovered around the $17 billion mark.

At the time, Tesla publicly stated that they were having a rough time dealing with the effects of the worldwide economic crisis – which was probably one of the reasons why Elon Musk decided to sell about 75% of Tesla’s Bitcoin holdings, freeing up about $936 million at the time.

At the time, Musk made it clear that the decision to sell BTC was not made due to a pump and dump scheme, which some anxious investors accused him of doing at the time. Instead, the decision to sell off BTC was made purely due to a lack of liquidity. Furthermore, Musk also sold none of his Dogecoin holdings.

“I might pump, but I don’t dump … I definitely do not believe in getting the price high and selling or anything like that. I would like to see Bitcoin succeed.”

Crisis Averted, HODLing Resumed

True to his word, Elon Musk refrained from selling any more of his Bitcoin stash once the required liquidity was achieved.

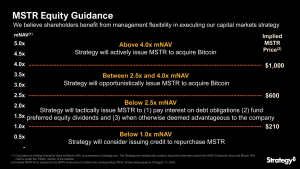

Whether the decision to HODL is due to personal values or due to taking a leaf out of Microstrategy’s book – whose CEO Michael Saylor uses BTC as a hedge against inflation – is unclear.

Earlier this year, Saylor told investors that despite the turbulence in the crypto market over the past 2 years, he’s managed to outperform competitors just by holding large amounts of Bitcoin.

“Ultimately, it’s not easy to see what better strategy there might be. We found by simply acquiring and holding Bitcoin we can outperform our peers in the enterprise software business. The regulatory environment for Bitcoin is improving. As capital flows out of the crypto industry, it flows into Bitcoin.”

However, the fact that Tesla’s Bitcoin holdings have remained untouched for the past year seems to indicate that Musk continues to believe in the value that Bitcoin can provide to the world at large.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.