Sandbox, Aptos, Optimism, Injective: August Token Unlock Impact

At least 15 cryptocurrencies in the top 100 rankings will unlock fresh tokens worth millions of dollars in August. Historical data analysis provides insight into the price impact of a potential token sell-offs in August.

Dozens of crypto projects will unlock millions of dollars worth of new tokens into circulation this month. BeInCrypto looks at some of the biggest unlocks that could affect prices negatively in August.

What Are Token Unlocks?

Token unlocks refer to the release of previously locked or restricted tokens. Many blockchain projects implement token locks to manage and control the supply of their native tokens.

Some vital reasons for token lock-ups include ensuring team members’ long-term commitment and incentivizing certain behaviors among investors and other participants within the ecosystem.

Analyzing the unlock events scheduled for August, The Sandbox (SAND) stands tallest, with fresh tokens worth approximately $138 million set to be released. However, crypto investors will also watch out for these three other tokens with unlocks coming up this month.

The Sandbox (SAND) Set to Unlock 332 Million Tokens

With over $800 million in market capitalization, The Sandbox (SAND) has emerged as one of the most popular metaverse projects. Currently ranking in the top 60 by market capitalization.

Like most metaverse projects, The Sandbox has had a relatively underwhelming start to 2023. Notably, SAND is currently down 55% from its 2023 peak of $0.94 recorded in February.

But investors are now growing increasingly concerned about another impending sell-off wave this month.

According to data from TokenUnlocks, over 300 million SAND tokens will be injected into circulation on August 14. The Arthur Madrid-led project will release 332.55 million SAND worth and estimated $138 million into circulation.

The Sandbox’s previous token unlock event was on February 14. On-chain data shows that Daily Active Addresses (DAA) on the Sandbox network spiked by 64% within the 10 following trading days. This led to a sharp 12% price increase from $0.68 to $0.76 between Feb 13 and Feb 23.

That February price action in the subsequent weeks provides an insight into what investors can expect in August.

However, from there on, an intense SAND sell-off followed as many investors began to cash in on the newly-distributed tokens. Within a month, the network activity had slowed considerably, sending the price down by 33% from $0.76 to $0.50.

This upcoming SAND token unlock constitutes 17.19% of the current circulating supply. Meanwhile, the 372 million tokens worth $155 million issued in February accounted for 19.25% of the circulating supply, 2.06% more than this months unlock.

Also, with current prices around $0.42, SAND investors face much larger unrealized losses. Hence, the impending sell-off will likely be less intense than what was observed six months ago.

Optimism (OP) Token Unlock Could Trigger Negative Sentiment

After delivering loss-making performances in each of the previous four months, Optimism (OP) finally broke out of the downtrend with 21% gains in July. However, the next OP token unlock event on July 30 threatens to truncate the rally.

Data from Defillama reveals that, beginning on May 30, 2023, Optimism has committed to a monthly unlock of 32.21 million OP tokens. Out of this total, 17 million OP tokens will be unlocked each month on the same date for the team. While the remaining 15.21 million tokens will be unlocked for investors on the same day too. This unlocking schedule is likely to have implications on the market dynamics and token price in the coming months.

Historical price data shows that the two previous unlocks on May 30 and June 30, triggered considerable price corrections.

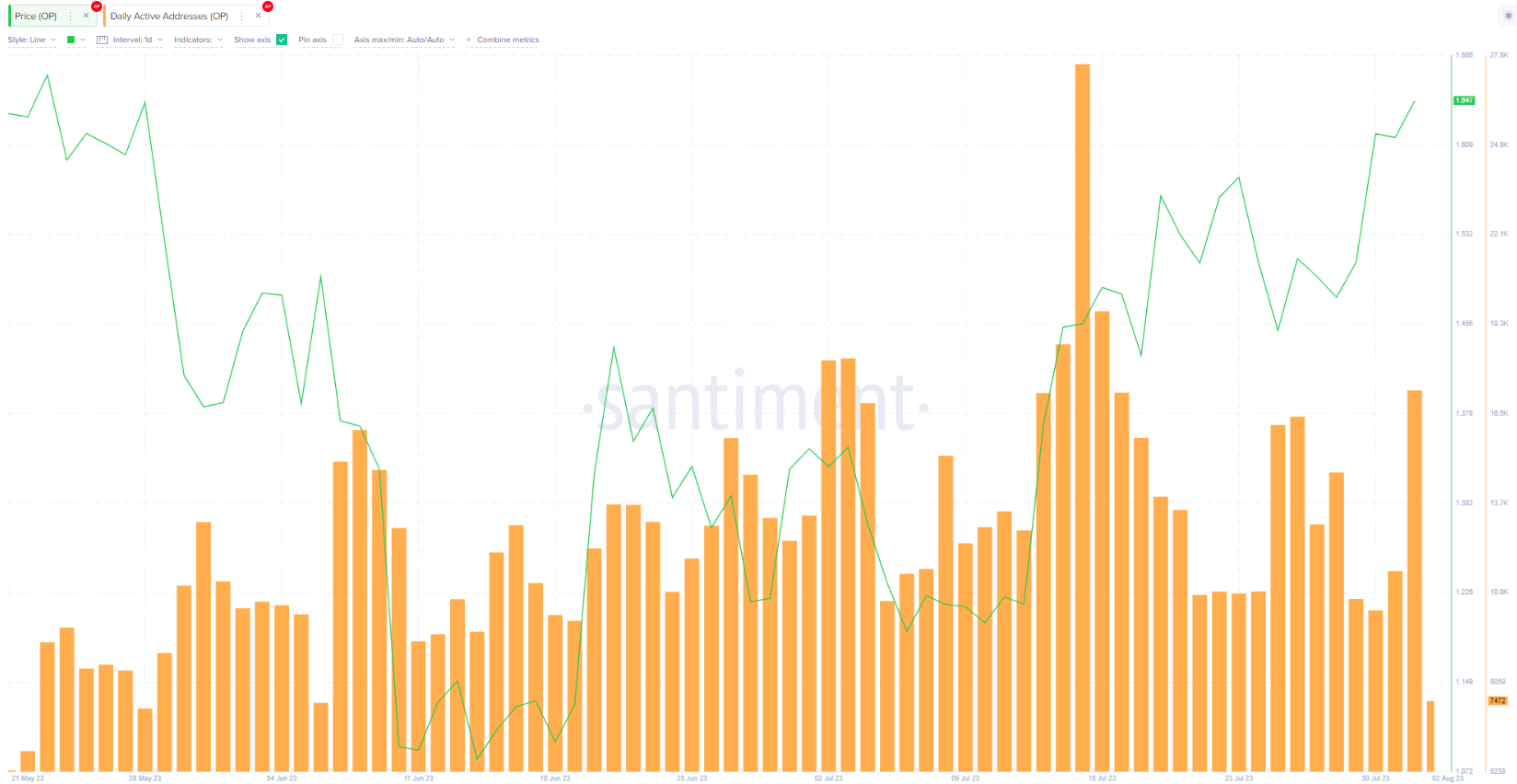

Daily Active Addresses Increase Before Price Declines

As seen below, when Optimism unlocked 32 million tokens on May 30, OP network activity spiked 56% from 7,200 to 11,200 DAA. This temporarily pushed the price 8.5% upwards from $1.42 to $1.54 between May 30 and June 6.

Following the short-term price increase, OP price retraced over 30% to hit a local bottom of $1.05 as the sell-off ensued.

A similar pattern emerged during the June 30 unlock. Between June 28 and July 1, OP price rose 16% from $1.18 to $1.38. Shortly afterwards, the price retraced nearly 14% toward $1.18 on July 6.

On July 30, the unlock of 32.21 million OP tokens, valued at approximately $52 million, took place. If we consider historical patterns, the recent marginal price gains are likely to be succeeded by a double-digit retracement in the coming days.

Furthermore, other notable tokens with scheduled token unlock events included Aptos (APT) and Injective protocol (INJ). Investors holding these tokens will be wary of a potential sell-off in August.

Aptos (APT) and Injective (INJ) Token Unlocks in August

Aptos (APT) will be replicating its July 12 token unlock with another 4.54 million APT unlock. Estimated to be worth $31.62 million. While Injective (INJ) follows a similar monthly unlock. On August 21, 2.86 million INJ tokens are scheduled to be unlocked, with an estimated value of $23 million.

In August, the Injective token unlock will direct the tokens towards ecosystem development. This is likely to have a lower price impact compared to the July 21 token unlock. During the July 21 unlock, 3.67 million INJ, totaling $29.52 million, got unlocked for advisors and the team.

The INJ price consequently saw a 20% decline from its 21 July high of $9.50 to a one month low of $7.25 on 1 August. This is most likely due to large sell-offs from advisors and the team. With the team tokens making up 90% of the token unlock last month.

What to Expect From Upcoming Token Unlocks

Before their token unlock events, The Sandbox (SAND), Optimism (OP), Injective (INJ), and Aptos (APT) are expected to experience a surge in Daily Active Addresses. Which may be followed by a subsequent sell-off.

The Daily Active Addresses data measures user activity on a blockchain network. It is derived by adding up the daily number of individual wallet addresses that carry out transactions.

Network activity often intensifies during token unlock periods. Many previously dormant investors often come alive to seek short-term profitable opportunities or carry out specific transactional activities required to claim rewards. This often propels the price marginally just before the sell-off begins.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.