Analyzing 3 Crucial On-Chain Metrics

The Ripple (XRP) price has failed to reclaim $0.70 since the beginning of August, slipping to fifth place on the global crypto rankings in the process. On-chain analysis uncovers crucial data points that could drive the XRP price toward the $1 milestone.

XRP price has trended below $0.70 for the past eleven days. However, a closer look at some underlying on-chain indicators suggests another price rally could be on the horizon.

Network Activity Spike Could Drive XRP to $1

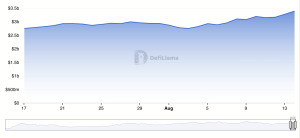

Despite the recent price downtrend, XRP has witnessed a noticeable increase in network activity over the past two weeks. According to Santiment data, XRP attracted 182,860 active users on August 8. After dropping slightly, it again edged up toward 135,000 active addresses at the close of August 10.

The 182,860 active addresses on August 9 are XRP’s peak network activity so far this month. Notably, the last time XRP attracted this level of network demand was back in May.

To put things in perspective, this August peak is more than three times higher than last month’s peak of 56,145 recorded on July 13, fueled by the famous victory in the SEC lawsuit.

The Daily Active Addresses (DAA) data point measures the number of network participants performing economic activity on a blockchain network. It signals growing demand and transaction activity across the network when it increases.

Remarkably, the chart above shows that, over the last 4 months, XRP price has often entered a double-digit rally whenever the DAA crosses the 100,000 mark

If this historical pattern reoccurs, this DAA data point could drive the XRP price toward $1 in the coming weeks.

Bullish Whale Investors Are Applying Pressure Behind the Scenes

The second vital data point that could drive XRP price toward reclaiming $1 is the accumulation frenzy among whale investors. A strategic cluster of whales holding 10 million to 100 million coins has been buying up XRP since the start of August.

The chart below shows that whales held a cumulative balance of 4.64 billion tokens at the end of July. But remarkably, it has now increased to 4.69 billion as of August 11.

Whale Wallet Balances tracks large institutional investors’ trading activity by monitoring real-time changes in their holdings. With XRP price currently sitting at $0.63, this means the whales have already made fresh inflows worth $31.5 million in August.

Notably, the timing of this ongoing accumulation wave suggests the whales started strategically buying once XRP prices dropped below $0.70.

In summary, the DAA and Whales Wallet Balances are two vital data points currently pointing to an impending XRP price rally toward $1.

XRP Price Prediction: After Consolidation, Next Rally Could Hit $1

If the spike in network demand persists, it could propel the XRP price back above the $1 milestone during its next bull rally. Thirdly, this view is validated by the Market Value to Realized Value (MVRV) data point, which gauges the net financial position of current XRP holders.

The chart below shows that most investors that bought XRP in the last 30 days are now staring at 11% unrealized losses.

As things stand, investors will likely shelve major sell-off plans until they break even around the $0.70 mark again.

However, considering the growing network demand, the bulls could smash past that resistance to reclaim the $1 milestone.

Conversely, the XRP bears could force a prolonged price correction if XRP drops below $0.55. However, the current holders will look to mount a buy wall around $0.60 to avoid booking losses greater than 15%.

Although less likely, the XRP price could decline to $0.55 if that buy-wall caves.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.