How Ordinals Elevated Bitcoin Beyond a Store of Value

The inception of Ordinals in December 2022, initiated by Bitcoin developer Casey Rodarmor through the release of the ORD software, changed Bitcoin’s paradigm. Once merely satoshis in a fungible ecosystem, introducing Ordinals added uniqueness to each satoshi.

An overarching effect is evident – Bitcoin is no longer just a store of value. It now allows for unique digital asset creation similar to NFTs.

How Bitcoin Ordinals Unlock Utility

Historically, the Bitcoin network is recognized for its rigidity. However, the over 23.4 million inscriptions on Ordinals by August 14, 2023, have created an avalanche of discourse.

Ordinals have manifested themselves as a sign of potentialities that Bitcoin’s network can unlock. In an exclusive interview with BeInCrypto, Kadan Stadelmann, CTO of Komodo Platform, stated:

“Bitcoin Ordinals are an innovation in blockchain because the metadata in question is stored on the Bitcoin blockchain as opposed to the NFT representing a link to a jpeg stored on an InterPlanetary File System (IPFS) or otherwise. By hosting the media on-chain, Ordinals embody the true essence of Bitcoin.”

Although Ordinals are not Bitcoin’s first tryst with NFTs – earlier iterations include the 2014-initiated Rare Pepe Cards on the Counterparty Layer 2 network – they have carved a unique niche.

Read more: Bitcoin NFTs: Everything You Need To Know

Sponsored

Sponsored

Distinctly, Ordinals thrive without relying on Layer 2 solutions. Instead, they leverage seminal Bitcoin network enhancements, like SegWit and Taproot, to embed data directly within the witness segment of a transaction.

“The primary difference lies in their fungibility. Bitcoin Ordinals are fungible tokens, meaning they can be exchanged one-to-one with other units of the same value. This makes them interchangeable and identical, similar to traditional currencies,” Stadelmann added.

The Impact on Bitcoin’s Fungibility

However, not all voices echo in harmony. Critics argue that Ordinals deviate from Bitcoin’s primary “peer-to-peer electronic cash system” objective. Moreover, concerns about blockchain bloat and compromised fungibility also shadow Ordinals.

“Bitcoin is designed to be censor resistant. That does not stop us from mildly commenting on the sheer waste and stupidity of an encoding. At least do something efficient. Otherwise, it is another proof of consumption of block-space thingy,” said Adam Back, CEO at Blockstream.

Still, it is essential to recognize that Ordinals emerge from Bitcoin’s existing infrastructure and the subsequent crypto progressions post its creation. The decreasing fungibility, though a concern, may not manifest to a large degree for several centuries, given current inscription rates.

“If a substantial number of satoshis are inscribed, Bitcoin’s fungibility will diminish, potentially affecting its primary use case as electronic currency. And — while the inscription of satoshis does decrease fungibility — it is estimated that it would take around 238 years to mint ~0.24% of the total terminal BTC supply,” stated Grayscale in a recent report.

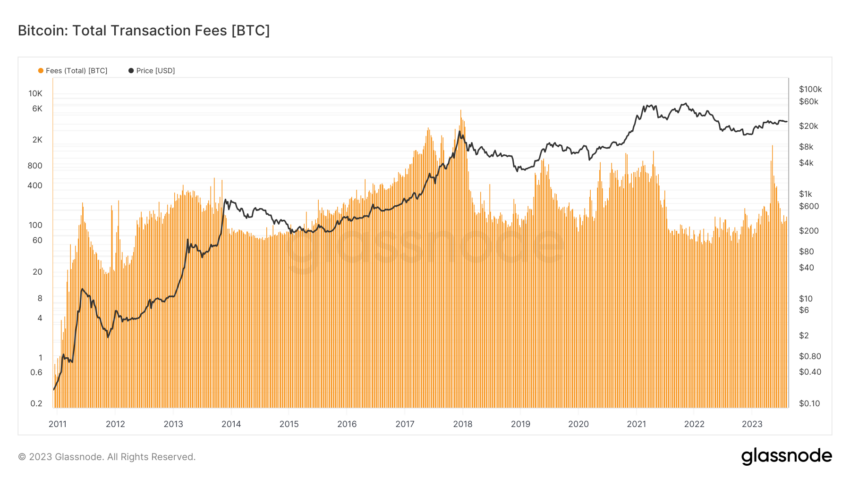

Where challenges lie, opportunities often follow. Indeed, with their increasing transactional fees, Bitcoin Ordinals might offer a long-term solution to the looming security budget issue.

As all new tokens become mined, transaction-derived miner rewards might prove insufficient to ensure network security. The rise in fees from Ordinals could form a safety net, ensuring the Bitcoin network’s security remains intact.

Read more: Explaining Bitcoin Transaction Fees

Furthermore, by attracting a diverse cohort of users interested in NFTs, Ordinals could invigorate a development-centric culture within the Bitcoin community.

“The story of Bitcoin Ordinals parallels NFTs. These tokens could redefine transactions, extending far beyond mere financial exchanges. They represent ownership, authenticity, and a new economic model that empowers creators,” elaborated Stadelmann on the potential.

The Lack of Network Interoperability

Overcoming interoperability challenges is crucial for Bitcoin Ordinals to be the game-changer they promise to be. Interoperability, ensuring diverse systems operate harmoniously, is vital for any technology.

Picture the chaos if Android devices could not interface with iPhones.

“Interoperability, or the seamless working of diverse systems, is pivotal. Without standardized protocols across blockchain platforms, Bitcoin Ordinals may face hurdles,” Stadelmann pointed out.

Yet, as with most technological challenges, solutions emerge. Cross-chain bridges, atomic swaps, and Layer 2 solutions like the Lightning Network could bolster interoperability.

Read more: Beginner’s Tutorial to Start Using the Lightning Network

These technologies pave the way for innovative financial products, decentralized exchanges, and more efficient scalability solutions.

“Interoperability opens doors to innovative financial products, such as cross-chain Ordinals lending, decentralized exchanges (DEXs), and pave the way for improved scalability by enabling off-chain solutions like Layer 2 protocols or sidechains. These advancements reduce congestion on the main blockchain network while maintaining the security guarantees provided by Bitcoin’s robust infrastructure,” Stadelmann added.

Komodo is focused on introducing interoperability to Ordinals. According to Stadelmann, the firm has put emphasis on tokenization and consistently highlighted atomic swaps and interoperability. This is a vision that aligns well with the NFT market.

The Bullish Case for Bitcoin Ordinals

Ran Neuner’s pivot from an altcoin maximalist to a Bitcoin enthusiast post the launch of Ordinals is telling. Not only does Bitcoin emerge as a potential safe haven, but its latest developments also captivate Neuner.

He highlighted the introduction of Ordinals, endowing Bitcoin with functionalities akin to Ethereum.

“Bitcoin has pivoted from being a store of value only to being a competitor to Ethereum,” Neuner enthused.

Read more: Bitcoin’s Smart Contract Functionality Threatens Ethereum’s Lead

Neuner’s enthusiasm extends beyond Bitcoin’s technological progress. His choice to offload his altcoins is rooted in his conviction that investing in Bitcoin and its surrounding infrastructure presents a more promising opportunity than lesser-known altcoins.

“We have really, really, really gone into a new era now on Bitcoin.… Would I rather be investing in small altcoins somewhere else? Or would I rather be investing on amazing infrastructure being built on the Bitcoin ecosystem?,” he asked rhetorically.

The excitement for Bitcoin Ordinals is not restricted to Neuner. Michael Saylor, the former CEO of MicroStrategy, deemed the emergence of BRC-20 tokens “bullish.”

“What happened with Ordinals and NFTs is we crossed this chasm from what was a bearish scenario to a bullish scenario. If I was a miner I would be ecstatic,” Saylor stated.

While Ethereum’s NFTs and Ordinals serve unique purposes within their respective ecosystems, Bitcoin Ordinals represent a straightforward, scarcer digital asset on a time-tested blockchain.

“Like Ethereum NFTs, Bitcoin Ordinals are programmable smart contracts that enable conditional payments based on predefined rules and triggers. The crucial difference being Ordinals are designed to be stored on-chain. This feature allows for automating complex financial agreements, eliminating the need for intermediaries and reducing transaction costs significantly,” concluded Stadelmann.

Read more: Bitcoin Ethereumized: The Good, the Bad, and the Ugly

With the insights shared by Stadelmann and the recent developments, it is evident that Bitcoin Ordinals might hold the key to its metamorphosis from a pure store of value to an ecosystem teeming with possibilities.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.