Dash Price Prediction for June 2021: Is $250 within reach?

As privacy becomes a hot commodity, can Dash reestablish itself as one of the top cryptos in June?

Dash is a privacy-oriented cryptocurrency that was formerly one of the top coins by market cap. Having started the year at $100, then hitting a high of $494 on May 7, followed by a pullback to $150 just days later, Dash has had quite a ride these past 6 months. The coin has recovered slightly after the May 19 crypto crash.

In this article, we will go over some important technical and fundamental factors that may influence Dash’s price movements going forward, and gauge the direction it may head into this month. Is Dash a bargain right now, or should you steer clear?

Dash Price Analysis

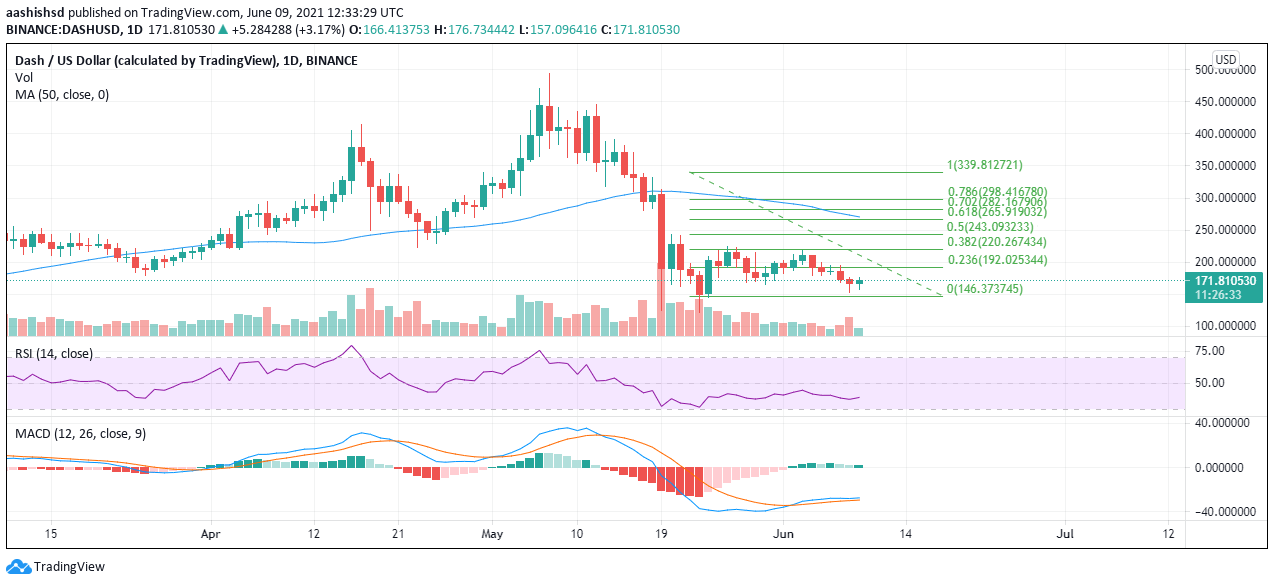

As mentioned above, Dash was trading at $171 at the time of writing, midway between the support and resistance levels at $146 (FIB 0) and $192 (FIB 0.236) respectively, consolidating well. Studying the DASH/USD price chart, it is evident that the coin has been fluctuating within a tight range since May 25, without trending either way. It shows that the supply and demand forces have been almost equal for the duration of this sideways movement.

DASH/USD 4-Hour Chart. Source: TradingView

DASH began the month of June well, close to $200, looking set to push for the resistance level at $220 (FIB 0.382), and from thereon rally towards the $250 region. It did touch a high of $220 on June 3, but was pegged back by a selling pressure resulting from the Elon Musk tweeted about possibly parting ways with Bitcoin.

From there onwards, DASH/USD has been in a bearish mode. It has been gradually losing ground, touching a low of $151 on June 8, just short of the $146 support level. However, as we write, Dash is showing signs of a rebound and reversal upwards. It’s worth noting that Dash has a strong correlation with Bitcoin, as it’s a fork of Litecoin which in turn forked from Bitcoin. So, any external factor that impacts Bitcoin has an effect on Dash too, often in equal measure.

Where to buy Dash today

eToro

eToro is one of the world’s leading multi-asset trading platforms offering some of the lowest commission and fee rates in the industry. It’s social copy trading features make it a great choice for those getting started.

Register with eToro instantly

Dash Price Factors for June

Let’s now talk about the possible directions Dash’s price may take this month, and the reasons behind them.

Inflation on the Horizon?

You have to keep some external factors in mind that may potentially impact the Dash price in the remaining part of June 2021. To begin, US Consumer Price Index (CPI) data will be out on June 10, and experts believe it’ll reveal CPI has risen to approximately 4.7%, with the core CPI having moved past the 3% level. A greater level of inflation would likely be positive for coins like Dash which have a limited supply — scarce assets tend to do well in periods of expanding money supply.

China Cracks Down on Crypto

How the Chinese crypto crackdown unfolds for the rest of the month, will also determine Dash’s future price. The DASH/USD chart shows a couple of red candles on June 6 and 7 respectively, amid concerns of further strict measures. All such bearish developments will inevitably push the DASH price into a downtrend.

Dash Price Forecast

Though Dash can move either way from its current price point at $171, there’s a good possibility that based on the past trend, it may push for an uptick. This is despite the current RSI level which is in the bearish range of below-40. The bears may alternatively want to justify a push downwards looking at the 50 SMA that has been well above the price candles since the crash of May 19. But unless they bring strong volumes into play, a solid bearish trend is not so much on the cards.

DASH/USD Daily Chart. Source: TradingView

On the other hand, the MACD indicator is making a gradual curve upwards, after having crossed the signal line on June 2. This bodes well for the Dash bulls, keen on a break-out into the $200 plus zone. However, they too will require more volume of trades to be able to make that kind of push. If they make it happen, we may possibly witness a good rally towards the resistance level at $243 (FIB 0.5) and a determined effort for the $298 at FIB 0.786.

In the event that bulls aren’t able to ward off the bears, Dash may possibly make its way downwards, bringing the FIB 0 support level at $146 into play. A breach of that level will bring Dash price into pre-February territory, with a new lower support. Hence, bears should keep a close watch on the $146 level.

If privacy continues to be a hot button issue, and if Dash can join the rest of the crypto market in making a strong technical recovery in June, then bulls will be looking at the $243 price level as a concrete target for the end of June. Sub-$200 Dash may well seem like a bargain in the coming weeks.

Min. Deposit

$50

Exclusive promotion

Accepts customers from the USA

Offers 15 crypto coins to buy&sell including BTC, LTC, ETC, NEO and more

Trade on the world’s leading social trading and investing platform

Payment Methods:

Wire Transfer, Bank Transfer

Full Regulations:

CySEC, FCA

Please note, this is an opinion article and hence the details provided above should be treated as the author’s personal opinion. None of these should be perceived as direct investment advice.