Will China Lift Its Crypto Ban?

Recent developments have sparked discussions on whether China is reconsidering its stance on cryptocurrency trading. Despite a pronounced crypto trading ban since September 2021, there is a noticeable uptick in interest within China. Surging search trends on platforms like Weibo and WeChat for Bitcoin evidence this.

Now, some speculate about a potential policy shift, especially considering Hong Kong’s more open approach to digital assets.

Will China Lift Its Crypto Ban?

China’s Economic Daily has reiterated warning investors to remain wary of Bitcoin and related products. It emphasized the country’s ongoing prohibition of such transactions. Beijing lawyer Xiao Sa further underscored this stance, highlighting the impossibility for residents in mainland China to engage in crypto trading legally.

“The approval of Bitcoin ETFs does not mean that cryptocurrencies will make breakthrough progress in the short term,” Sa said.

Despite these restrictions, the allure of cryptocurrencies has not waned among Chinese investors. The remarkable 58% year-to-date rally of Bitcoin, achieving a new all-time high, has reignited interest. This is against a broader economic slowdown in China and a faltering stock market. It has prompted individuals and financial institutions to explore crypto-related ventures, particularly in Hong Kong.

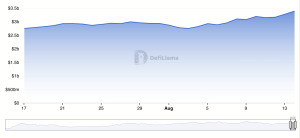

Despite the comprehensive ban, China’s crypto market has shown remarkable resilience. With an estimated transaction volume of $86.4 billion between July 2022 and June 2023, the underground market’s vibrancy is undeniable.

Techniques ranging from using grey-market dealers to leveraging Hong Kong’s relatively lax regulatory framework for digital asset transactions are a testament to the ingenuity of investors navigating the ban.

“China seems to have been unsuccessful in its efforts to ban crypto trading, possibly putting their strict capital controls at risk,” Coin Center’s Neeraj Agrawal said.

Financial entities facing domestic market stagnation increasingly consider digital assets a growth avenue. Notably, subsidiaries of major Chinese financial institutions in Hong Kong are delving into the cryptocurrency space, underscoring a broader interest that extends beyond individual investors to the institutional level.

The situation presents a complex scenario. On the one hand, the Chinese government’s firm warnings and legal restrictions reflect a cautious approach towards digital currencies, likely stemming from concerns over financial stability and capital flight. On the other hand, the economic pressures and the lure of high returns from cryptocurrencies are pushing individuals and institutions to bypass these restrictions creatively.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The robust underground crypto market, alongside the government’s hardline stance, raises questions about the future direction of China’s regulatory framework for cryptocurrencies. While the official line remains unwavering, the developments in Hong Kong could pave the way for a more nuanced approach.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.