Hedge Funds Lead Bitcoin ETF Investment Surge

The institutional fervor surrounding Bitcoin (BTC) has surged to unprecedented heights, as evidenced by the recent 13F filings presented by major financial institutions to the United States Securities and Exchange Commission (SEC).

According to data from CoinShares, there are currently more than 1,900 holders of US ETFs, and the average BTC allocation in portfolios is 0.6%.

Hedge Funds Aping Into Bitcoin

Further insights into professional investment firms unveil a growing affinity for Bitcoin, with hedge funds leading the charge. On average, hedge funds allocate 2.1% of their portfolios to the flagship digital asset, while private equity firms and holding companies follow suit with 1.5% and 1%, respectively.

Backing this trend, Sam Baker, an analyst at crypto brokerage firm River, highlights that 52% of the top 25 US hedge funds have ventured into this investment product. These hedge fund investments exhibit a wide spectrum, ranging from Millenium Management’s significant holding of 27,263 BTC to Bluecrest Capital Management’s more modest 8 BTC allocation.

BeInCrypto reported that Millennium invested approximately $2 billion in ETF products, with notable investments of $844.2 million in BlackRock’s iShares Bitcoin Trust (IBIT), $806.7 million in Fidelity’s Wise Origin Bitcoin Fund (FBTC), and substantial sums in other prominent ETFs.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Indeed, the interest in BTC ETFs has remained resilient despite the outflows in April. Available data shows that inflows into the ETFs this month have compensated for the previous month’s setbacks. This week, over $1 billion worth of BTC were purchased by ETFs, propelling their total Bitcoin holdings to a new record high.

“The Bitcoin ETFs have put together a solid two weeks with $1.3 billion in inflows, which offsets the entirety of the negative flows in April—putting them back around high water mark of +$12.3 billion net since launch. This key number IMO bc it nets out inflows and outflows (which are normal),” Bloomberg ETF analyst Eric Balchunas said.

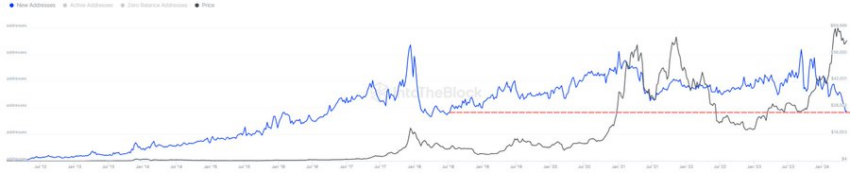

However, amidst this ETF fervor, on-chain Bitcoin transactions depict a subdued landscape, marked by dwindling transaction volumes. According to IntoTheBlock data, the 7-day average for new BTC addresses plummeted to 276,000 last week, hitting its lowest point since July 2018.

Read more: What Is a Bitcoin ETF?

“Is this because ETFs are acting as a proxy for new users? Are people moving off-chain? Or is there simply a lack of new entrants in the market?” analysts at IntoTheBlock questioned.

Nevertheless, experts opine that the tepid on-chain activity may not necessarily signal bearish sentiment. It’s plausible that a growing number of newcomers are turning to ETFs as a preferred avenue for Bitcoin exposure.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.