Nobel economists warn Trump’s re-election could reignite inflation, impacting crypto markets

Photo by Darren Halstead on Unsplash.

Key Takeaways

Sixteen Nobel economists express concerns over Trump’s potential re-election and its economic risks.

Economists cite increased inflation and instability as major threats under Trump’s economic policies.

Share this article

Sixteen Nobel Prize-winning economists have warned that Donald Trump’s potential re-election could harm the US economy and reignite inflation, a development with significant implications for the broader crypto market.

The economists’ letter, released on Tuesday, argues that Trump’s policies would lead to economic instability and higher consumer prices. They claim his “fiscally irresponsible budgets” could revive high inflation, contrasting this with praise for President Biden’s economic record, including investments in infrastructure and clean energy.

This warning comes as Trump, now a convicted felon, has pivoted to a pro-cryptocurrency stance in his campaign. He has vowed to end what he calls the US government’s hostility towards crypto and has begun accepting crypto donations. This shift represents a marked change from his previous critical views on crypto and digital assets more broadly.

“We believe that a second Trump term would have a negative impact on the US’ economic standing in the world and a destabilizing effect on the US’ domestic economy,” the economists said.

Leaders in the crypto industry like Cathie Wood back Trump’s presidential bid, believing that a win for Trump is “best for our economy.” Founders such as the Winklevoss brothers also support Trump, despite their donation to the campaign getting refunded.

Crypto and inflation data

The potential for renewed inflation under a Trump presidency could have mixed effects on the crypto market. While some view Bitcoin as an inflation hedge, data shows a negative correlation between its price and rising consumer prices. However, crypto often experiences gains when the money supply (M2) grows, which could occur under expansionary fiscal policies.

Recent crypto market rallies have already raised concerns about potential inflationary impacts. The “wealth effect” from unrealized crypto gains could boost consumer spending, potentially injecting demand-pull inflation into the economy. This might force the Federal Reserve to reconsider planned interest rate cuts.

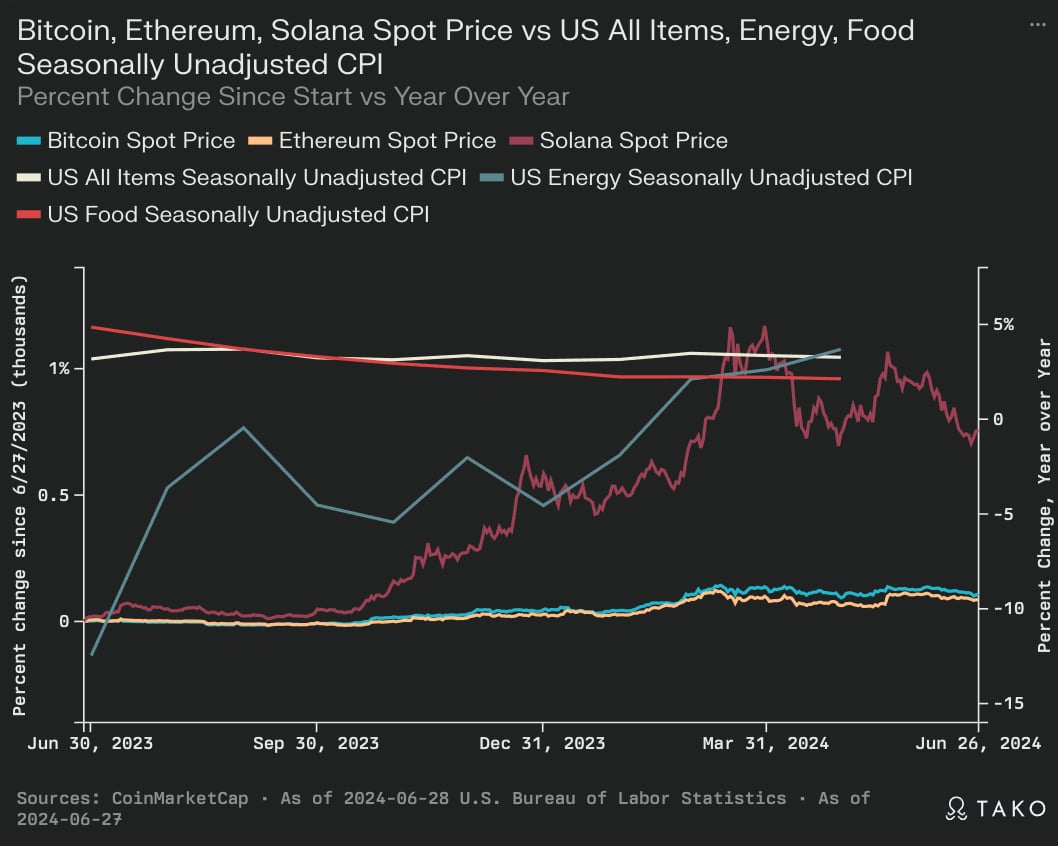

The chart below, pulled from Perplexity based on data from CoinMarketCap, shows that there is a complex relationship between economic factors and crypto’s performance.

The graph shows that crypto prices, particularly for Bitcoin, Ethereum, and Solana, have exhibited higher volatility compared to traditional CPI measures over the past year. This volatility could be exacerbated by the economic instability warned of by Nobel economists in the event of Trump’s re-election.

The chart indicates that while crypto has seen significant price appreciation, it remains susceptible to sharp corrections. These corrections often coincide with periods of economic uncertainty, which could become more frequent under policies described as “fiscally irresponsible” by the Nobel economists. The unpredictable nature of Trump’s policy-making style, as highlighted in the warning, could lead to increased market volatility, potentially deterring institutional investors and slowing mainstream adoption of crypto.

The data also shows that energy prices have a notable impact on overall CPI. Trump’s energy policies, which may differ significantly from current approaches, could lead to fluctuations in energy costs. This, in turn, could affect mining profitability and network security for proof-of-work networks like Bitcoin, potentially destabilizing the broader crypto ecosystem.

The economists’ concerns about international relations under a Trump presidency could also negatively impact the global nature of crypto markets. Strained diplomatic ties might hinder cross-border transactions and collaborative efforts in developing global crypto regulations, potentially fragmenting the market and reducing liquidity.

For the crypto industry, the economists’ warning highlights the complex interplay between macroeconomic policies, inflation, and digital asset markets. While Trump’s pro-crypto stance might seem favorable, the broader economic instability predicted by these economists could create a challenging environment for crypto.

The contrasting economic visions presented by Trump and Biden, and their potential impacts on inflation and monetary policy, are likely to be key factors influencing the crypto market’s trajectory in the lead-up to and following the 2024 US presidential election.

Share this article