Uniswap Price Prediction June 2021 – could it cross $30 soon

With Uniswap V3 on the horizon, what will June bring for UNI’s price?

The decentralised finance (DeFi) space has witnessed massive growth over the past few years. Uniswap is one of the most popular names in the DeFi space and performs a whole host of DeFi functions on the Ethereum blockchain.

As one of the leading DeFi platforms and the tenth-largest cryptocurrency by market cap, Uniswap is a cryptocurrency of interest for thousands of traders and investors. This post looks at Uniswap’s price potential for June 2021.

Uniswap Price Analysis

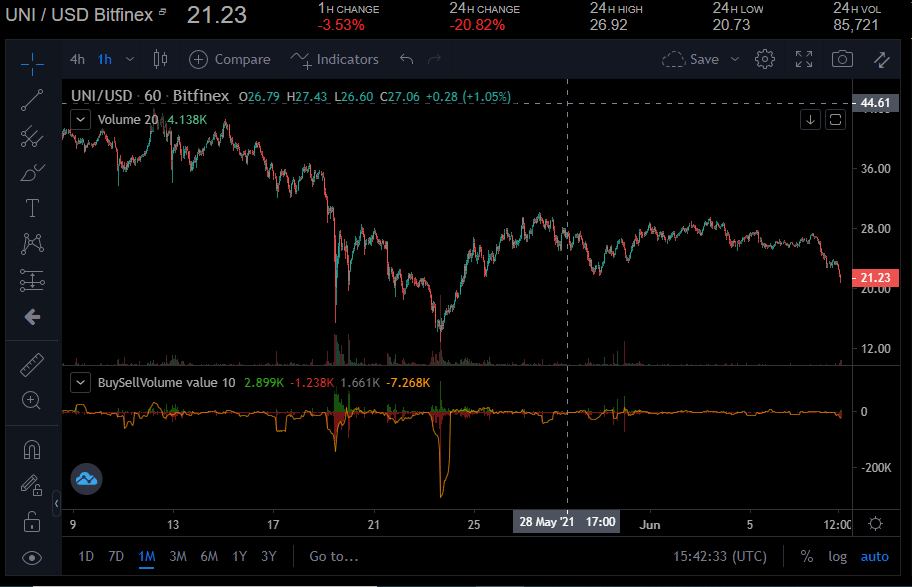

Uniswap has performed excellently so far this year. UNI began 2021 trading at $4.97 per coin. However, as the cryptocurrency market continued to rally, UNI’s price also rallied. The growing adoption of DeFi also saw UNI’s price rally higher, reaching its all-time high of $44.69 on 2 May, representing nearly 1000% in profits from the start of the year.

UNI’s price began to tumble a few weeks ago, as the cryptocurrency market lost over $1 trillion in market cap thanks to a massive correction. The UNI price crashed to $15 per coin towards the end of last month, but it has bounced back, and it is currently trading just above $23.

UNI price chart. Source: CoinMarketCap

UNI is currently up by roughly 500% year-to-date, making it one of the best performers in the market. Uniswap is one of the top ten cryptocurrencies by market cap, an indication of how much the coin has grown over the past few months. With the DeFi market still growing, UNI remains one of the best cryptocurrencies in the market.

Where to buy Uniswap (UNI) today

Binance

Binance has grown exponentially since it was founded in 2017 and is now one of, if not the biggest cryptocurrency exchanges on the market.

Register with Binance instantly

Uniswap Price Factors for June

Uniswap has experienced some interesting events so far this month, and more are expected to come. Let’s examine the fundamentals that will underpin UNI’s June performance.

Uniswap V3

The launch of Uniswap V3 has seen it become the largest decentralised exchange on the Ethereum network, second only to Uniswap V2. With the DeFi market growing, the Uniswap V3 offers excellent features such as greater efficiency and more liquidity. These features could help push UNI’s price higher as its adoption continues. Uniswap V3 will go live on Ethereum’s second layer (L2) via Optimism soon. This will increase scalability and make Uniswap more accessible due to lower fees. This could bring in a new class of user, and further propel UNI’s price skyward.

Hayden Adams, Uniswap’s founder, revealed that the platform would run a liquidity mining program again in short order. If the liquidity mining program returns, it would be a huge boost for the Uniswap network as it would allow users to earn an additional token on top of the regularly expected yield when they add their tokens to the liquidity pool. This would ensure that the network always has adequate liquidity, and it could help push UNI’s price even higher in the coming weeks and months.

Silicon Valley Interest

Perhaps the biggest news for Uniswap this month is the fact that it has gotten the backing of Silicon Valley. According to the Financial Times, Silicon Valley companies are now investing in cryptocurrency projects that could disrupt the financial sector and Uniswap tops the list. With more investment coming into the DeFi space via Uniswap, the decentralised exchange protocol is expected to get a lot more exposure over the coming weeks and months. This could help push its price higher despite the current market conditions.

Governance and Partnerships Growing

The Uniswap governance proposal is also gaining a lot of support within the cryptocurrency space. The proposal suggested setting aside tokens for a new DeFi fund for political lobbying. ConsenSys has given its support, and more crypto entities are expected to back the proposal in the next few weeks. The support would show Uniswap’s strong position in the market.

The Exo Economy is set to launch its native token on the Uniswap platform soon. The Exo platform hosts over 7,800 coaches, investors, and innovation specialists. It is designed to fast-track the development of businesses and streamline their processes.

Uniswap Price Forecast

Uniswap is arguably an excellent cryptocurrency, and this is clear from its fundamental analysis, however its technical indicators are bearish at the moment due to the performance of the broader cryptocurrency market. UNI has struggled to surpass the key psychological resistance at $35 in recent weeks, and if it fails to do this soon, it could affect its performance for the remainder of June.

After reaching an all-time high of $44 last month, the UNI/USD pair has lost nearly 50% of its value and is currently trading below $22 on most exchanges. However, despite the price decline, investors have been trooping into the Uniswap market due to its position in the crypto space.

UNI/USD chart. Source: Coinalyze

If the UNI/USD pair can maintain the support level at $21, then it could allow the cryptocurrency to break the resistance point at $26, giving the bulls an opportunity to move further towards the major psychological point at $36. However, for UNI’s price to rally that high, it would need the support of the broader market.

If Bitcoin can recover and lead the crypto market into a bull run resumption, then UNI could very possibly follow. With Uniswap V3 now up and running, and the L2 version just around the corner, Uniswap could emerge as a market leader should the bull run get back underway. If the technical picture can heal, Uniswap’s strong fundamentals will bring the targets of $30 and $36 into view.

Min. Deposit

$1

Exclusive promotion

The world’s largest cryptocurrency exchange with over 2bn daily users

Innovative trading platform offering enormous range of crypto coins

Supports over 60 methods of payment including PayPal

Payment Methods:

Cryptocurrencies

Please note, the details provided above are entirely a personal opinion of the writer, derived from the relevant market data. None of these are meant to be taken as direct investment advice.