Shiba Inu (SHIB) Price Woes Linked to These 2 Crucial Metrics

In most cases, a whirlwind of activity on a blockchain influences the price of the project’s native token. For Shiba Inu (SHIB), data shows that its recent woes can be linked to the absence of notable interaction on the network.

Besides that, SHIB experienced an odd surge in one of the vital metrics. This on-chain analysis dives into the short-term potential of the 12th-ranked cryptocurrency.

Decline in Shiba Inu Network Activity Raises Concerns

At press time, BeInCrypto examines the active, zero-balance, and new addresses on Shiba Inu’s network. According to IntoTheBlock, these on-chain metrics have all declined in the last seven days.

Active addresses simply refer to the number of users actively involved in transactions. New addresses, on the other hand, take into account participants making their first transactions, while zero-balance addresses measure participants yet to transact.

Put together, these indicators give an overview of user engagement. Shiba Inu’s notable fall in this aspect implies that there is a dearth of participants either sending or receiving tokens on the network.

Read More: Shiba Inu — A Beginner’s Guide

Typically, this is a bearish sign as it implies a drop in traction and a lack of demand for SHIB. Should this continue, SHIB’s price may be unable to recover from its recent downturn.

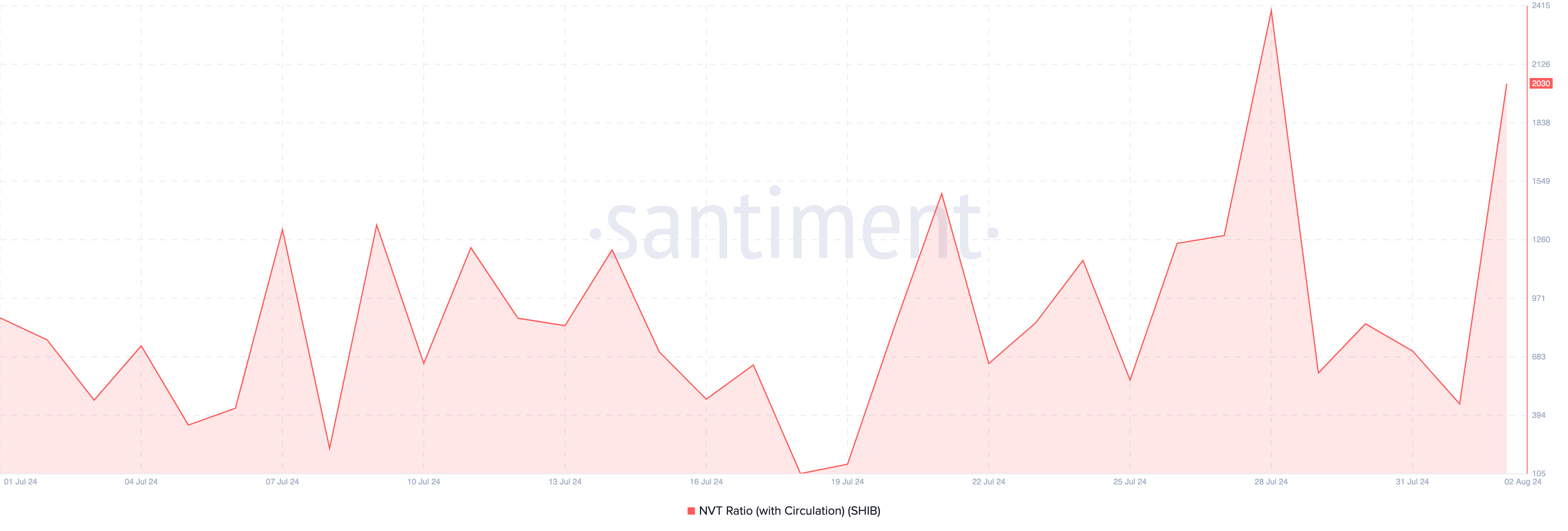

Further, the Network Value to Transaction (NVT) ratio brimmed with an astonishing spike. This ratio shows if a network is undervalued or overvalued.

Low NVT ratios indicate the network is undervalued, as transactions outpace the market capitalization. However, a high NVT ratio indicates that the network is undervalued and cannot efficiently handle a high volume of transactions, as is the case with SHIB.

SHIB Price Prediction: Will Bulls Surrender?

The daily chart shows that SHIB is exchanging hands at $0.000015. Three weeks ago, the token traded at a peak of $0.000020, sparking bullish calls for a higher price. However, that was not to be.

In addition, the Awesome Oscillator (AO), a technical oscillator that measures market momentum has fallen into the negative zone. When the AO is positive, momentum increases to the upside.

However, a decline similar to SHIB’s suggests downward momentum. Therefore, if the AO rating continues to fall, so will SHIB’s price. Should this linger, the token’s price may drop toward $0.000012.

However, the Money Flow Index (MFI), which measures the flow of capital into a cryptocurrency, seems to be diverging from the direction of SHIB’s price and AO.

Read More: 12 Best Shiba Inu (SHIB) Wallets in 2024

This trend, if sustained or moves higher, will indicate that market participants are buying the dip. Should that continue over the coming days, the token’s value may increase, and the price may attempt to revisit $0.000019.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.