4 Reasons Why HashKey Capital is Bullish on Altcoins

HashKey Capital remains optimistic about altcoins, taking cues from the ongoing Bitcoin boom. Their bullish stance is based on a mix of market analysis, strategic investments, and economic factors that suggest strong potential for low-cap tokens.

At the same time, Bitcoin (BTC) continues to perform well, with the $70,000 milestone within reach. Should positive sentiment lead to capital flowing into altcoins, Ethereum and Solana are expected to be the primary beneficiaries.

HashKey Capital Eyes Market Potential for Altcoins

The investment firm has articulated its bullish outlook in a recent Medium post. It outlined the strategic rationale behind its focus on altcoins amid changing market outlook and investor sentiments. Specifically, HashKey Capital has identified a critical shift in investor behavior, citing an increasing demand for diversified portfolios that extend beyond Bitcoin and Ethereum.

Growing Institutional Interest

The post emphasizes that the increasing institutional interest in cryptocurrencies serves as a strong catalyst for the growth of altcoins. It highlights the growing narrative around cryptocurrencies as major financial players and asset managers become more involved in the digital asset space.

Further, institutions are looking beyond Bitcoin and Ethereum, considering altcoins as viable investment vehicles. Among them is Bitwise, which recently revised its XRP ETF (exchange-traded fund) filing. Others, like Grayscale, are pivoting their trust funds to altcoins such as Aave, Sui, and XRP.

Read more: 10 Best Altcoin Exchanges In 2024

According to Jupiter Zheng, HashKey Capital’s partner of liquids funds and research, professional investors are eager to explore altcoin opportunities. Due to their lower market capitalization and growth potential, these tokens have historically provided substantial returns.

Changing Market Conditions

HashKey Capital’s optimism is also grounded in favorable market conditions. Recent trends indicate that cryptocurrency markets are stabilizing, aided by improved liquidity and shifting macroeconomic conditions. The firm points to signs of a market bottoming out, which, coupled with the potential easing of US interest rates, is seen as a favorable environment for altcoin investments.

“The peaking of US interest rates combined with improved liquidity in the crypto market creates an ideal environment for investors to explore altcoins,” Zheng noted

The increase in applications for spot crypto ETFs (exchange-traded funds) also reflects a growing acceptance and normalization of digital assets. For instance, Nashville-based investment firm Canary Capital filed for a Litecoin ETF, which further enhances the investment avenue for altcoins.

Regional Regulatory Boost

Another key component of HashKey Capital’s bullish outlook on altcoins is the supportive regulatory environment. Hong Kong is a key focus for the asset manager, given that it is based there. The region has made significant strides in establishing a strong framework for digital assets.

This has attracted institutional interest and provided a favorable atmosphere for crypto investments, with the likes of Animoca Brands exploring a possible IPO (initial public offering) in Hong Kong or the Middle East. The regulatory clarity is expected to facilitate greater adoption of altcoins and pave the way for new projects to emerge.

As HashKey navigates this regulatory playing field, its focus on altcoins aligns with the broader trend of institutional players entering the market. This influx of capital and expertise is anticipated to drive innovation and create new investment opportunities within the altcoin space.

Diversification Strategy

Nevertheless, HashKey Capital’s strategy goes beyond capitalizing on market trends. It is also about prudent risk management through diversification. The firm plans to allocate less than 50% of its funds to Bitcoin and Ethereum, allowing for greater exposure to smaller-cap cryptocurrencies. This strategic allocation aims to optimize risk-return profiles by tapping into the potential of various altcoin projects.

The selection criteria prioritize projects that exhibit strong fundamentals and novel approaches. Taken together, the asset manager’s altcoin pivot highlights an understanding of market inefficiencies. Smaller market cap-sized cryptocurrencies often experience higher volatility, but they also provide opportunities for outsized returns. By strategically investing in a range of altcoins, the crypto investment firm seeks to balance risk while pursuing substantial upside potential.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season.

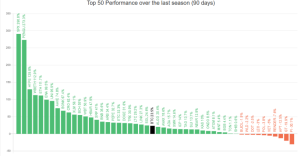

HashKey Capital’s expression of bullishness on altcoins is timely, coming along with analysts’ expectation that the colloquial “alt season” is near sight. As BeInCrypto reported, the Altcoin Season Index has dropped to its lowest level since early September, signaling a potential shift. Nevertheless, some are also skeptical about an altcoin season happening, given Bitcoin’s prevailing dominance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.