BTC/USD Retraces as Bitcoin Targets $36,000 Low

Bitcoin (BTC) Falls to the Range- Bound Zone as Bitcoin Targets $36,000 Low – August 3, 2021

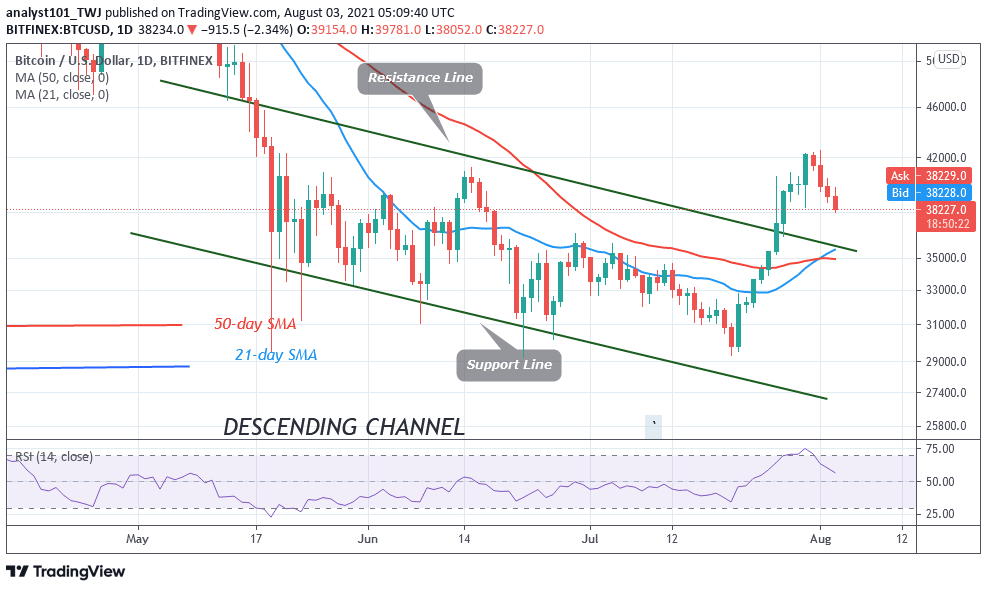

On July 31, BTC/USD faced rejection from the $42,400 high as Bitcoin targets $36,000 low. This has compelled Bitcoin to decline to the downside. Bitcoin bulls have failed to sustain the bullish momentum above the $42,451 resistance. The implication is that the king coin is likely to resume the range-bound move between $30,000 and $42,451.

Resistance Levels: $45,000, $46,000, $47,000Support Levels: $40,000, $39,000, $38,000

Bitcoin (BTC) has resumed a downward move after the failure of the bulls to continue the upside momentum. The BTC price will only continue the upside momentum when the $40,000 to $42,451 resistance zones are cleared. In the meantime, BTC’s price is likely to fall and extend the downtrend to the low of $36,000. However, the selling pressure will persist if the $36,000 support also cracks. On the upside, if price retraces and rebounds above the $36,000 support, it is a signal that a fresh uptrend has begun. Meanwhile, BTC’s price is attempting to hold above $38,000 as the market continues to fluctuate below and above the $ 38,000.

Bitcoin Miners May Be Exempted From Proposed Crypto Taxes

Some lawmakers in the United States want assurances that Bitcoin miners and crypto software developers will not be subject to the newly proposed tax rules. According to reports, amendments, tighter rules on crypto reporting requirements could offer the government $28 billion in an additional fund. Efforts to protect miners from burdensome tax reporting requirements come as US-based miners expand their capacity. According to a spokesperson for Senator Portman stated, “This legislative language does not […] force non-brokers, such as software developers and crypto miners, to comply with IRS reporting obligations.”

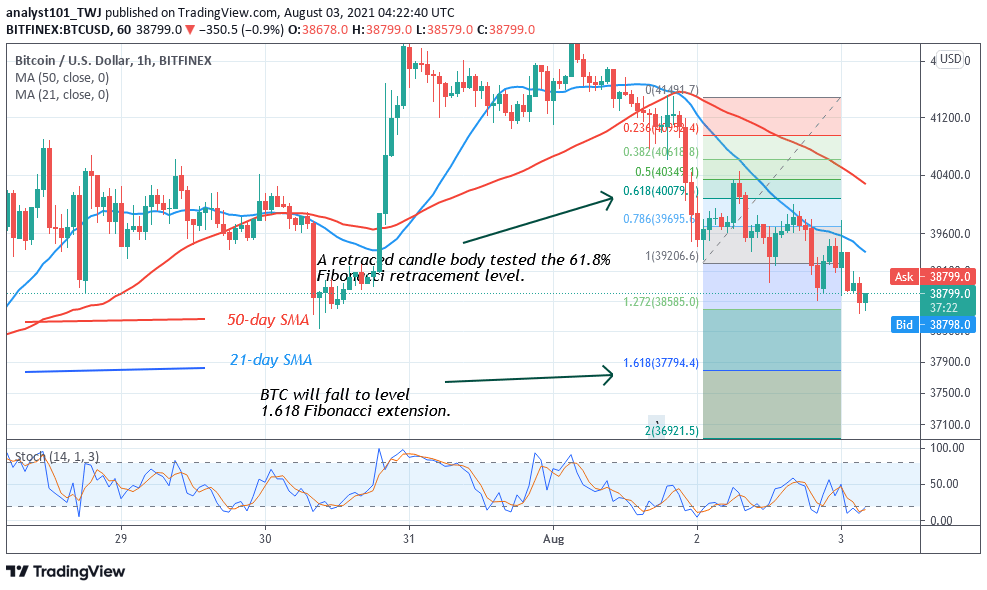

Meanwhile, the BTC/USD price is still trading above the $38,000 as Bitcoin targets $36,000 low. Traders have expected the market to decline to the low of $66,000 low. Meanwhile, on August 2 downtrend; a retraced candle body tested the 61.8% Fibonacci retracement level. The retracement indicates that Bitcoin will fall but reverse at level 1.618 Fibonacci extension or level $37,794.40.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider