Record $1 Billion ETF Inflows Push Value Up 45% in 30 Days

TLDR

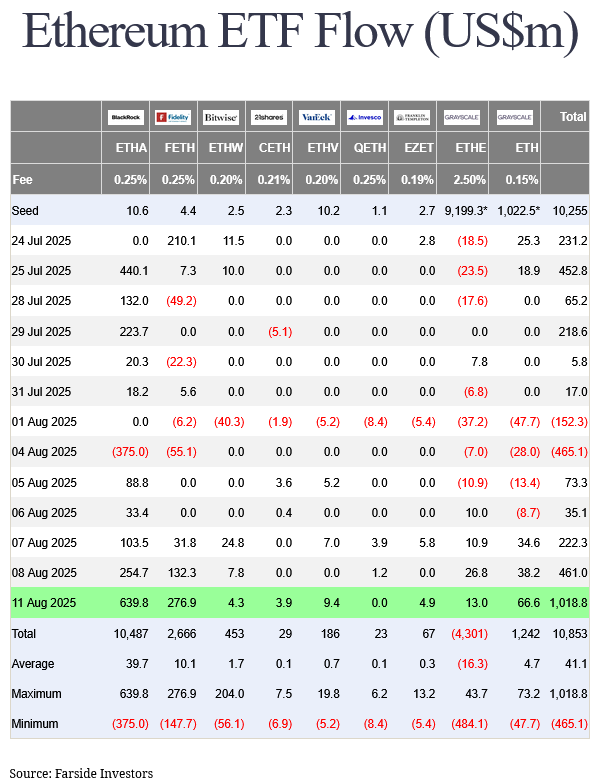

Spot Ether ETFs recorded their biggest day of net inflows ever with $1.01 billion on Monday

BlackRock’s ETF (ETHA) led with $640 million in inflows, followed by Fidelity’s FETH with $277 million

ETH has gained 45% in the past 30 days, now trading around $4,275

Ethereum remains the dominant chain for tokenized assets, accounting for about 58% across all chains

Assets staked on the Ethereum network surpassed $150 billion for the first time

Ethereum has been making headlines as its price continues to climb toward its all-time high. The second-largest cryptocurrency by market cap has seen a remarkable price increase over the past month, driven largely by institutional interest and investment.

ETH has gained 45% in value over the past 30 days, trading at approximately $4,275 at the time of writing. This puts the cryptocurrency within striking distance of its previous all-time high of $4,800 set four years ago.

The most eye-catching development came on Monday when spot Ether exchange-traded funds (ETFs) recorded their biggest day of net inflows ever. Total flows across all Ether ETFs reached $1.01 billion in a single day, far exceeding Bitcoin ETFs which saw net inflows of $178 million on the same day.

BlackRock’s iShares Ethereum Trust ETF (ETHA) attracted the lion’s share of these flows, with a record $640 million entering the fund. The Fidelity Ethereum Fund (FETH) took second place with $277 million, also setting a record for its largest single-day inflow.

This surge in ETF interest comes as Ethereum displays several positive market indicators. The amount of ETH held on exchanges has dropped to a nine-year low, reaching 15.28 million ETH – the lowest level since November 2016. This movement of assets off exchanges typically suggests investors are moving their holdings into long-term storage, a pattern often interpreted as bullish.

Institutional Buying Power

The scale of institutional buying has been impressive. Reports indicate that a single unidentified institution purchased 49,533 ETH worth $212 million in just one day. Over the past week, the same buyer accumulated 221,166 ETH valued at $946.6 million.

A consistently positive Coinbase Premium Index, which has been negative for only seven days in the last three months, further suggests strong buying pressure from U.S.-based investors, including institutions.

NovaDius president Nate Geraci commented that Ether ETFs were previously underestimated because traditional finance investors didn’t understand Ethereum. He noted that institutional investors are now viewing ETH as the “backbone of future financial markets.”

Ethereum also continues to dominate in the world of tokenized assets. According to on-chain data platform Token Terminal, Ethereum accounts for about 58% of all tokenized assets across all blockchains.

The network recently reached another milestone as assets staked on Ethereum surpassed $150 billion for the first time, demonstrating growing confidence in the blockchain’s long-term prospects.

Market Leverage and Risk Factors

Despite the bullish momentum, some market indicators suggest caution may be warranted. The all-exchange Estimated Leverage Ratio (ELR) has reached 0.68, close to its historic highs. This means that on average, open interest in perpetual and futures contracts is 68% of the spot reserves.

While this level of leverage doesn’t represent maximum risk, it is high enough to potentially accelerate price movements in either direction. Binance’s ELR appears lower at 0.52, indicating that other exchanges carry greater leverage.

The recent price rally has also seen an uptick in short-term traders booking profits, which may indicate expectations of a potential pullback. Ethereum co-founder Vitalik Buterin recently warned that the trend of corporations buying ETH for their treasuries could turn into a dangerous “overleveraged game.”

Corporate holders of Ether have seen their assets under management increase to $13 billion on Monday due to the price appreciation of ETH. Crypto influencer Anthony Sassano noted that Ether ETFs have bought over 50% of the ETH issued since the Merge in late 2022.

The Taker Buyer Sell Ratio has surged to 1.005, entering positive territory after previously dipping into negative territory. This ratio, which compares aggressive buying to selling, indicates that buyers currently have control of the market.

If the current pace of accumulation continues, ETH could target price levels of $4,501 and then $4,788. However, a leverage-driven long squeeze could potentially push the price below $3,980, which analysts have identified as a key reversal zone.

The spot Ether ETF inflows on Monday bought up approximately 238,000 ETH, representing over 50% of all the net issued ETH (451,000) since the blockchain switched to proof-of-stake in late 2022.