Polygon’s MATIC Token Breaks Out Targeting $2.60

Key Takeaways

MATIC is down by more than 14% in the past two days.

The downswing could be part of a bear trap.

Technical analysis points to an incoming 62% breakout.

Share this article

Polygon’s MATIC token prepares to revisit previous all-time highs after breaking out of a bullish continuation pattern.

MATIC Retraces Before Skyrocketing

Polygon’s MATIC token has broken out of an inverse head-and-shoulders formation that has been developing since early July on its daily chart. After moving past the pattern’s neckline at $1.63, the altcoin surged by more than 10% to hit a high of $1.80.

A further increase in buying pressure around the current price levels could push MATIC’s price by another 46% towards $2.64. This target is determined by measuring the inverse head-and-shoulders’ widest range and adding that distance upward from the breakout point.

While the odds seem to favor the bulls, it is imperative to note that assets breaking out of inverse head-and-shoulders patterns tend to retest the neckline or breakout point before advancing further. Such downswings help shake out some of the so-called “weak hands” and provide an opportunity for side-lined investors to re-enter the market.

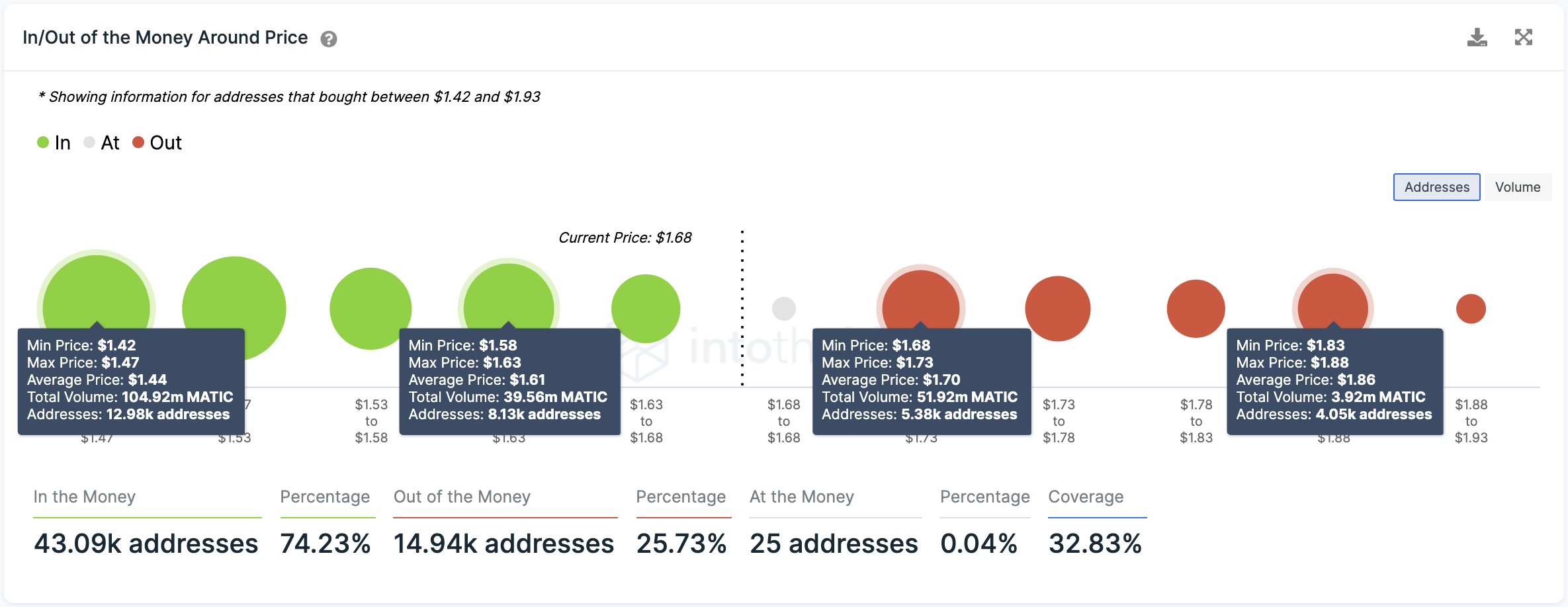

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that in the event of a downswing, the $1.58-$1.63 demand barrier would likely keep Polygon’s prices at bay. Here, more than 8,130 addresses had previously purchased nearly 40 million MATIC.

Given the significant interest around the $1.61 support level, token holders would likely do anything to prevent their investments from going out of the money. They may even buy more tokens allowing prices to rebound and reach the head-and-shoulders’ target of $2.63.

It is worth noting that there are a few obstacles that Polygon would have to overcome to achieve its upside potential. Based on the IOMAP cohorts, the most crucial supply barrier sits at $1.70, where 5,380 addresses hold roughly 52 million MATIC.

Once this resistance level is breached, the next critical wall lies between $1.83 and $1.88 as 4,000 addresses bought 3.90 million MATIC around this price point.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Polygon Acquires Layer 2 Blockchain Hermez for $250 Million

Polygon is acquiring Hermez Network in the first merger and acquisition deal involving two projects with tokens. Hermez To Become Polygon Hermez Formerly known as Matic network, Polygon has recently…

How Polygon and xDai Will Adopt EIP-1559

To maintain their compatibility with Ethereum, Polygon and xDai have also planned to implement the fee burning proposal used in EIP-1559 on their own networks. EIP-1559 on Sidechains Ethereum shipped…

Hop Protocol Cuts Polygon Withdrawal Times to Minutes

The Hop Protocol update allows for quick MATIC withdrawals from Polygon to Ethereum. New Bridge Update For Polygon Users Hop Protocol has announced a new cross-chain liquidity solution that lets…

How to Trade Using the Inverse Head and Shoulders Pattern

In stock or cryptocurrency trading, you may have heard of the term “inverse head and shoulders.” Also known as the “head and shoulders bottom” formation, the inverse head and shoulders chart pattern can…