Cosmos, Harmony, DeFi 2.0 Tokens Defy Market Slump

Key Takeaways

Cosmos has soared 20% in the past 24 hours, currently approaching a new all-time high.

Harmony’s ONE token is also one of the day’s biggest gainers, climbing 15%.

Several DeFi 2.0 tokens involved in the “Curve Wars” have also put in double-digit gains.

Share this article

Cosmos, Harmony, and several so-called DeFi 2.0 projects have put in double-digit gains over the past 24 hours despite a decline across the wider market.

Cosmos and Harmony Rally

Cosmos and Harmony are nearing all-time highs.

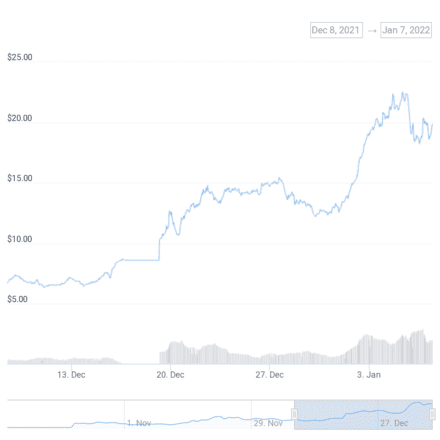

Cosmos has climbed over the last month despite weak momentum among market leaders. The Layer 0 blockchain’s ATOM token has jumped 45% in a seven-day period that saw Bitcoin shed 10.4%. Today, ATOM has climbed 20%, and is closing in on its all-time high of $44.42 achieved in September.

An increased focus on interoperability is likely driving interest in Cosmos. Several Layer 1 blockchains such as Terra and Binance Smart Chain are built using the Cosmos software developer kit, making it easy to build bridges between them. Cosmos is also pioneering the Inter-Blockchain Communication Protocol, a standard for interoperability that allows independent blockchains to talk to each other and transfer data and assets.

Osmosis Hub, the first decentralized exchange for IBC-connected coins built on the Cosmos SDK, recently broke past its prior all-time highs, soaring 19% over the past 24 hours. The OSMO token is currently trading at $9.23 as it enters price discovery.

Harmony, an Ethereum-compatible Layer 1 chain, has also surged amid market uncertainty. The network’s ONE token has gained 15% on the day, breaking past the psychological barrier of $0.30. ONE is currently trading at $0.316, just $0.06 off its all-time high.

DeFi Kingdoms, a gamified play-to-earn DeFi app built on Harmony, has soared over recent weeks, bringing more attention to the Layer 1. The protocol’s JEWEL token has risen over 175% since the start of December as users flock to Harmony to start playing DeFi Kingdoms (players need JEWEL to access the game).

DeFi 2.0 Shows Strength

Elsewhere, a group of nascent decentralized finance protocols is also taking flight.

Frax Shares and Dopex Rebate Tokens are up double-digits on the day, while OlympusDAO fork Redacted Cartel’s BTRFLY token has soared 25% to over $3,400.

These projects all play a central role in the so-called “Curve Wars,” a development that’s seen DeFi protocols competing to lock up CRV tokens to gain voting power over the stablecoin exchange Curve Finance. Locking up more tokens gives protocols more power to vote on which Curve pools receive the highest yields, which means they can vote for their preferred pools to receive more rewards. In turn, they can offer higher yields to users, creating a flywheel effect to help them acquire and lock up even more CRV tokens.

Other notable players in the Curve Wars include Convex Finance and Yearn.Finance. Although these protocols have not shown as much resilience as Frax or Dopex’s tokens in the last 24 hours, they have outperformed many other assets and appear to be maintaining their upward trends.

A large portion of these tokens’ value is derived from stablecoin yields, which may explain why the recent drop in the market has had little effect on their price. The increased demand for Curve voting power has also affected the CRV token price. CRV is up 22.6% over the past month and reached a new local high of $6.71 on Jan. 4. Due to the recent market turbulence, it has since cooled off and currently trades at $5.11.

Disclosure: At the time of writing this feature, the author owned ETH, CRV, and several other cryptocurrencies.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Cosmos and Osmosis Surge While Rest of Market Flounders

The tokens for both Cosmos and its most prominent decentralized exchange, Osmosis, are up today while much of the rest of the cryptocurrency market is either flat or down. Positive…

Convex Finance Crosses $20B Locked, Overtaking DeFi Staples

Convex Finance is now the second-largest DeFi protocol with over $21 billion in total value locked. Convex Finance Jumps to Second-Ranked TVL Convex Finance now holds the second-highest amount of…

Terra, Abracadabra Stablecoins “Are Going to Zero”: Maker …

MakerDAO founder Rune Christensen described the UST and MIM stablecoins as “solid ponzis” in a tweet earlier this morning. Abracadabra.Money and Terra founders Daniele Sestagalli and Do Kwon immediately fired…

Investing Survey: Win A $360 Subscription To Pro BTC Trader

We’re doing this because we want to be better at picking advertisers for Cryptobriefing.com and explaining to them, “Who are our visitors? What do they care about?” Answer our questions…