Binance US Faces Criticism as Withdrawal Issues Impact User

As Binance.US’s market dominance drops to around 1%, its customers have expressed frustrations over ACH withdrawal delays from the exchange.

Multiple users have shared their experiences of pending transactions that have remained unresolved for several days.

Binance.US experienced a surge in withdrawal requests in response to its advisory urging users to withdraw their USD balances before June 13. The exchange attributed this decision to its banking partners’ abrupt halt of its USD payment channels.

Binance.US Response

A Binance.US email response shared on Twitter showed that the exchange said the volume of requests it had to honor caused the delays. According to the email, the exchange has processed more than 85% of the 285,000 withdrawal requests it had received.

The exchange further stated that its banking partners’ decision to restrict access to its accounts before the Court heard the SEC freeze request exacerbated the situation. Meanwhile, Binance.US and the SEC have agreed that its customers’ assets will be under the sole control and direction of the exchange staff.

As of press time, Binance.US was yet to respond to BeInCrypto’s request for additional commentary.

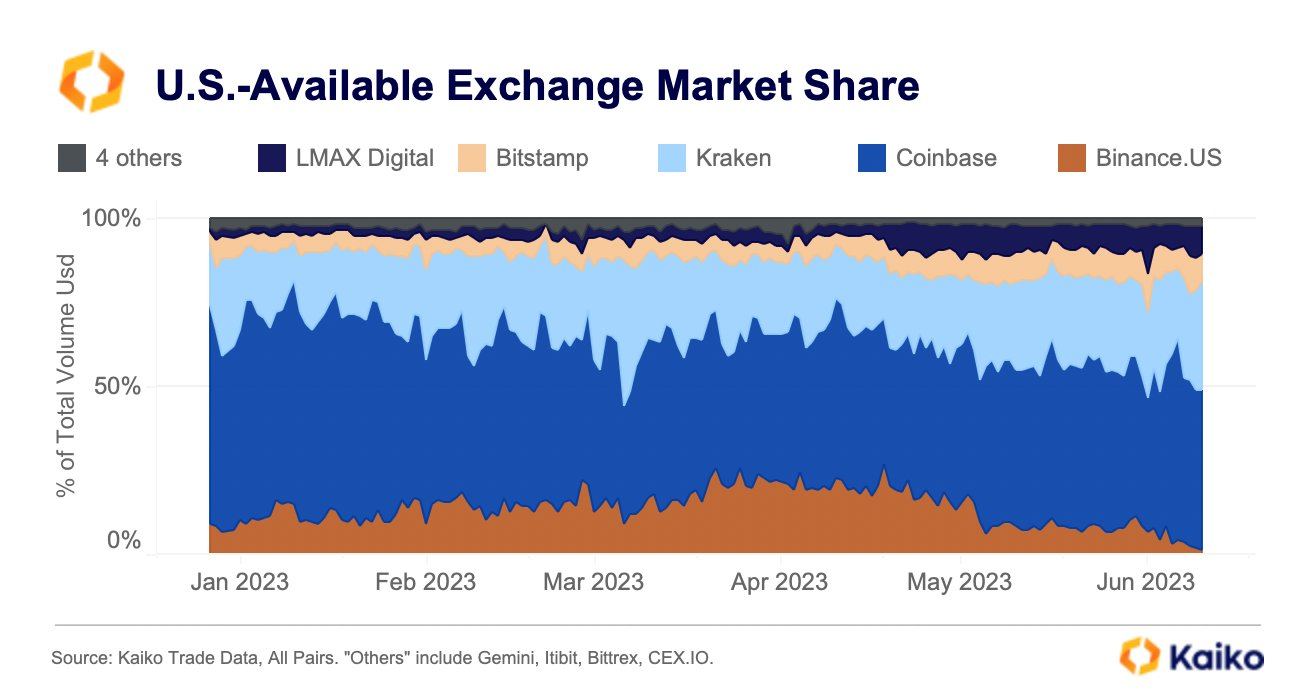

Binance.US Market Share Drops to 1%

According to data from Kaiko, Binance.US’s market share among U.S. exchanges plummeted to 1% following the lawsuit, marking a significant decline from the 20% recorded in April. At the time, CEO Changpeng ‘CZ’ Zhao pointed out that the US subsidiary’s volume reached 41% of Coinbase.

The SEC’s lawsuit has further worsened liquidity on Binance.US, with some whales selling their Bitcoin at discounts of up to 15%.

Regulatory Troubles Spread Across Multiple Jurisdictions

In addition to Binance’s regulatory challenges in the U.S., the exchange is encountering further difficulties in various jurisdictions. Over the past week, the exchange exited two European markets, specifically the Netherlands and Cyprus, and faces an ongoing investigation in France.

The exchange could not get a virtual asset service provider (VASP) license in the Netherlands despite its best parlays with the authorities.

In France, the Paris public prosecutor’s Office investigates the exchange for “acts of aggravated money laundering” and illegally providing crypto trading services before its subsidiary was registered. However, CZ insisted that it cooperated fully with the surprise visit and the subsidiary would “continue to be our flagship center in Europe.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.