Bitcoin and Ethereum Flash Sell Signals After Major Gains

Key Takeaways

The Tom DeMark Sequential indicator has flashed sell signals on Bitcoin and Ethereum’s daily charts.

Despite the pessimistic outlook, transaction history shows BTC faces no resistance until $42,600.

Likewise, ETH may advance to $2,500 before it retraces towards $2,000.

Share this article

Bitcoin and Ethereum continue to make higher highs, but one technical indicator suggests that a correction could be coming.

Bitcoin May Pump Before the Dump

Bitcoin and Ethereum may be due for a correction.

Bitcoin has seen its price surge by more than 37% over the last week, going from a low of $29,800 to hit a high of almost $41,000.

The impressive uptrend marked one of the best winning streaks that Bitcoin has experienced since its downturn began in mid-April. The leading cryptocurrency also closed its eighth consecutive green day for the first time since December 2020.

The Tom DeMark (TD) Sequential suggests that Bitcoin is primed to retrace despite the significant gains it has incurred. This technical indicator presented a sell signal in the form of a green nine candlestick on BTC’s daily chart.

The bearish formation is indicative of a correction of one to four daily candlesticks before the uptrend resumes.

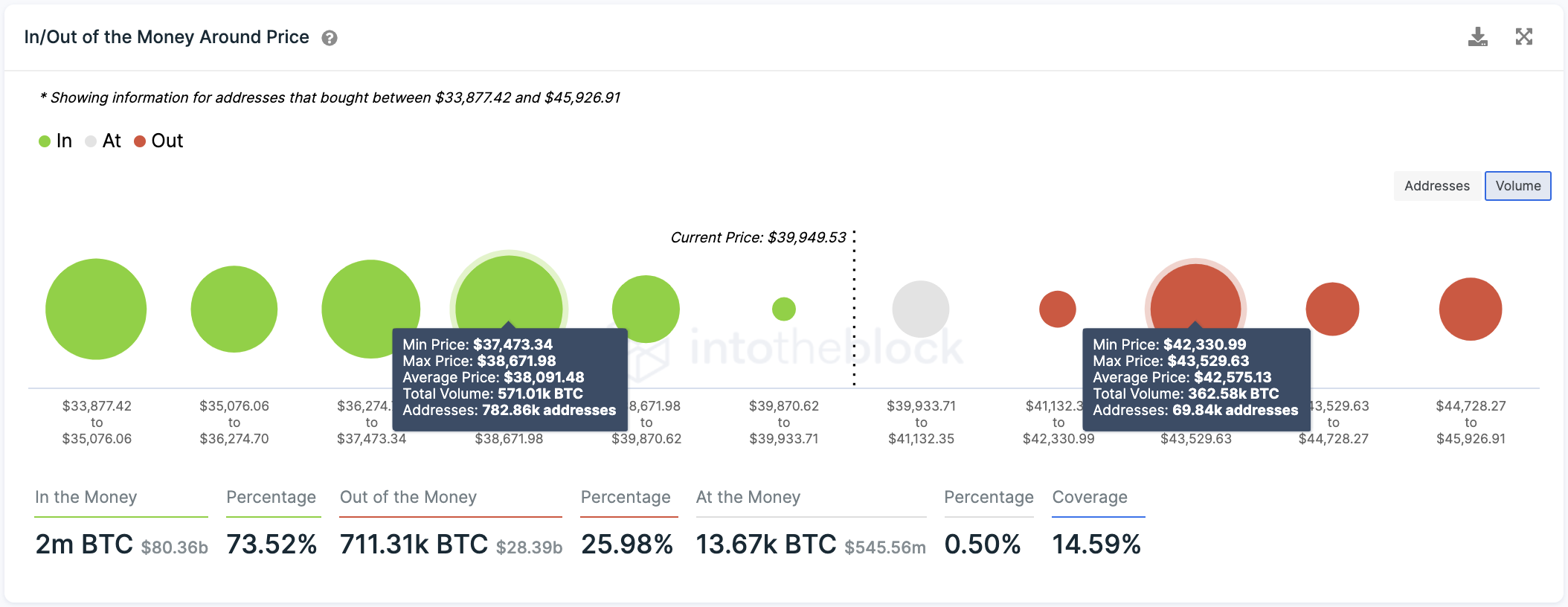

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that there isn’t any critical resistance level on top of Bitcoin that could prevent it from advancing further. The only major supply zone sits between $42,330 and $43,530. Here, roughly 70,000 addresses have previously purchased nearly 363,000 BTC.

Given the lack of opposition ahead, the flagship cryptocurrency may continue rising toward the $42,330-$43,530 range before the TD’s bearish outlook materializes.

A spike in profit-taking anywhere between the current price levels and the overhead resistance could result in a pullback to the demand zone between $37,470 and $38,670. The IOMAP model reveals that this is the most significant support barrier underneath Bitcoin as more than 780,000 addresses bought 570,000 BTC around this price point.

Ethereum Follows the Bitcoin’s Path

Like Bitcoin, Ethereum seems bound for a downswing before it continues posting higher highs. The TD Sequential suggests that ETH is trading at overbought territory after flashing a sell signal in the form of a green nine candlestick on the daily chart.

A spike in selling pressure could see ETH shed some of the 36.5% gains it posted over the last week.

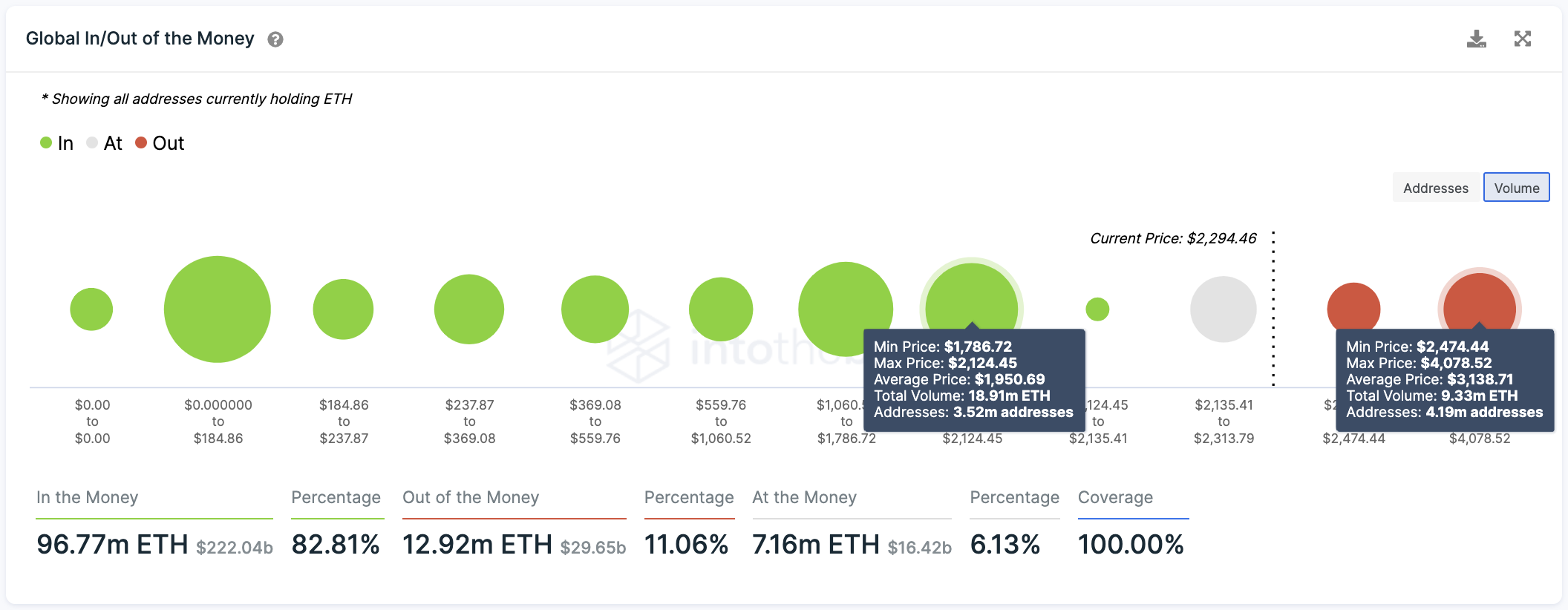

Transaction history reveals that the most significant support barrier underneath Ethereum lies between $1,790 and $2,130. Here, more than 3.5 million addresses have previously purchased nearly 19 million ETH.

The $1,950 demand wall may have the strength to prevent prices from falling further and serve as a rebound zone for ETH.

The IOMAP model also shows that Ethereum does not face any significant resistance until $2,475.

Therefore, ETH is well-positioned to advance toward this level before the TD’s cell signal gets validated. Only a rejection from the overhead resistance is likely to result in a sell-off toward the underlying support that extends from $1,790 to $2,130.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.