Bitcoin, Ethereum Enter Potential Buy Zone

Key Takeaways

Bitcoin appears to be forming a market bottom.

Likewise, Ethereum has entered the “opportunity zone.”

BTC and ETH must break resistance to march to new all-time highs.

Share this article

Bitcoin and Ethereum appear bound for high volatility as several on-chain metrics suggest that a market bottom is near. Still, these cryptocurrencies must overcome a significant obstacle to resume the uptrend.

Bitcoin in Accumulation Mode

Bitcoin appears to be trading in oversold territory while crypto enthusiasts remain fearful of further losses.

Bitcoin’s Entity-Adjusted Dormancy Flow suggests that the flagship cryptocurrency could be forming a local bottom. It considers the ratio of the current market capitalization to the annualized dormancy value to determine whether experienced market participants are spending their BTC.

Whenever there is a substantial decrease in spending from the so-called “old hands,” the Entity-Adjusted Dormancy Flow drops below the 250,000 threshold, representing an excellent historical buy zone. This on-chain metric has almost perfectly timed every market bottom since 2011, and a similar outlook could now play out as dormancy value has overtaken market capitalization.

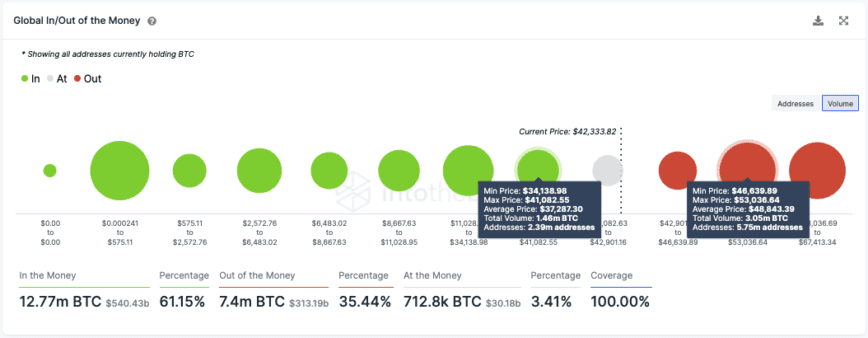

Still, IntoTheBlock’s Global In/Out of the Money model reveals that Bitcoin faces stiff resistance ahead. Approximately 5.75 million addresses had purchased more than 3 million BTC between $46,700 and $53,000.

Only a substantial break above this supply barrier can confirm that the pioneer cryptocurrency will resume its bull market.

It is worth noting that Bitcoin currently trades above a thin layer of support. Roughly 2.4 million addresses hold nearly 1.5 million BTC between $34,000 and $41,000. Such a vital demand wall must hold to prevent the bellwether cryptocurrency from capitulating to $30,000 or even $20,000.

Ethereum in Opportunity Zone

Ethereum appears to have entered an accumulation zone, encouraging sidelined investors to get back in the market.

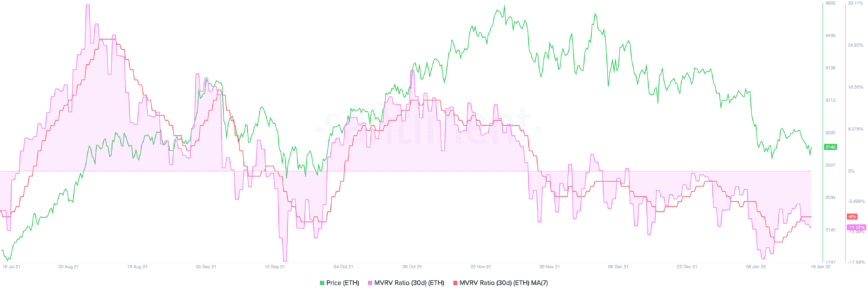

The Market Value to Realized Value (MVRV) index suggests that Ethereum is undervalued at the current price levels. This fundamental index measures the average profit or loss of addresses that acquired ETH over the past month.

The 30-day MVRV ratio currently hovers at -11.12%, indicating that Ethereum sits in the “opportunity zone.” The lower the MVRV ratio, the higher the probability of an upward price movement.

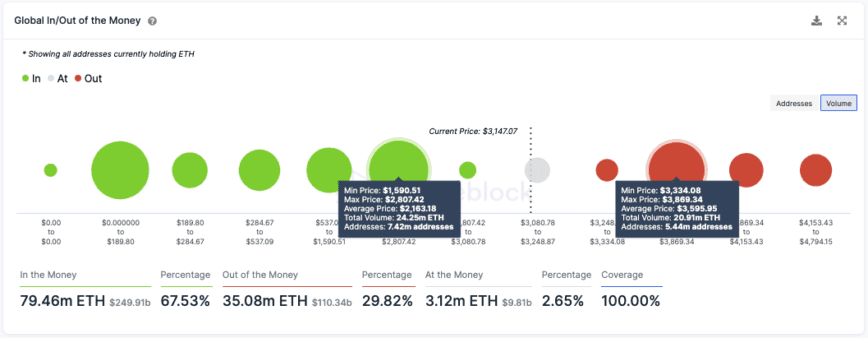

Although Ethereum is sitting on top of weak support, transaction history shows that it only has one obstacle to overcome to resume the uptrend.

More than 5.44 million addresses have acquired approximately 21 million ETH between $3,300 and $3,900. A decisive candlestick close above this resistance barrier could propel ETH towards new all-time highs.

Regardless, investors must pay close attention to the $2,800 support level as any signs of weakness around it could encourage market participants to sell. Under such circumstances, Ethereum could fall to $2,500 or even $2,000.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Bitcoin, Ethereum Dip Below Key Psychological Footholds

The two most dominant crypto assets have been shedding points for weeks since reaching all-time highs in November. Today, however, they both dipped below key psychological levels. Psychological Resistance Almost…

Ethereum Hits Crucial Level After Breaking Below $3,000

Ethereum has started the week in sluggish mode after its price suffered another 7% dip. While many market participants are displaying signs of fear, the number two crypto appears to…

Bitcoin Struggling Against Bearish Momentum

Bitcoin is struggling to find a stable support floor as bears appear to have taken over. Historical price action suggests that BTC must hold above $37,300 to avoid capitulation. Bitcoin…

What Is The Crypto Volatility Index?

The Crypto Volatility Index (CVI) is a decentralized solution used as a benchmark to track the volatility from cryptocurrency option prices and the overall crypto market.