Bitcoin, Ethereum Network Activity Shows Major Downside Risk

Key Takeaways

Bitcoin whales are selling or redistributing their tokens.

Both BTC and ETH have suffered sharp declines.

The top two cryptocurrencies are at risk of major sell-offs.

Share this article

Volatility has struck the cryptocurrency market, leading to more than $160 million in liquidations over the past 24 hours. Bitcoin and Ethereum are now sitting on top of weak support, posing the risk of further losses.

Bitcoin and Ethereum Retrace

Bitcoin and Ethereum’s recent activity looks precarious, and without a significant improvement, the top two cryptocurrencies could suffer from major corrections.

Bitcoin appears to have developed a Bart pattern following a Tuesday downturn. Bitcoin rose from a low of $18,700 and briefly broke out to $20,390 Tuesday. However, it’s since retraced, erasing its gains to hit a low of $18,480.

From an on-chain perspective, investors are showing little interest in accumulating Bitcoin at current prices. Addresses holding between 1,000 and 10,000 Bitcoin have sold or redistributed roughly 50,000 coins worth around $950 million over the past week. The mounting selling pressure could soon take a toll on Bitcoin’s price.

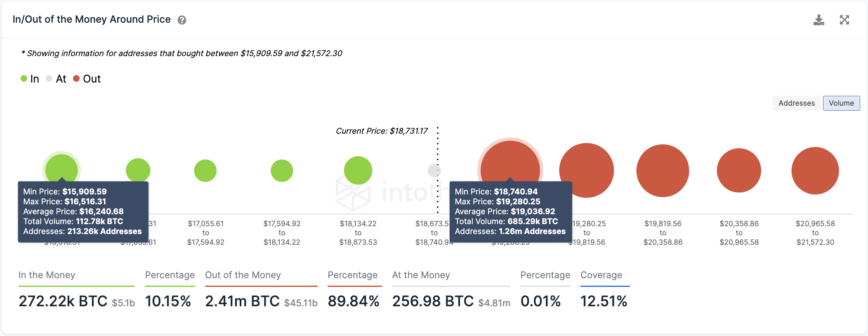

Transaction history shows that Bitcoin is sitting below a significant supply wall with few considerable demand walls underneath it. Around 1.26 million addresses purchased 685,000 Bitcoin at an average price of $19,000. Another downswing could encourage these investors to exit their positions to avoid further losses. Given the lack of support levels, Bitcoin could suffer a drop toward $16,240.

Bitcoin needs to reclaim the $19,000 level as support as soon as possible to have a chance of invalidating the pessimistic outlook. If it succeeds, it could march toward the recent $20,390 high, marking a crucial break above the $20,000 psychological level.

Ethereum has also seen high volatility over the past 24 hours, shedding nearly 150 points in market value. According to IntoTheBlock data, the number of addresses joining the network has increased from around 64,000 to 80,000 since September 26, which would typically be a bullish sign.

Nonetheless, given Ethereum’s close correlation with Bitcoin and other risk assets like stocks, there is reason to believe that it could decline further. Ethereum broke below $1,420 on September 18 and has so far failed to reclaim the key level. $1,420 is considered an important benchmark for Ethereum as it marked the number two crypto’s all-time high at the tail end of the 2017 to 2018 bull run.

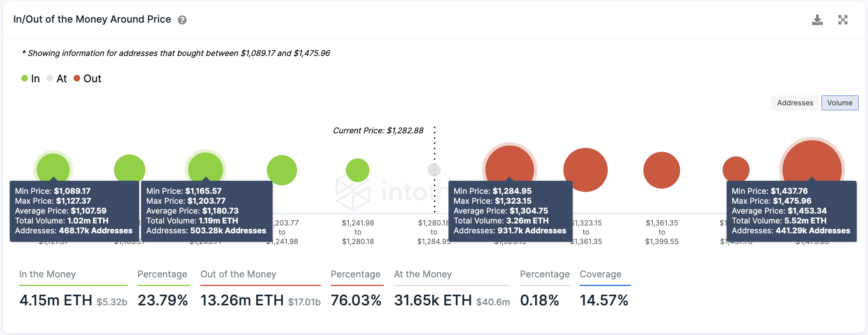

IntoTheBlock’s IOMAP model shows that further downward pressure could take Ethereum to $1,180, where 500,000 addresses hold around 1.19 million ETH. But if this support level fails to hold, the correction could extend toward $1,000.

Ethereum must climb and print a daily close above $1,300 to invalidate the bearish thesis. If it succeeds, it could recover and ascend toward $1,450.

Editor’s note: This piece quoted incorrect data on the number of new addresses joining the Ethereum network when it was published. It’s been amended to include new data and analysis on Ethereum.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH. The information contained in this piece is for educational purposes only and is not investment advice.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.