Bitcoin Price Steady, US Dollar Weakens Amid Inflation Reports

Bitcoin currently holds steady above $30,000 as the US Dollar weakened following the Wednesday Consumer Price Index (CPI) inflation report.

Bitcoin is currently holding firm above the key support level at $30,000. However, no relative strength is seeing the price push and hold above $31,000.

CPI Numbers Boost Bitcoin Temporarily

CPI inflation numbers from Wednesday saw inflation cooling to 3% – This offered some positive price action for Bitcoin as it mounted a challenge to break $31,000. But this resistance area continues to hold as the price touched $30,983 on Binance.

However, the Bitcoin price has since seen a pullback of 1.80% ahead of the upcoming Producer Price Index (PPI) numbers expected later today.

US Dollar Hits One-Year Low

The US Dollar dropped to a new one-year low following the release of CPI numbers, implying that the Federal Reserve could be looking to raise the interest rate once again. The US Dollar has declined by 1.3% since Wednesday’s numbers were released.

High volatility is expected later today once again as PPI numbers are released. The question is can Bitcoin push above $31,000 and hold, or will it decline back to its key support area at $30,000?

BTC Long-Term Price is Bullish – Mike Novogratz

Following the recent news that BlackRock, the world’s largest asset manager, is preparing to file a groundbreaking Bitcoin ETF application in partnership with Coinbase, Galaxy Digital Founder and CEO Mike Novogratz stated that he is undeterred by Bitcoin not breaking $31,000.

Speaking to Bloomberg, Novogratz commented on his opinion on where Bitcoin will end the year price-wise. He stated:

“I think it ends the year higher. We’re consolidating between $28,000 and $32,000. I think if you take out the top, we’ll have a nice leg up”

Novogratz added that following the Blackrock ETF news, “real adoption is coming.” He further backed the move saying that if the Securities and Exchange Commission (SEC) approved the Blackrock ETF, it would likely approve more Bitcoin ETFs. Indicating that access to Bitcoin would grow exponentially.

All Eyes on Key BTC Price Levels

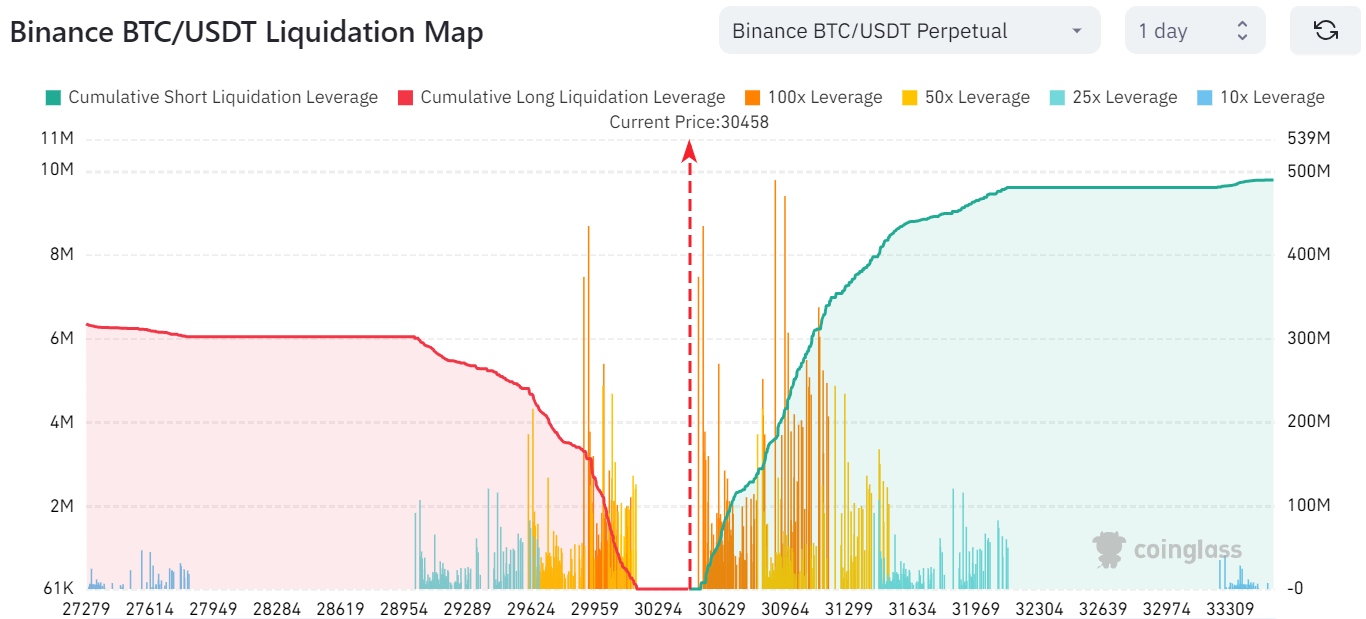

All eyes will be on Bitcoin today as PPI numbers are released. Traders appear to be swinging both long and short. According to Coinglass, high-leverage liquidations could trigger below $30,300 and above $30,500.

While short positions appear to mount, key inflation data could further depict which direction the price of Bitcoin moves later today.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.