Ethereum Breaches $4,000, Marking the Presence of Whales

Key Takeaways

Ethereum is back above $4,000 after breaking out of a consolidation pattern.

The bullish impulse coincides with an increase in the number of large Ether transactions.

The network activity suggests that whales may be positioning themselves for higher highs.

Share this article

Ethereum is making headlines again, after surging by more than 18% within the past four days to test the psychological $4,000 level.

Ethereum Breaks $4,000

The second-largest cryptocurrency by market cap has resumed its uptrend after consolidating for more than three weeks.

Ether made a series of higher lows throughout the stagnation period, while the $3,350 resistance level prevented it from advancing further. Such market behavior led to the formation of an ascending triangle on ETH’s daily chart.

A sudden spike in the buying pressure allowed Ethereum to break out of the consolidation pattern on Aug. 31 and rise by more than 18% over the past four days to reach a target of $4,000.

The Fibonacci retracement indicator, measured from the May 12 high of $4,372 to the Jun. 22 low of $1,700, suggests that further buying pressure has more room to push the asset up. Further buying at around the current price levels could see ETH retest its all-time high.

Whales Are Back

The presence of whales and institutional players on the network suggests Ethereum could even target $5,000 if buying orders continue piling up.

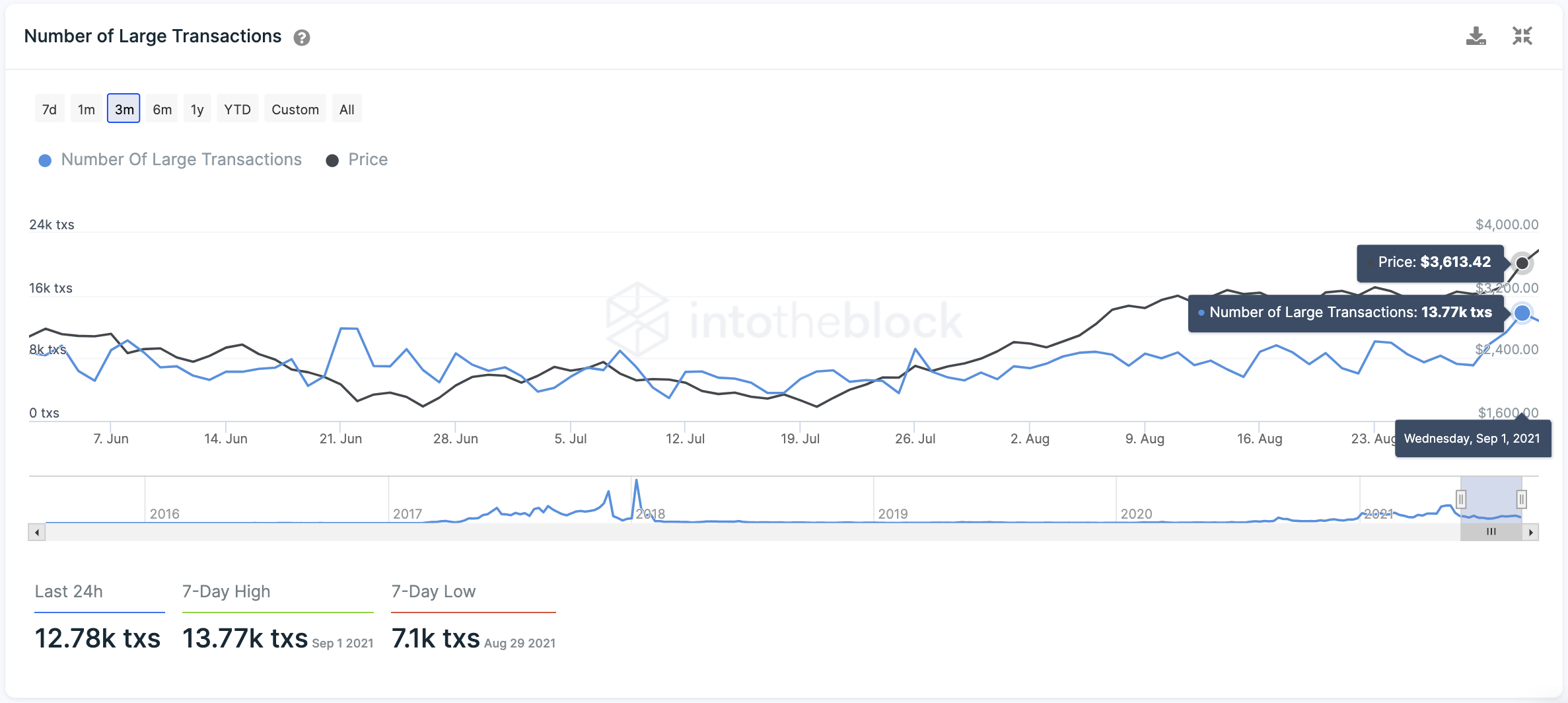

The number of large Ether transactions with a value of $100,000 or greater continues to rise. Roughly 13,770 large transactions were recorded on Sep. 1, and this on-chain metric appears to be trending higher.

Since whales disproportionately impact prices because of their enormous holdings, they can coordinate buying and selling activity to pump or dump tokens. Such is the case that over the past few years, each time the number of large Ether transactions starts to increase, prices tend to follow.

As long as Ethereum can keep its momentum and prices hold above $3,800, further gains can be expected.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Vitalik Buterin: “Ethereum Depends Less on Me Than Ever”

In a Thursday AMA on Twitter, Ethereum co-founder Vitalik Buterin answered some of the crypto community’s most important questions, sharing his thoughts on crypto privacy, game theory, protocol design, and…

Why Are NFT Collectors Looking for Loot on Ethereum?

LOOT (for Adventurers) is the latest set of NFTs to soar in value, inspiring creators to launch several successful derivative projects. The Loot Craze Just as the NFT market appears…

Arbitrum Is Now Live on Ethereum Layer Two

Arbitrum launched on Ethereum mainnet today. Arbitrum is a Layer 2 protocol that seeks to scale and lower the gas fees on Ethereum by carrying transactions off-chain. Arbitrum Launches With…

What is Impermanent Loss and How can you avoid it?

DeFi has given traders and investors new opportunities to earn on their crypto holdings. One of these ways is by providing liquidity to the Automated Market Makers (AMMs). Instead of holding assets,…