Ethereum Looks Ready for a Supply Shock

Key Takeaways

Ethereum looks primed to resume its uptrend.

The circulating supply of ETH is drastically decreasing due to EIP-1559, suggesting an incoming supply shock.

Transaction history shows that ETH could target $3,700 first.

Share this article

Ethereum could soon experience a supply shock thanks to EIP-1559 and prices holding on top of a massive demand wall.

Ethereum Ready to Break Out

Some of the most prominent analysts in the cryptocurrency industry believe that Ethereum is poised for higher highs.

Twitter user Rekt Capital maintains that the second-largest cryptocurrency by market cap has “successfully” retested a crucial support level. Such price action appears to be part of all the “right things” ETH is doing “towards confirming a breakout.”

$ETH has successfully retested this blue Lower High resistance as new support

ETH is doing all the right things towards confirming a breakout#Crypto #Ethereum https://t.co/M5XRZsEEUL pic.twitter.com/kEhSbDY6AR

— Rekt Capital (@rektcapital) August 24, 2021

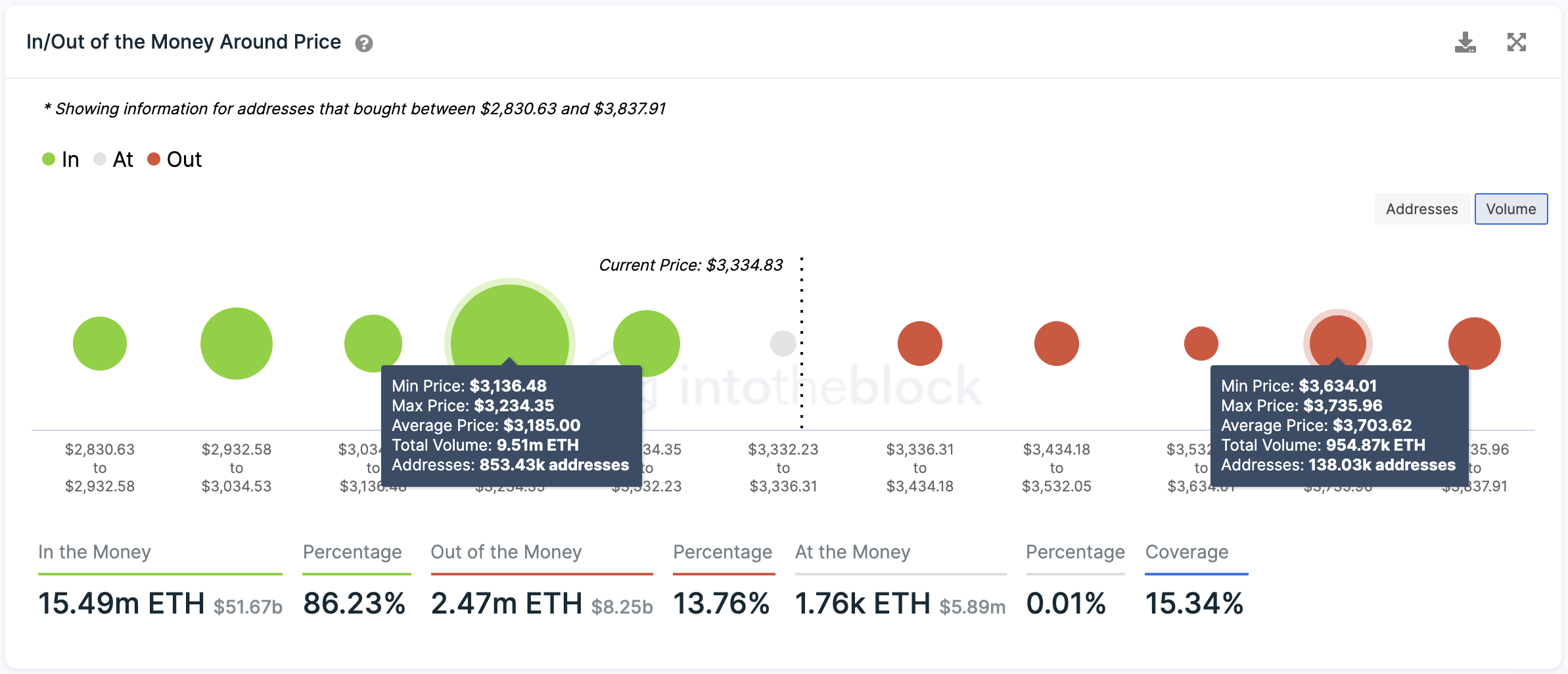

Transaction history shows that the $3,140-$3,234 price range is indeed a crucial interest area. IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that more than 850,000 addresses have previously purchased over 9.5 million ETH around this price level.

Given the magnitude of this demand wall, bears will struggle to push prices down. ETH holders within the $3,140-$3,234 price range could do anything to prevent seeing their investments go “Out of the Money.” They may even buy more tokens in the event of a downswing to prevent prices from falling further.

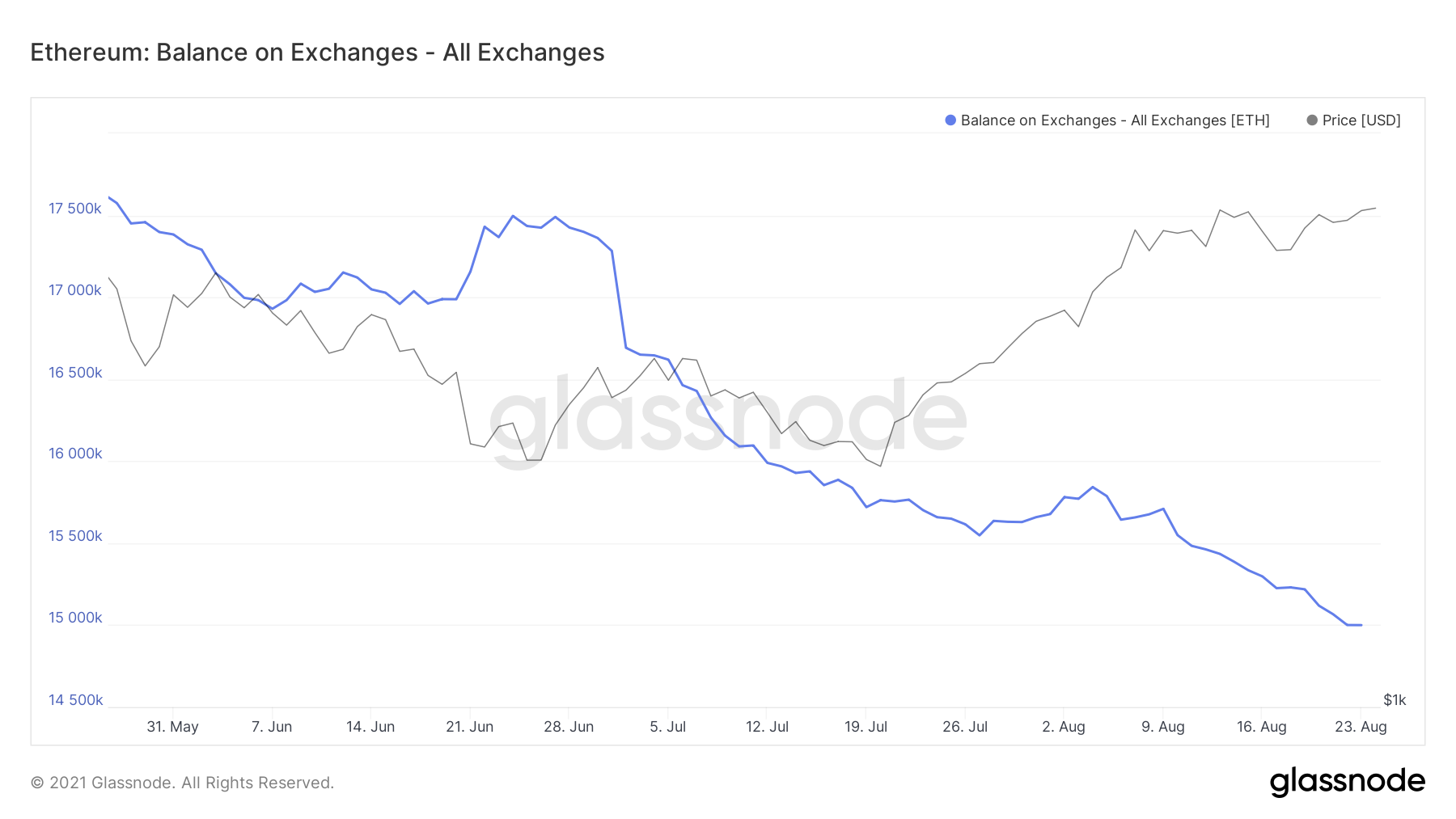

While Ethereum holds on top of stable support, the number of ETH tokens held on cryptocurrency exchanges continues declining at an exponential rate.

Since the beginning of the month, more than 842,000 ETH have been depleted from trading platforms, representing a 5.32% decline. Additionally, roughly 83,500 ETH have been burned since the implementation of EIP-1559 in the London hardfork.

The declining ETH supply on known cryptocurrency exchange wallets alongside the rising number of tokens being put out of circulation paints a positive picture for Ethereum’s future price growth. It technically reduces the number of ETH available to sell, consequently capping the downside potential.

A spike in buying pressure around the current price levels could see Ethereum advance further. The IOMAP cohorts show that ETH faces no significant supply barrier to prevent it from achieving its upside potential. In fact, the only important resistance zone ahead sits at $3,700, which could be considered an intermediate target.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Ethereum Is Getting a New Layer 2 Optimistic Rollup

Enya and OMG Network have released the mainnet beta of a new Layer 2 Optimistic Rollup called Boba Network. Boba Network Goes Live A new Layer 2 solution created by…

Efficient Market Hypothesis: Does Crypto Follow?

The Efficient Market Hypothesis (EMH) is a concept in financial economics which states that security prices reflect all the available information about a financial instrument. EMH is one of the…

These Ethereum Projects All Go Live on Arbitrum This Month

The Arbitrum team has launched the Arbitrum One portal, showcasing the wallets, apps, and tools available to use after the scaling solution goes live to the public later this month….

Jack Dorsey Explains Why He’s Steered Clear of Ethereum

Twitter founder and CEO Jack Dorsey has expressed his stance on Ethereum after a long history of focusing on Bitcoin. Dorsey Turns Down Twitter ETH Wallets Recently, Twitter users suggested…