Internet Computer (ICP) Price Jumps 14%, Eyes on $11 Target

On September 11, 2024, Internet Computer (ICP) made waves in the cryptocurrency market with its impressive price performance. However, based on its chart and price action, it appears that ICP is just one step away from a potential 25% rally.

Internet Computer (ICP) Price Performance

At press time, ICP is trading near $8.8 level and has experienced a price surge of over 15% in the last 24 hours. Meanwhile, its trading volume has increased by 60% during the same period, indicating higher investors and traders participation amid the ongoing price recovery.

ICP Technical Analysis and Upcoming Levels

According to expert technical analysis, Internet Computer (ICP) appears bullish despite trading below the 200 Exponential Moving Average (EMA) on the daily time frame. Currently, ICP is facing strong resistance near the $8.9 level.

This is the second time since the beginning of August 2024 that the ICP price has reached that resistance level. The last time ICP reached that level, it underwent significant selling pressure, resulting in a steep price decline of nearly 20%.

However, this time, trader and investor participation is different, and the sentiment has shifted, increasing the likelihood that ICP could breach this resistance level. If ICP breaks out this resistance level and closes a daily candle above $9, there is a strong possibility it could soar by 25%, reaching the $11 level in the coming days.

This bullish thesis is only valid if the ICP price closes its daily candle above $9, otherwise, it may fail.

Bullish On-Chain Metrics

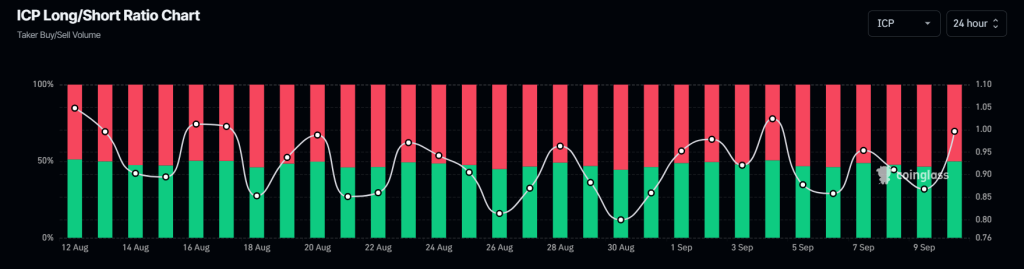

Moreover, Internet Computer’s (ICP) bullish outlook is also supported by on-chain metrics. Coinglass’s ICP Long/Short ratio currently stands at +1.019, reflecting bullish market sentiment. Additionally, ICP’s futures open interest has increased by 21%, indicating more futures-long positions have been built in the last 24 hours. Notably, this OI has been steadily increasing.

According to the data, a positive long/short ratio and rising future open interest signals potential buying opportunities. Traders and investors often take this while building long/short positions.