Key Insights from LBank X Live With Sonic Labs

Sonic is an EVM L1 with a confirmation time of about 1 second and an average transaction cost of less than $0.01. It has emerged as a blockchain solution focused on increasing speed and scalability. Furthermore, one of the primary goals of this project is to improve user experience in decentralized finance (DeFi).

Sonic Labs is transitioning from the Fantom project and produced its Genesis Block on December 2, 2024. During a recent X Live discussion with LBank as the host, Matt, a representative from Sonic Labs, provided deep insights into the project’s origins, its technology, and the roadmap ahead. The conversation covered the motivation behind Sonic Labs and the initiatives designed to attract developers and users to its ecosystem.

The Genesis of Sonic Labs

LBank, a crypto exchange established in 2015, hosted Sonic Labs in an X space for several discussions on their project. Sonic Labs evolved from the Fantom ecosystem to address key limitations in blockchain technology. Over the past three years, the team has developed a virtual machine, a consensus mechanism, and a database structure.

Matt stated, “Our EVM is one of the best in the crypto industry, and it will remain that way for a while.”

Sonic Labs’ commitment helps deliver an ecosystem with low gas fees and fast transactions. From a user perspective, the platform is designed for better scalability. Because of this design, network performance can remain stable even during high-traffic periods.

“Scalability means that even when there’s a lot of traffic on the network, the performance doesn’t suffer,” Matt explained.

The blockchain migration was Sonic Labs’ major transition challenge, which proved ten times harder than expected.

“You have to really start from scratch. You have to convince everyone to start all over again,” Matt noted.

This emphasizes the effort required to transition an entire blockchain ecosystem.

400,000 TPS and Sub-Second Finality

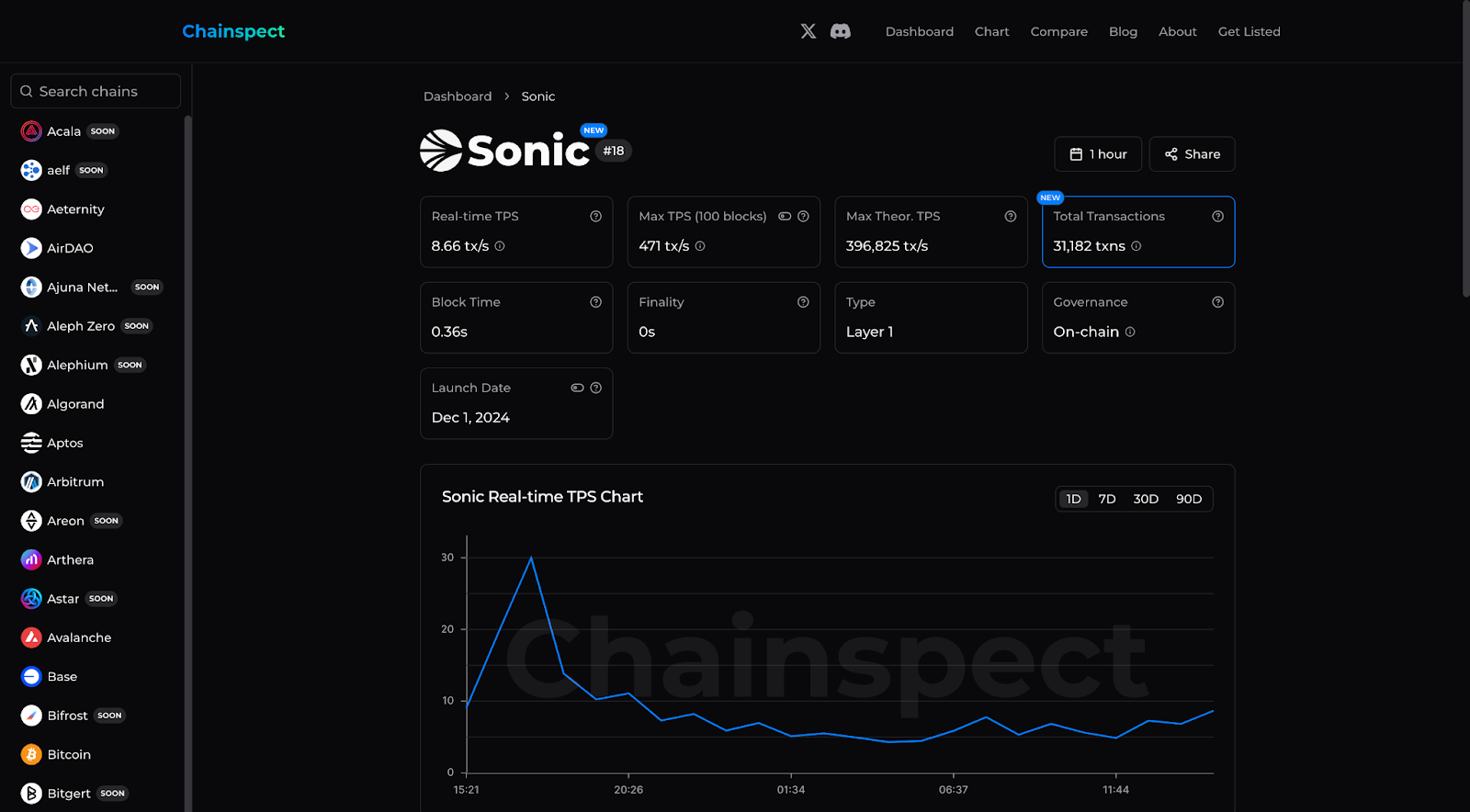

Sonic Labs’ technological advancements are now more than previous blockchain speed and efficiency limitations. Their network speed is typically said to be within 10,000 transactions per second. However, Sonic Labs reiterated that this is just the average TPS.

At best, the Sonic Chain can handle up to 400,000 transactions per second. The Sonic Labs team verified this milestone through Chainispect.

Several technologies, including an advanced consensus mechanism and a highly optimized database structure, contribute to these capabilities. The database, developed with the assistance of a Swedish professor, introduces a live pruning feature.

Live pruning automatically removes historical data, reducing storage demands on validators. Previously, pruning required validator nodes to go offline, causing operational risks and financial strain. Sonic Labs’ approach removes this issue.

Sonic Labs’ consensus mechanism uses Asynchronous Byzantine Fault Tolerance and Directed Acyclic Graphs (DAGs). This framework is strengthened by Practical Byzantine Fault Tolerance, a system designed to maintain network security even when some nodes behave maliciously.

Additionally, Sonic Labs uses a PoS model, requiring validators to lock their native tokens. If validators engage in malicious activity, their funds are slashed, ensuring they remain aligned with the network’s best interests.

SonicVM: A Great Solution for Developers

Sonic Labs is also involved in smart contract execution with its proprietary SonicVM. The SonicVM is designed for optimal efficiency, integrating multiple technologies that work in parallel to deliver a decent developer experience.

“Sonic has more efficient execution. The VM has been built in a way that it allows for optimization in parallel with other features of the chain,” Matt stated. “It’s like a cocktail of different technologies working together to provide the best experience in speed and security.”

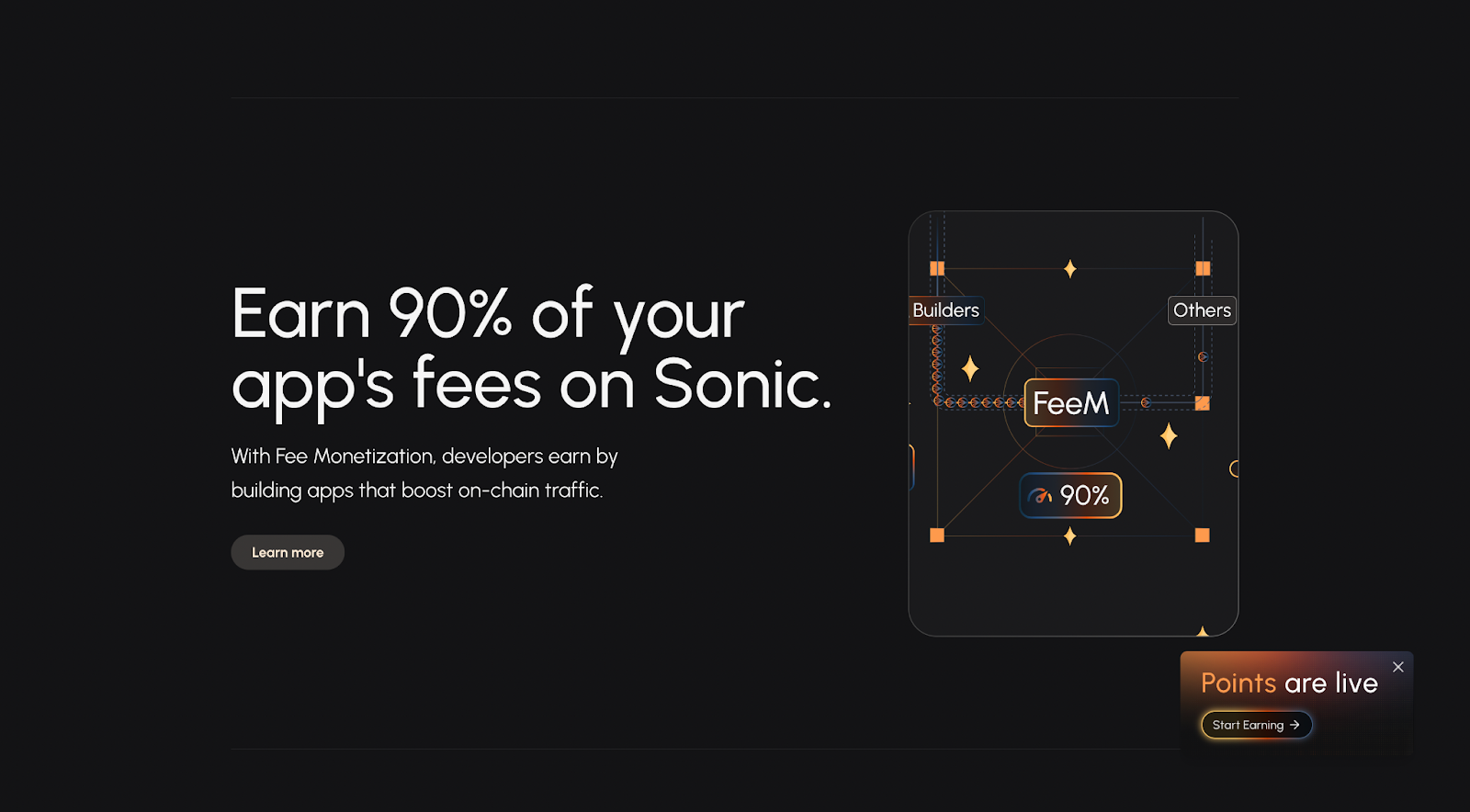

Sonic Labs has introduced a Fee Monetization (FeeM) program to attract top-tier developers. This program allows developers to earn up to 90% of the transaction fees generated by their applications. Web2 ad-revenue models, such as YouTube, inspire the initiative.

When a transaction occurs on a FeeM-enabled app, up to 90% of the fee goes directly to the developer, with the remaining amount given to validators. In contrast, transactions on non-FeeM apps follow a different model, where 50% of the fee is burned. Then, the rest is distributed to the Ecosystem Vault and validators.

Supporting Developers and Seamless Asset Bridging

Sonic Labs is creating an inclusive and supportive developer community. Its team is available to assist developers transitioning to the platform. The company also aims to provide transparency regarding grants and funding opportunities.

“Obviously, there’s only so much budget that we have, but we’re more than willing to have conversations and be open about spending it,” Matt stated.

Additionally, Sonic Labs has introduced Sonic Gateway, a secure bridge between Ethereum and Sonic.

Key features of the Sonic Gateway include:

Security: A fail-safe mechanism ensures that users can recover their bridged funds on Ethereum if the bridge experiences prolonged failure (14 consecutive days).

Speed: Transactions are processed in 10-minute intervals from Ethereum to Sonic and hourly in reverse.

Supported Assets: Sonic Gateway supports USDC, EURC, WETH, and FTM at launch and plans to expand further.

Sonic Labs has allocated $2 million for a bounty program to reinforce the bridge’s security. The program will encourage security researchers to identify potential vulnerabilities.

The Sonic DeFAI Hackathon: Supporting AI in Blockchain

Sonic Labs wants to actively integrate AI with DeFi through its Sonic DeFAI Hackathon, offering a $295,000 prize pool.

“The AI hackathon is important to us because AI is making its way into crypto, and I think it’s important for us to embrace it at Sonic,” Matt explained.

Over a four-week competition, developers will create AI-driven agents capable of executing social and on-chain actions. The main goal is to integrate AI within the Sonic ecosystem. Michael Kong (CEO, Sonic Labs), Seg (Developer Relations, Sonic Labs), Bird Mania (Sonic World), and Jeffy Yu (Founder, Zerebro) will be among the panel of judges.

The Future of Sonic Labs: Expansion, DeFi, and Mainstream Adoption

Sonic Labs plans to expand its DeFi ecosystem in the future. The platform is set to launch with Aave, featuring $15 million in incentives to attract liquidity providers. Other major protocols, including Pendle and Bitcoin DeFi projects, will also be integrated into the network.

Beyond DeFi, Sonic Labs aims to scale its team globally and introduce retail-friendly products, including the Sonic Visa Card. This crypto card will primarily help drive crypto adoption.

“We want to provide a unique experience for users and developers,” Matt emphasized. “The best way to explain our role is by providing the best experience and good vibes—giving users and developers a lot of opportunities.”

Disclaimer

In compliance with the Trust Project guidelines, this guest expert article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.