Stablecoin Issuance Saw Significant Growth Last Year – Altcoins Bitcoin News

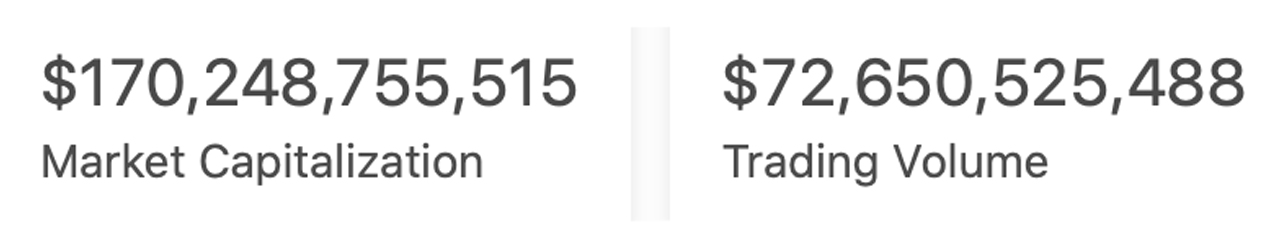

As crypto-assets grew immensely in value last year, the growth of the stablecoin economy swelled as well and today, there’s $170.24 billion worth of stablecoins in circulation. Data indicates that over the last 12 months, a slew of stablecoin valuations grew exponentially.

12-Month Stats Show Stablecoin Market Valuations Saw Massive Growth

Last year, numerous crypto assets touched all-time high (ATH) prices as current data highlights the crypto economy’s significant growth in 2021. Moreover, fiat-pegged tokens, commonly referred to as stablecoins, have also seen massive growth as centralized custodians and decentralized protocols have issued billions of tokens since last year.

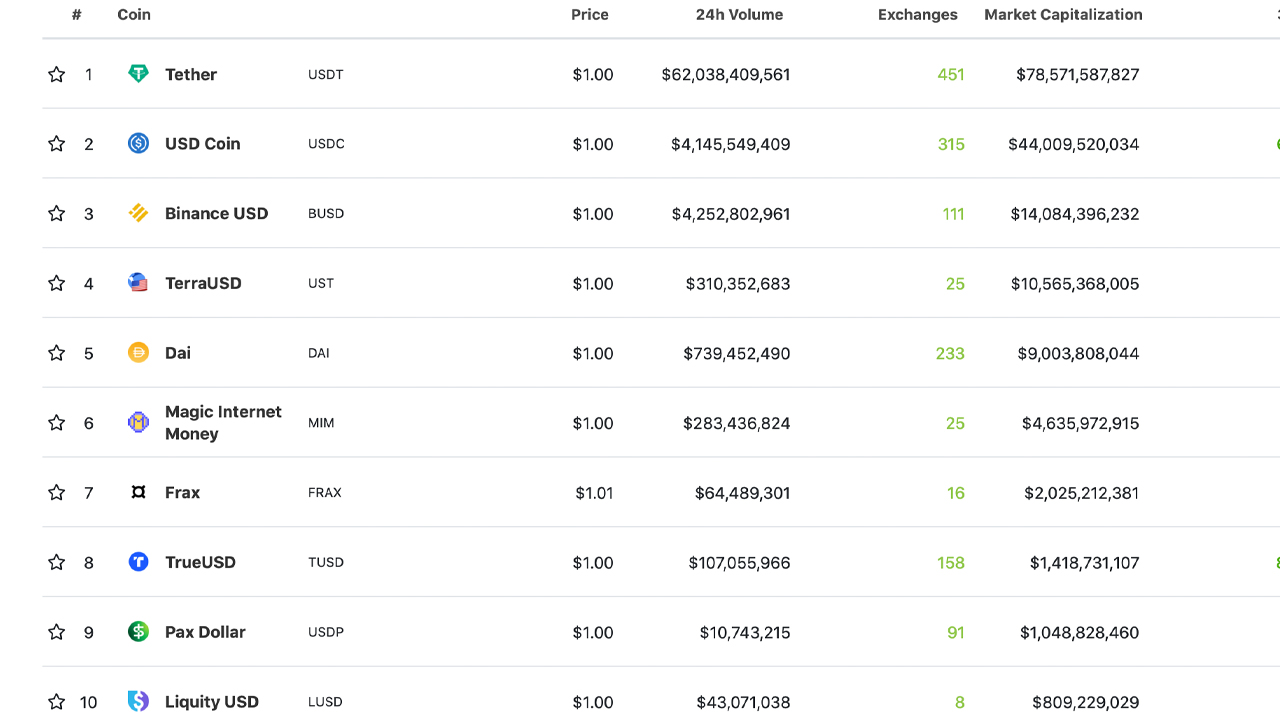

For instance, on January 11, 2021, tether’s (USDT) market cap was $24.4 billion and it has grown 221.31% since last year. Usd coin (USDC), the second-largest stablecoin asset in terms of market valuation, had a market cap of $4.4 billion on the same day last year. Today, USDC’s market cap is $43.9 billion, which is an increase of 897.72%.

The stablecoin issued by Binance (BUSD) only had a $1 billion market cap a year ago and now it’s $14 billion, increasing 1,300% this past year. Terra’s stablecoin UST had a market valuation of $138 million on January 11, 2021, and today the market cap is $10.5 billion.

Over the Last Year, Fiat-Pegged Token Market Caps Jumped Higher Than Most Crypto Gains

Makerdao’s DAI token went from $1.3 billion to today’s $9 billion as it grew 592.30% over the last year. MIM, otherwise known as Magic Internet Money, is a stablecoin that’s not even a year old but is the 6th largest stablecoin in existence.

MIM started issuance in September 2021 with $5.4 million and today, MIM’s market cap is $4.6 billion. Furthermore, the stablecoin frax (FRAX) has a $2 billion market cap currently but last year it was only $92 million.

It’s safe to say some of the dollar-pegged token market caps that saw immense growth over the last year have seen their market cap gains grow more than the gains of traditional crypto assets like bitcoin or ethereum.

Currently, stablecoins represent 8.24% of the entire crypto-economy worth just over $2 trillion today. Stablecoin global trade volume during the last 24 hours was around $72.6 billion, which is 61.94% of today’s $117.2 billion in volume across the entire crypto economy.

What do you think about the stablecoin market caps that have grown 500% to 1,300% over the last year? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko, tradingview,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.