In brief

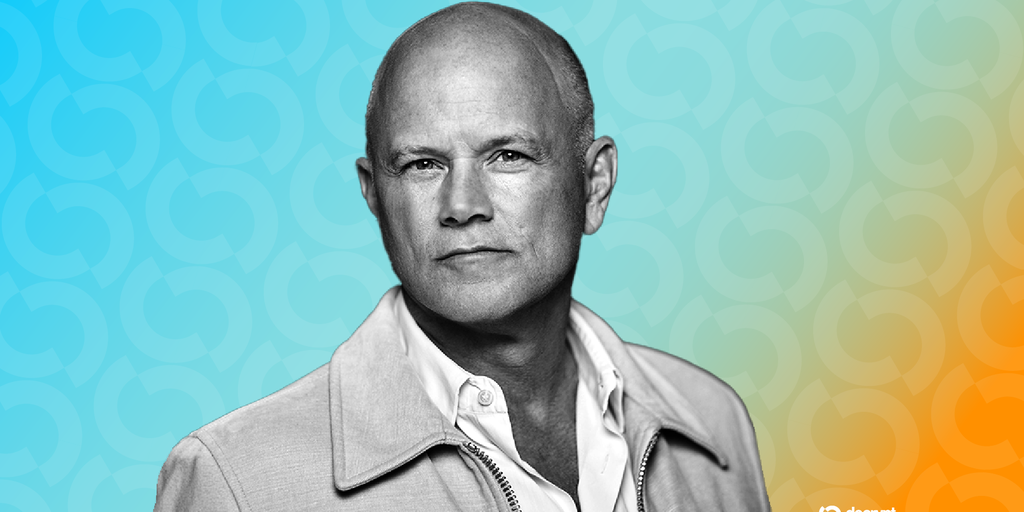

Bitcoin-buying firms offset Galaxy Digital’s massive Bitcoin sale, Mike Novogratz said.

Crypto-buying firms should continue to support prices, he added.

Galaxy Digital has partnered with 20 crypto asset treasury firms.

Institutional crypto firm Galaxy Digital was tasked with executing one of the largest Bitcoin sales in history at a pivotal time, according to Galaxy Digital CEO Mike Novogratz.

During the company’s second-quarter earnings broadcast on Tuesday, Novogratz expressed relief that Galaxy’s recent sale of 80,000 Bitcoin, executed on behalf of a single client, was absorbed by Bitcoin treasury firms nearly instantaneously.

“Call it grace, call it luck, call it fortune, call it timing—a combination of all that—but the execution happened when there was a tremendous amount of buying,” he said. “That buying is coming mostly from these balance sheet companies.”

Some publicly traded firms have been stockpiling Bitcoin since 2020, but analysts have pointed to a wave of new Bitcoin-buying companies this year as a buoyant force for crypto prices.

On Tuesday, Novogratz referenced Strategy, formerly MicoStrategy, as one source of elevated demand for Bitcoin, as well as Trump Media and Technology Group, the Bitcoin-buying owner of Truth Social, U.S. President Donald Trump’s social media platform.

Strategy’s latest Bitcoin purchase totaled 21,000 Bitcoin worth $2.3 billion, while the Trump-linked firm recently bought 18,400 Bitcoin worth $2 billion, according to Bitcoin Treasuries.

“Demand met supply,” he said. “As long as that continues, crypto prices are going to look pretty good.”

The trend applies to Ethereum as well, with companies like SharpLink Gaming and BitMine Immersion buying “a couple-hundred-million dollars” worth of the cryptocurrency each week.

Galaxy unveiled the massive sale late last month, describing a Satoshi-era investor’s decision to cash in as “one of the earliest and most significant exits from the digital asset market.”

Galaxy went public on the Nasdaq through a public listing in May, and its shares fell 5.6% on Tuesday to $27.29, according to Yahoo Finance. Shares have still climbed 13% year-to-date.

The company posted $30.7 million in second-quarter profit, falling short of an expected $85 million in net income, according to data from MarketScreener. Still, Galaxy said on Tuesday that July was the best month for its digital assets operating business on record.

Novogratz noted that Galaxy has benefited from a slew of new crypto asset treasury firms, partnering with over 20 of them to provide asset management and capital execution services, such as the fulfillment of buy and sell orders.

“We want to service those,” he said. “It has probably added close to $2 billion in assets on-platform, recurring income that will go on and on and hopefully grow.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.