Why US Employees Are Ditching Their 401(k) Plan for Bitcoin

Traditional retirement savings in the United States predominantly revolve around the 401(k) plan. However, many US employees are reassessing this conventional path for various reasons as an unexpected contender arises. Bitcoin, the leading cryptocurrency, is increasingly being viewed as the superior savings technology.

Recent shifts in the financial landscape highlight Bitcoin’s ascent in retirement savings discussions and the re-evaluation of the 401(k) plan amid growing economic uncertainties.

The Waning Appeal of a 401k Retirement Plan

Decades ago, 401(k) plans emerged as a beacon of financial security, but recent events indicate a shift in sentiment. Financial commentators have deliberated on the pause in 401(k) account contributions.

Reasons include the potential for bear markets and the lack of satisfactory growth, leading many to reconsider their investment strategy. Other factors include the high probability of scams.

Indeed, the Lincoln Police Department recently reported a phone scam involving a 67-year-old woman who was swindled out of her 401(k) retirement savings. She reportedly lost $52,000 in the fraud. Initially, she was informed about fraudulent charges on her bank account linked to Amazon.

Believing she was dealing with her bank’s Fraud Department, she engaged in phone discussions with a man. He persuaded her to withdraw from her 401(k) to buy Bitcoin over two months. The scammer promised her two checks in the mail, amounting to $69,999. However, these checks never arrived.

The case further highlights the vulnerability of these savings plans. Even Shawn Plummer, CEO of The Annuity Expert, highlights the real threat of 401(k) accounts losing money, casting doubts on their touted security.

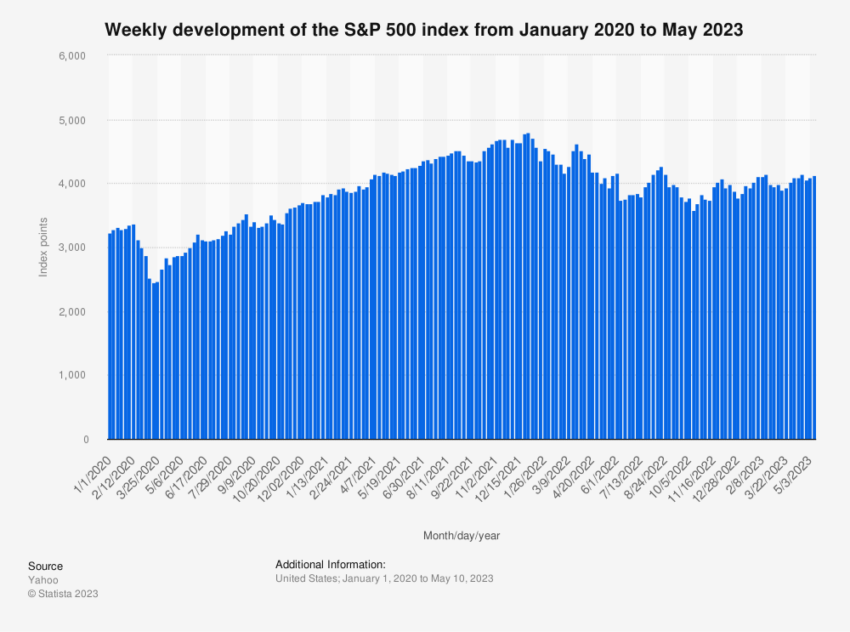

“Your 401k retirement plan can lose money. However, it is essential to understand that this does not mean all your money is gone forever. The stock market is constantly fluctuating, which means the value of your investments will go up and down over time,” said Plummer.

Bitcoin: A New Era in Employee Savings

Amid these emerging doubts over 401(k) plans, Bitcoin is entering the mainstream narrative. A recent report sheds light on the pros and cons of owning Bitcoin in a 401(k) plan, which is becoming central to retirement savings discussions.

Douglas Boneparth, the founder of Bone Fide Wealth, suggests that those investors wishing to allocate a portion of their retirement savings to crypto should consider focusing on Bitcoin. As the most prominent cryptocurrency, it presents a less complex opportunity for speculation, according to Boneparth.

The inherent difficulties of dealing with other cryptocurrencies are significantly amplified, thus making Bitcoin the preferable option for the time being.

Renowned financial adviser Ric Edelman argues that including Bitcoin in 401(k) plans emphasizes the potential for high returns. He supports the potential of Bitcoin investments within a 401(k) plan.

Consequently, signaling a shift in the perception of cryptocurrency from a speculative asset to a viable investment option.

“[Including Bitcoin in a 401k retirement plan] is extraordinarily exciting and will be remembered as one of the seminal moments in the development of digital assets. Tens of millions of American workers will now suddenly be able to invest in Bitcoin on a tax-advantaged basis and with the employer match that many of them receive,” said Edelman.

Edelman added that US employees adopt a dollar-cost averaging strategy by including Bitcoin in 401(k) retirement plans. This strategy involves consistently investing a set amount of money from each paycheck over an extended period.

It effectively mitigates volatility, creating a more stable investment environment. According to Edelman, “this makes it the ideal place to be buying Bitcoin.”

The Risks and Rewards of Bitcoin in Retirement Plans

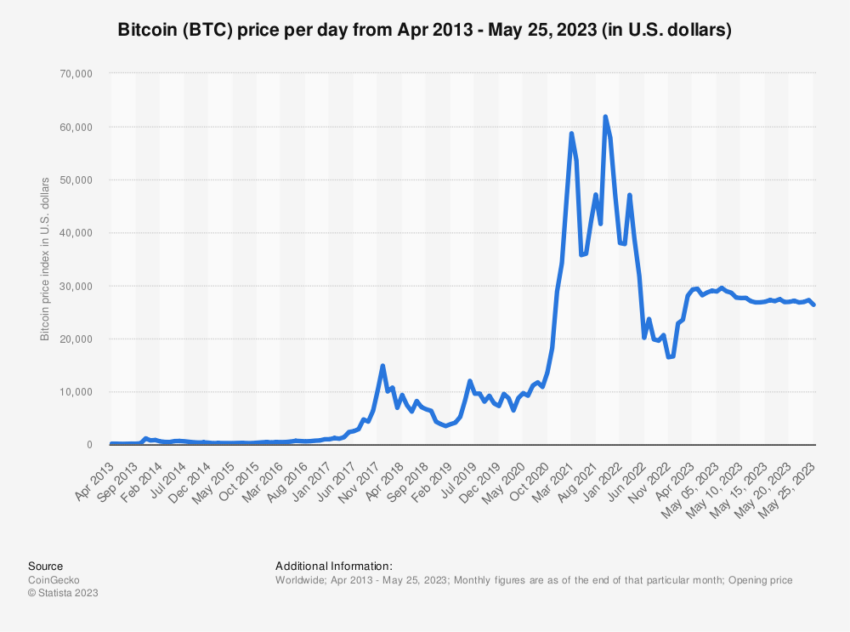

Despite the burgeoning interest in Bitcoin, including cryptocurrency in a 401(k) plan is not without risks. “As volatile as it is, it has the potential for huge upswings,” said Ivory Johnson, the founder of Delancey Wealth Management.

Still, he further explained that most individuals react impulsively, often leading to short-term sales.

“People make decisions based on Twitter, they hear something that is compelling… and they go all in and put 30% of their retirement money in Bitcoin. You’ve [potentially] made a bad situation exponentially worse,” Johnson explained.

Despite the risks, the potential benefits of Bitcoin in retirement plans seem to outweigh the potential drawbacks.

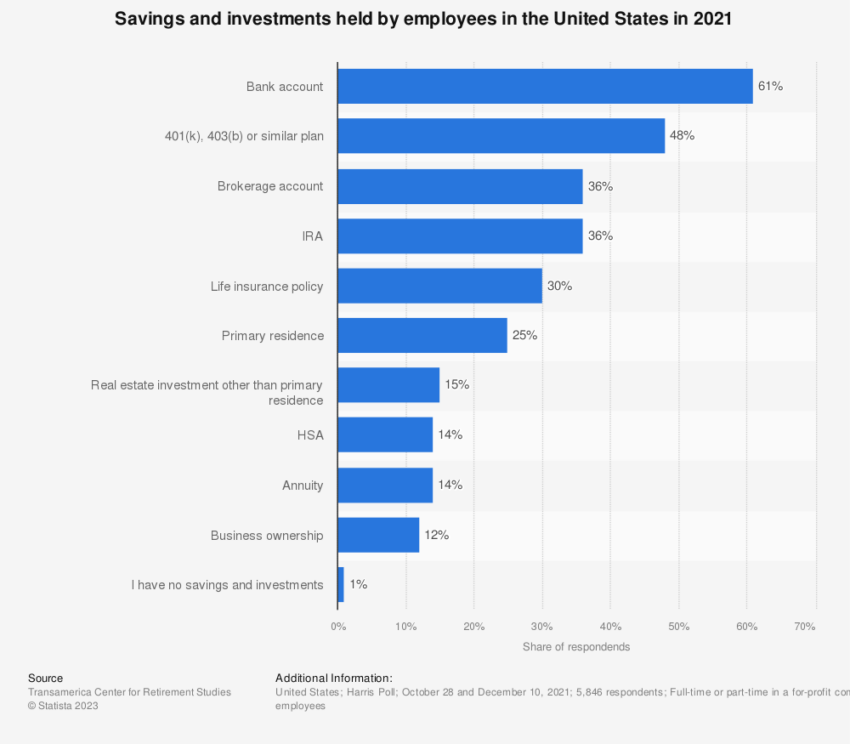

Some financial commentators suggest that a Health Savings Account (HSA) could provide better returns than a traditional 401(k). According to a recent report, an HSA could be at least 17% better than a 401(k). However, Bitcoin’s high return potential suggests it could outperform both HSAs and 401(k)s.

As a digital asset that operates independently of traditional financial systems, Bitcoin offers freedom and potential returns that conventional savings technologies struggle to match.

Jack Mallers, CEO of Strike, maintains that Bitcoin is finding increasing favor as a superior alternative to 401(k) retirement plans.

“I think for money, Bitcoin is superior savings technology. It is the best designed money in human history. Bitcoin is the best money of all time, and you use money to save, you use money to protect purchasing power, you use money to trade. So all that money encompasses, I think that is the use case for Bitcoin, the asset. And as a monetary instrument, it is superior payments,” said Mallers.

The Future of Saving: Dollar-Cost Averaging

US employees’ growing interest in Bitcoin signals a potential paradigm shift in retirement savings. While the traditional 401(k) plan was once seen as the gold standard of retirement preparation, the advent of cryptocurrency has created new possibilities for financial security.

With its potential for high returns and independence from traditional financial systems, Bitcoin is being embraced as the superior savings technology.

As one continues to explore the pros and cons of Bitcoin as a retirement savings option, it is clear that this digital asset has already begun to disrupt traditional financial planning strategies.

The transformation of the retirement savings landscape is underway, led by the pioneering spirit of Bitcoin and its adopters.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.