Will Bitcoin Kill Ethereum? Find the Answer Here!

Will Bitcoin “kill” Ethereum? Bitcoin has been honing its technological prowess with the advent of BRC-20 token standards following the Taproot upgrade. The BRC-20 token standard is a pivotal development enabling the creation of fungible assets on the Bitcoin blockchain, aiming to replace the popular Ethereum ERC-20 token standard. However, BRC-20 tokens face challenges like the lack of support for smart contracts and non-fungible tokens (NFTs), which are integral to the Ethereum blockchain.

The Taproot upgrade, a recent development on the Bitcoin blockchain, offers significant improvements to Bitcoin’s privacy and smart contract features. Despite the BRC-20 token’s limitations, the Taproot upgrade exhibits promise for Bitcoin’s potential to support smart contracts.

Bitcoin vs. Ethereum: What Is the Difference?

Bitcoin and Ethereum are the leading players in the cryptocurrency market, each with unique features and capabilities.

Ethereum, the second-largest cryptocurrency network, is more than a digital currency. It is a comprehensive blockchain ecosystem with its native currency, Ether.

In addition to serving as a medium of exchange, Ethereum’s purpose extends to enabling the development of decentralized applications (dApps) and the creation of NFTs. Despite these advanced features, Ethereum has not gone without its criticisms, particularly in comparison to Bitcoin’s intended purpose and structure.

On the other hand, Bitcoin has held its position as the world’s first and largest digital currency since 2009. It has maintained its supremacy, not because of an array of advanced features but because of its simplicity and promise of being a superior form of money.

With a limited supply of 21 million coins, Bitcoin has set itself apart as a valuable digital asset. Consequently, this starkly contrasts the inflation-prone nature of traditional fiat currencies.

Decentralization and Blockchain Technology

Despite their differences, Bitcoin and Ethereum share common traits: decentralization, cryptographic encryption, open-source software, and native currencies.

Both cryptos operate on their own blockchains, enabling the creation of wallets for users to store coins and complete transactions. They rely on a global network of computer nodes to add and verify transactions, ensuring system integrity.

However, beyond these similarities, the functionalities and utility cases of Bitcoin and Ethereum diverge. Bitcoin was created as a superior form of money, while Ethereum’s more complex capabilities, such as tokens and smart contracts, set it apart.

Some argue that these additional features of Ethereum compromise the blockchain’s integrity. But, with Bitcoin’s recent advances like BRC-20 tokens and the Taproot upgrade, Bitcoin might be stepping into Ethereum’s territory.

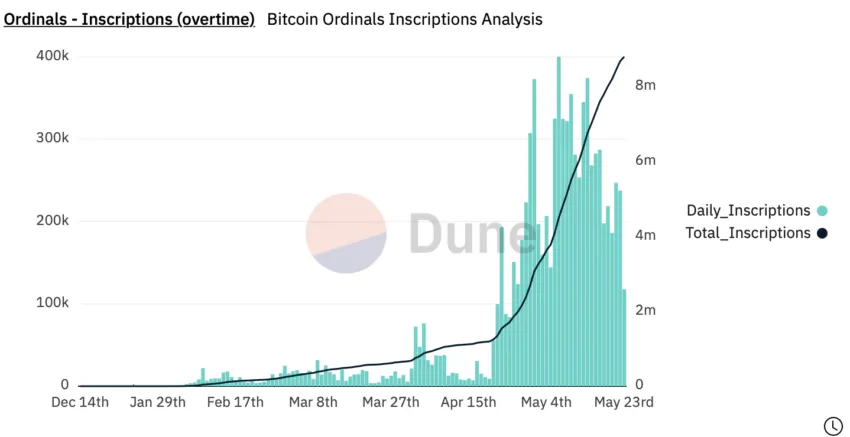

Bitcoin Ordinals and the Bitcoin Virtual Machine

Bitcoin’s evolution did not stop with the introduction of BRC-20 tokens. Two key developments stand out in the quest to further enhance the blockchain’s capabilities: Bitcoin Ordinals and the Bitcoin Virtual Machine.

Bitcoin Ordinals, a unique addition to the Bitcoin blockchain, enhanced the fungibility of its tokens. The Bitcoin Virtual Machine (BVM) introduction promises to mark a significant shift in Bitcoin’s functionality, enabling an environment similar to Ethereum’s EVM.

This leap allowed for the introduction of smart contract functionality on the Bitcoin blockchain, thus expanding its potential use cases. However, it is important to note that the full capabilities of this system are yet to be fully realized.

Despite this progress, it is crucial to highlight that Bitcoin’s smart contract functionality does not yet match Ethereum’s versatility. Ethereum’s ERC-20 standard, with its advanced smart contract capabilities and support for features like NFTs, remains the more adaptable framework.

The Lightning Network: Speed and Economy

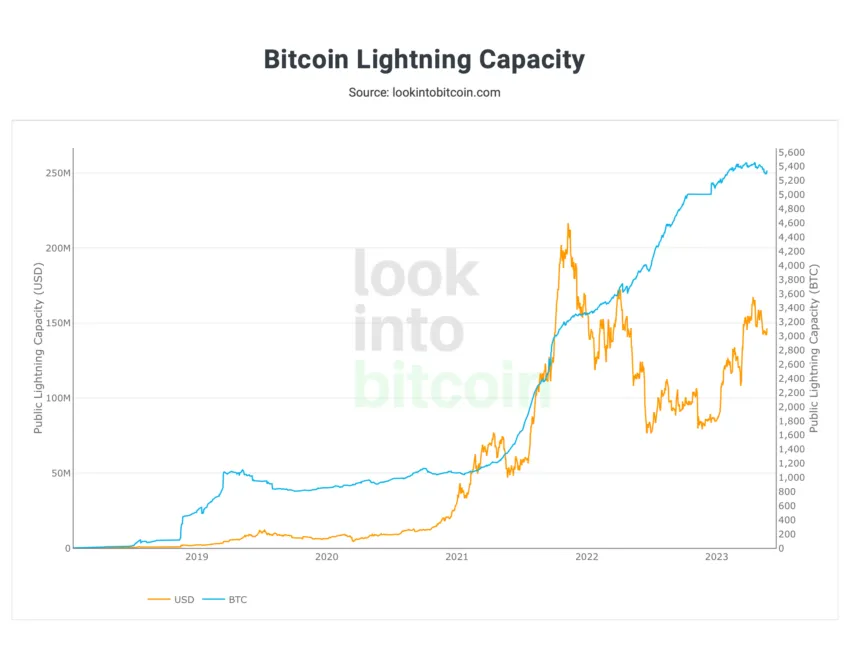

One of the most significant advancements in the Bitcoin ecosystem is the Lightning Network.

This layer-two solution has fundamentally changed the speed and cost of transactions on the Bitcoin network, addressing one of Bitcoin’s long-standing challenges: scalability.

The Lightning Network allows for the creation of off-chain payment channels, facilitating fast, low-cost transactions.

This innovative solution allows for significantly more transactions per second than the base Bitcoin network, providing a more efficient and scalable system for processing payments.

Compared to Ethereum, Bitcoin transactions via the Lightning Network are significantly cheaper and faster, addressing some of the scaling issues that have long plagued the Ethereum network.

While Ethereum has introduced its own scalability solutions, such as sharding and layer-two solutions, Bitcoin’s Lightning Network has shown to be a robust and reliable solution.

Despite these advances, it is important to recognize that the Ethereum network has strengths. With its wide range of applications, from decentralized finance (DeFi) to NFTs and more, Ethereum’s versatility cannot be understated.

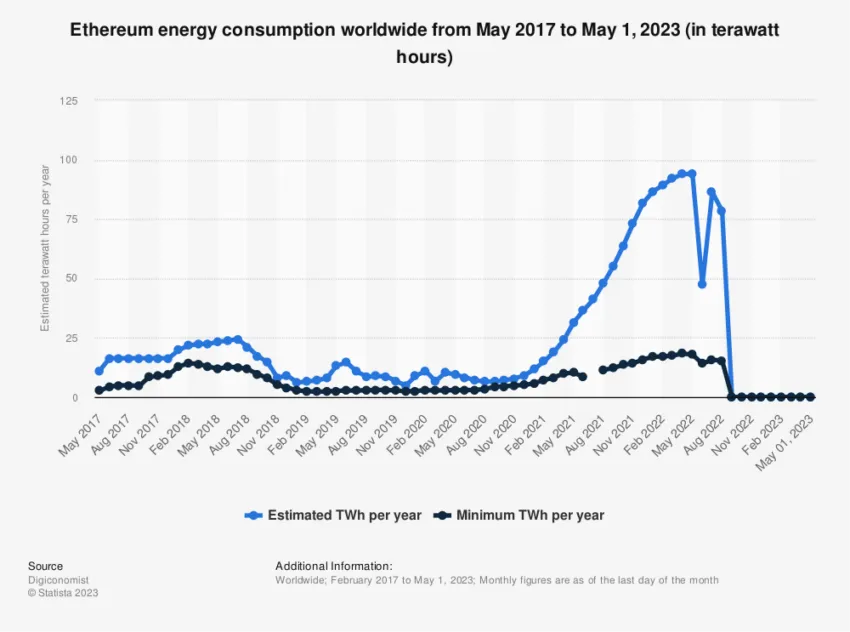

Its Proof-of-Stake consensus mechanism also offers energy efficiency and transaction speed advantages.

Will Bitcoin Kill Ethereum?

The battle between Bitcoin and Ethereum is far from over. While Bitcoin has made significant strides in recent years, Ethereum’s versatility and range of applications make it a formidable competitor.

The introduction of BRC-20 tokens, Bitcoin Ordinals, and the Lightning Network have expanded Bitcoin’s capabilities. Still, Ethereum’s ERC-20 standard and various applications keep it in the game.

The future of these two giants will likely depend on how effectively they can address their respective weaknesses while capitalizing on their strengths.

Will Bitcoin kill Ethereum? That remains to be seen. The crypto landscape is dynamic, and the race is far from over with new developments on the horizon.

FAQs

Whether it’s better to hold Bitcoin or Ethereum largely depends on your investment goals, risk tolerance, and understanding of each cryptocurrency’s technology.

Bitcoin (BTC) is often viewed as a “store of value,” akin to “digital gold”. It has a finite supply of 21 million coins, a feature that appeals to investors looking for an asset that can potentially hedge against inflation. Bitcoin has been around for longer, so it has a larger market capitalization and is more widely recognized, even among non-crypto audiences.

Ethereum (ETH), on the other hand, powers a robust decentralized platform for smart contracts and dApps. The Ethereum blockchain enables more use-cases than Bitcoin, such as NFTs and decentralized finance (DeFi) applications. Its value comes not just from its coin, Ether, but also from the versatile ecosystem it supports.

While both Bitcoin and Ethereum have their unique strengths and use-cases, there are several reasons why some may consider Bitcoin as a superior investment.

Store of Value: Bitcoin was the first cryptocurrency and has established itself as a digital equivalent of gold. With its limited supply of 21 million coins, Bitcoin is seen as a deflationary asset that can serve as a hedge against inflation, which is not a feature inherent to Ethereum.

Market Dominance: As the first and largest cryptocurrency by market capitalization, Bitcoin has significant market dominance. It is widely recognized and has a high level of liquidity, making it an attractive option for investors.

Security and Stability: Bitcoin’s blockchain has been in operation for over a decade without major incident. It’s considered to be highly secure and robust. On the other hand, Ethereum, while also secure, is undergoing a major transition from Proof of Work to Proof of Stake consensus mechanism, which may introduce elements of uncertainty and risk.

Upgrades and Innovations: Bitcoin’s recent Taproot upgrade has improved its transaction efficiency, flexibility, and privacy. This upgrade also introduces the ability for more complex types of transactions and paves the way for smart contract-like functionality on Bitcoin, which was once a major advantage for Ethereum.

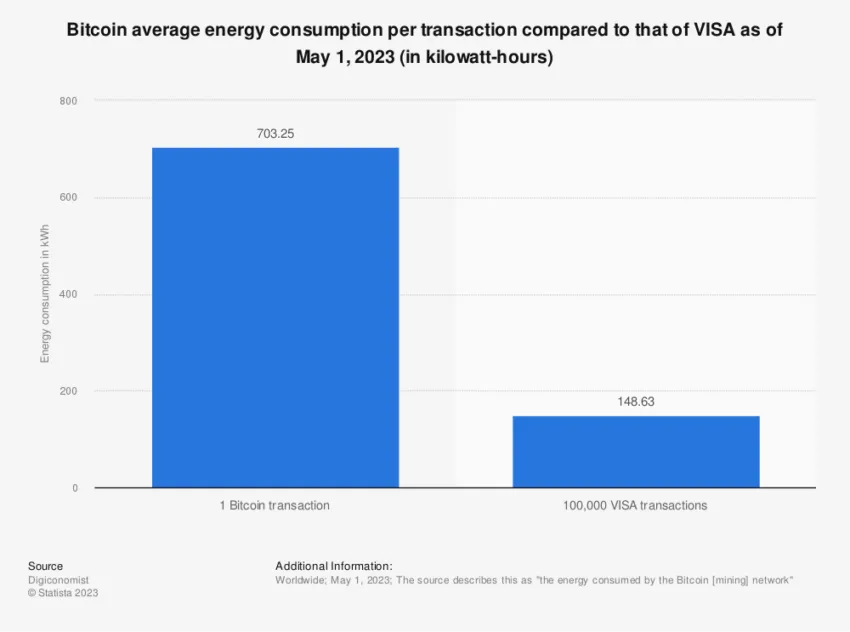

Energy Efficiency: While Ethereum’s transition to Proof of Stake will make it more energy-efficient, as of now, Bitcoin’s Proof of Work consensus mechanism is argued by some to be more energy-efficient and secure than Ethereum’s current mechanism.

The decision between investing in Bitcoin or Ethereum in 2023 can be a complex one and largely depends on your personal investment goals and risk tolerance.

Bitcoin, being the first and largest cryptocurrency by market capitalization, is often considered as “digital gold.” Its primary value proposition is that it’s a store of value with a limited supply of 21 million coins. The recent Taproot upgrade to Bitcoin has improved its functionality by introducing a new type of transaction that improves the efficiency, flexibility, and privacy of transactions. This upgrade has also made it possible to implement smart contract functionality on the Bitcoin network.

Ethereum, on the other hand, provides more versatility as it supports the creation of decentralized applications (dApps) and smart contracts. Ethereum has been described as a more versatile platform than Bitcoin due to its multiple utility cases, including enabling the development of other digital currencies and the creation of NFTs.

ERC-20 and BRC-20 are token standards on the Ethereum and Bitcoin blockchains, respectively.

ERC-20 has been the industry standard for token creation on the Ethereum blockchain since its inception in 2015. It supports the creation of a wide variety of tokens, including those used for smart contracts, and has a wide acceptance across different cryptocurrency wallets. Furthermore, it supports features such as Non-Fungible Tokens (NFTs) through the ERC-721 standard. Ethereum’s use of the Proof-of-Stake (PoS) consensus mechanism contributes to the efficiency of transaction fees and scalability.

On the other hand, BRC-20 is a newer token standard on the Bitcoin blockchain. Its intent is to enable the creation of fungible tokens on Bitcoin, similar to how ERC-20 does on Ethereum. However, BRC-20 lacks some of the features that ERC-20 tokens have, such as support for smart contracts and NFTs. It uses Ordinal Inscriptions instead. There are also concerns about scam tokens and scalability issues on the Bitcoin blockchain that hinder the widespread adoption of BRC-20.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.